Feature Videos

Foreword by MisterBond™

Fellow Advisors

At the outset I must thank Mr. Vijay Venkatram (Founder- Wealth Forum) for giving birth to MisterBond. He was the one who christened me as MisterBond when I started writing articles for his website. This brand has grown over the years and is treated as synonymous with good advice, correct advice, and an unbiased advice.

MisterBond has gained credibility, trust, faith and respect of his fellow advisors. MisterBond will continue to advise the IFA community and share his thoughts and insights gained over 33 years of experience in Finance markets.

Your love, affection, recognition and acceptance of MisterBond and his articles has given him confidence of hosting an exclusive platform viz. MisterBond’s Advisor to Advisor (A2A) Platform dedicated to the needs of our community.

+ Read more

Foreword by MisterBond™

Fellow Advisors

At the outset I must thank Mr. Vijay Venkatram (Founder- Wealth Forum) for giving birth to MisterBond. He was the one who christened me as MisterBond when I started writing articles for his website. This brand has grown over the years and is treated as synonymous with good advice, correct advice, and an unbiased advice.

MisterBond has gained credibility, trust, faith and respect of his fellow advisors. MisterBond will continue to advise the IFA community and share his thoughts and insights gained over 33 years of experience in Finance markets.

Your love, affection, recognition and acceptance of MisterBond and his articles has given him confidence of hosting an exclusive platform viz. MisterBond’s Advisor to Advisor (A2A) Platform dedicated to the needs of our community. We have worked really hard to bring Mutual Fund Industry to its current level. However, our last mile connect with investors seems to be still eluding us. We are missing out somewhere to convert investors to look at mutual funds as their first recall investment vehicle.

This is because investors have suffered time and again due to omissions and commissions by all participants of our industry. We need to bring back confidence of investors .This can happen only if we first think of investor needs and then provide solutions to fit those needs. There are 40 plus AMCs with 1000s of Schemes. How does one identify right scheme or an asset class or the right solution from such a huge mine? As one of the leading IFAs put it: "MisterBond has the ability to identify Gems (schemes) from a huge mine"

Even in the asset allocation triangle, most stable and bigger pie is given to cash and debt solutions. As we go higher up the triangle, rest of the asset classes like equity, real estate, commodities, etc. get clubbed and form top of the triangle. Our industry unfortunately is missing out on converting conservative FD investors to first look at bottom of the pyramid i.e. debt. We are jumping the gun and going straight at top of the pyramid (riskiest asset classes). This is where we have lost confidence of investors time and again.

In this day and age of fierce competition from DIRECT as an option for Investors, disruptive platforms like Paytm, ROBO Advisors and reducing margins due to constantly reducing Total Expense Ratios (TERs), Advisors will have to show their VALUE ADD and try and increase their volumes. As per AMFI data, Mutual Fund Industry is likely to grow to Rs.95 trillion by 2025. Huge scope for all participants to be part of this journey.

You will need 4 main pillars to succeed in this environment viz. Technology, Knowledge, Investment Solutions and a good Mentor. This Platform will provide all these tools to empower all those in the Mutual Fund practice. It is the endeavor of MisterBond to empower his Advisor friends by giving Workshop Videos, Articles, Calculators, Transaction Platform and Smart Investment solutions of MisterBond.

As he has been saying: “we are creating Abhimanyus out of our Equity Investors. They are stuck in a Chakravyuha of Equity investing with no exit strategy or profit booking strategy”. For this we will need to change our mindsets, move away from Traditional Mantras like “BUY and HOLD”, “SIP KARO BHOOL JAO” and “DO NOT TIME THE MARKET” and provide some valuation based trigger driven Investment solutions with in built strategies for DOWNSIDE PROTECTION and INVESTING AND DISINVESTING AT RIGHT VALUATIONS IN THE RIGHT ASSET CLASSES.

MisterBond has been conducting workshops on various subjects for the benefit of IFA community across the length and breadth of the country. Many IFA friends have requested him to be their mentor and guide them to scale up their Advisory businesses so that they can then concentrate on client acquisition, back office matters, operational issues, etc. This Platform is created with these requests in mind.

