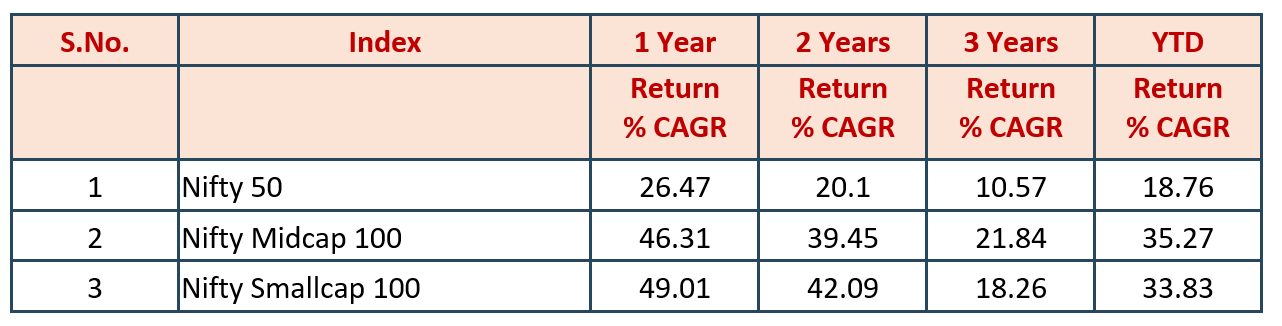

Markets have scaled new highs in this calendar year from January 2024 before turning volatile due to various factors. However, in spite of this volatility, Small Caps and Mid Caps are delivering stellar performances as is evident from the table below of point to point returns as on 16th October 2024 for past 1/2/3 years and YTD:

Investors generally look at past performance and decide on where to invest. Many will look to invest at current juncture in Small & Mid Cap space & ignore investing in Large Caps. This is like looking into the rearview mirror and driving your car. Naturally, if you do not think of what lies ahead and only look into the rearview mirror and drive, there will be mishaps and accidents going forward. Similarly, not taking cognizance of market valuations of different market caps and investing purely based on recent past performance (RECENCY BIAS), investors will meet with major mishaps going forward in their portfolios.

One of the metrics that is a good guide for investors to decide whether to invest in Small Caps or Mid Caps (especially Small Caps) is NIFTY Small Cap 100/NIFTY 50 ratio. This gives an idea of how much Small Cap segment is quoting at a premium compared to Large Caps.

As of 16th October 2024, NIFTY Small Cap 100 index was 19,304 and NIFTY 50 closing was 24,971. If you divide Small Cap Index by Large Cap Index = 19304/24971 = 0.77 or 77% Historical average of this ratio over past 10 years has been around 0.63 or 63%. Whenever this ratio has increased, Small Caps have underperformed or delivered negative returns. Following chart shows the result of this Ratio (in Blue line) and returns in Small, Mid and Large Cap indices post 3 years of investments. Reverse is also true – whenever an investor has invested in Small Caps when this ratio is on the lower side (read less than 60), 3 year returns in Small Caps have been better than Large Caps.Orange, Yellow and Grey lines depict 3 year returns in respective Indices.

.png)

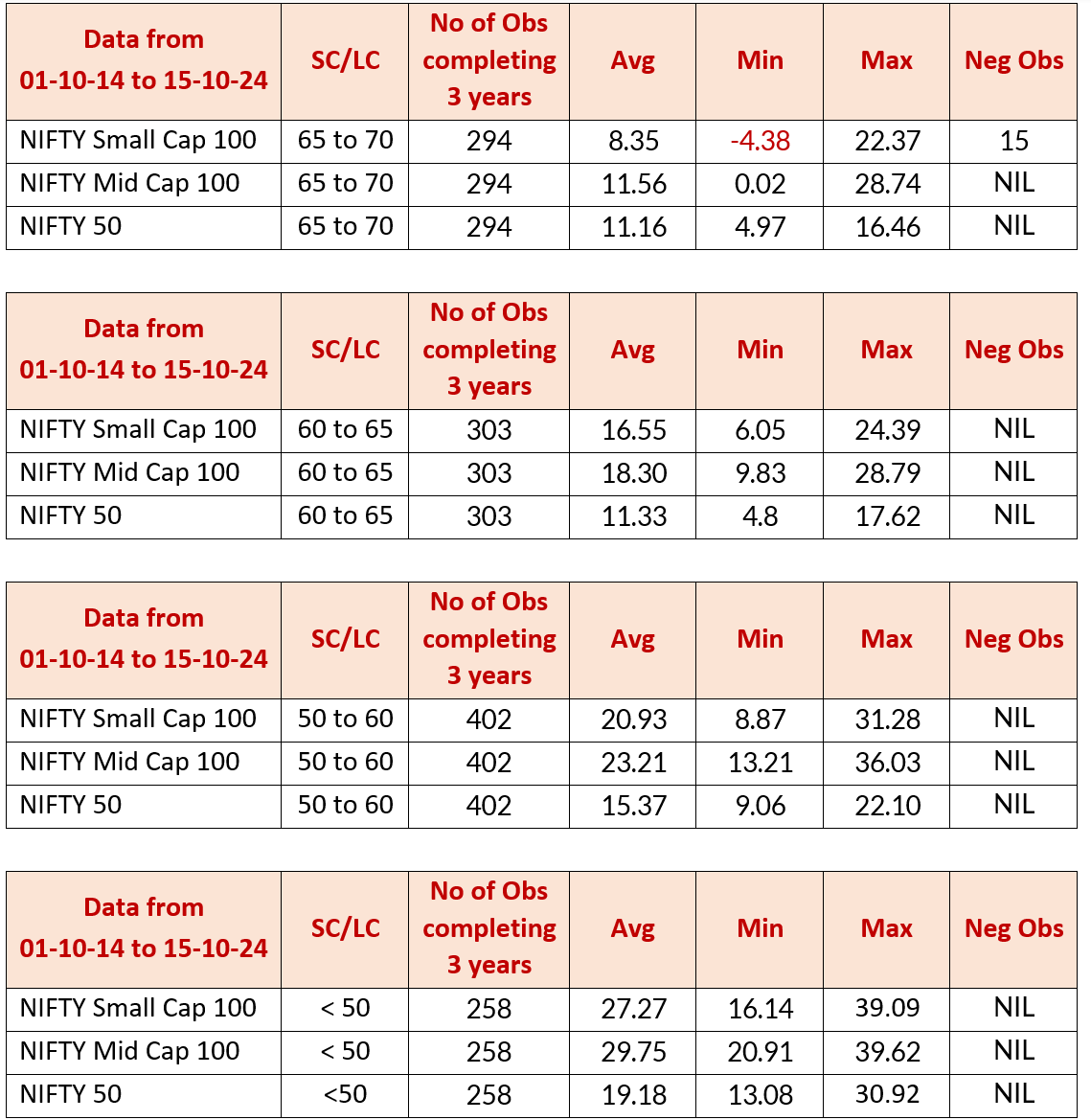

Now let me share with you the outcome of investing in different indices over different bands of this ratio of NIFTY Small Cap100/NIFTY 50 (SC/LC) and how to interpret the data:

.png)

Above data shows whenever this ratio has gone above 70 and investors had invested in Small Caps on those dates and held the investments over next 3 years. Not only the average of 482 such observations is negative but Small Caps have delivered negative returns in 371 observations out of 482 observations which had completed 3 years after investing in different indices when the ratio was > 70. As mentioned earlier, currently this ratio is 0.77 (way higher than 0.70) and probability of earning negative returns from now to next 3 years is very high.

Though popular way of gauging whether markets are expensive or cheap is to look at PE, PB or Dividend Yield of different Indices, it does not guide the investors correctly when it comes to gauging expensive or cheap valuations of Small Caps. Many Small Caps have no earnings and hence it becomes difficult to calculate PE when the denominator (EPS) is negative. So, a good guide is this ratio of Small Caps/ Large Caps and see the divergence in returns of Small & Large Caps from historical averages.

Let us see the results of investing in lower bands of this ratio and their outcomes. This data is self-explanatory and guide the investors on when they should or should not invest in Small Cap segment:

Hope investors take cognizance of these factors before investing by simply looking at past performances through the rearview mirrors. It will be a good idea to look through the front wind screen and avoid speed breakers that may lay ahead.

To Conclude:

- While investing in Small Cap space, look at this ratio of Small Cap/Large Cap as a guiding force rather than traditional metrics like PE, PB, etc. which can mis-guide investors for reasons mentioned above

- Even my Value Shastra Multi Cap strategy is suggesting investing in Large Caps rather than Small or Mid Caps at current juncture – corroborated by this ratio as well

- Only when you invest in the right bucket at right valuations, can an investor hope to generate wealth – otherwise they will end up eroding their wealth