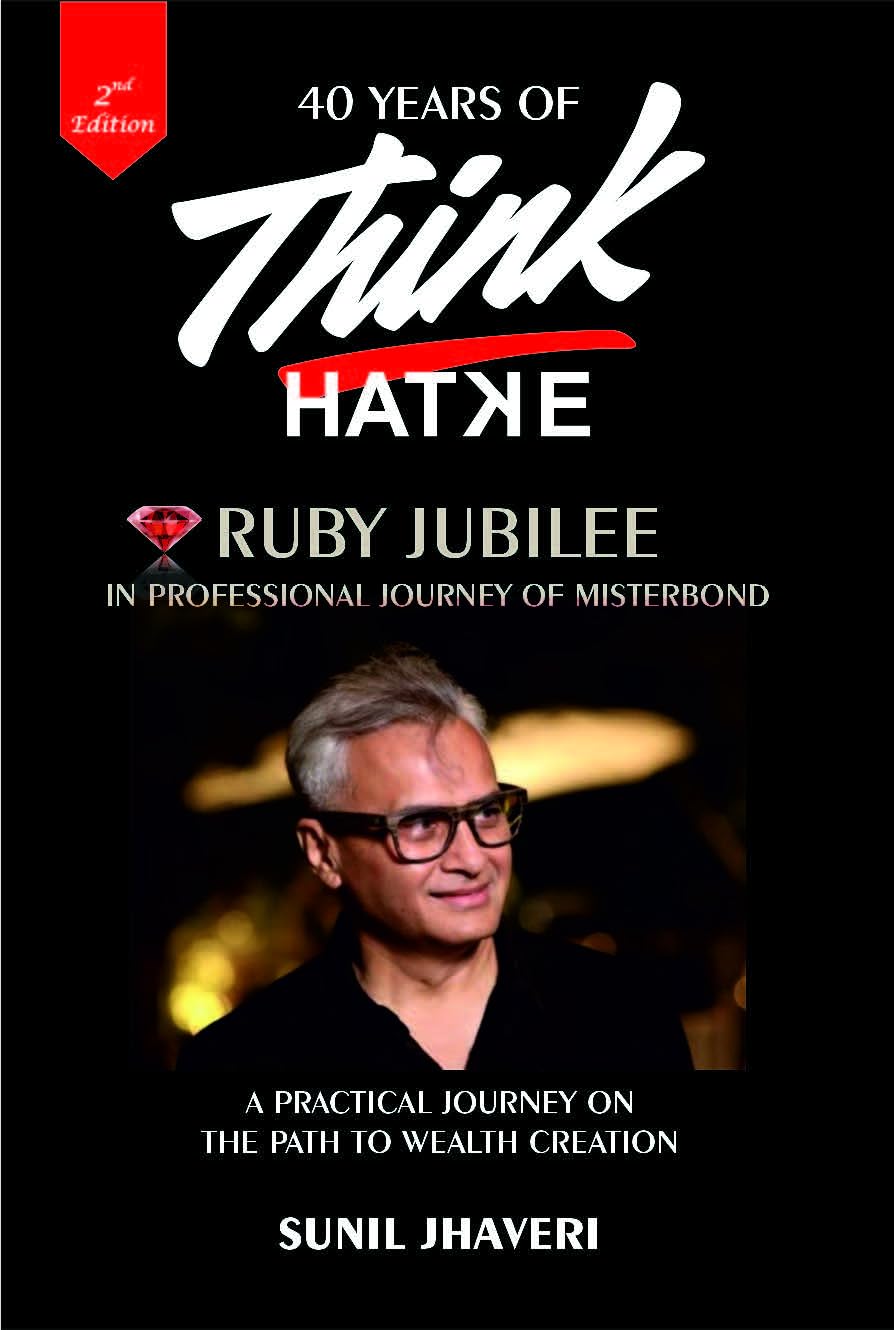

Why MisterBond™ as Advisor to Advisors?

Sunil Jhaveri aka MisterBond, is a Mentor, a Coach, an Author and an Advisor. He is extremely popular with his peers, colleagues, business partners and his investors. In the words of one of his IFA (Independent Financial Advisor) friends “The biggest plus point with him is that he is grounded to earth and is very accessible. Gives a Big Broad Smile whenever you meet him. True Inspiration.”

He is also a consultant to many AMCs with whom he interacts on regular basis to give new ideas on scheme designing, add on features, positioning of their schemes in right perspective. His contribution to the MF Industry can be summarized by some of the ideas which have now become part of the MF Industry

+ Read moreWhy MisterBond™ as Advisor to Advisors?

Sunil Jhaveri aka MisterBond, is a Mentor, a Coach, an Author and an Advisor. He is extremely popular with his peers, colleagues, business partners and his investors. In the words of one of his IFA (Independent Financial Advisor) friends “The biggest plus point with him is that he is grounded to earth and is very accessible. Gives a Big Broad Smile whenever you meet him. True Inspiration.”

He is also a consultant to many AMCs with whom he interacts on regular basis to give new ideas on scheme designing, add on features, positioning of their schemes in right perspective. His contribution to the MF Industry can be summarized by some of the ideas which have now become part of the MF Industry norms:

- He has trained more than 50,000 IFAs, Wealth Managers of Banks and Sales Teams of Mutual Funds over the past 3-4 years

- He recommended that SIPs should be done on weekly basis. Till then SIP was only a monthly phenomenon

- He has been a vociferous advocate of only showing Rolling Returns rather than Point to Point returns. Many AMCs have started showing Rolling Returns in their fact sheets

- He was the first to advocate waiver of Exit Loads for SWPs from Debt Schemes (post LTCG period changing from 1 year to 3 year for debt schemes) and Equity Schemes for generating better tax efficient and assured cash flows. Most AMCs have adopted this suggestion

- He has put traditional wisdom on its head by recommending infusion of flavors of equity in Senior Citizen portfolios with some credible back tested data

- He is closely working with a few AMCs to create add on features to marry fundamentals to SIP Investing - disinvesting and make them truly Fill It, Shut It and Forget It features

- He is the first one in the industry who has talked about Exit Strategy from SIPs. All in the industry have been only speaking about SIP KARO BHOOL JAO

- He has created 4 Smart Investment Solutions which will be used by IFA community for their investors. Some of these will be Add on Features in Mutual Fund schemes

- His Smart Investment Solutions are going against the old adages like “BUY and HOLD”, “SIP KARO BHOOL JAO” and “DO NOT TIME THE MARKET”

- Many of his ideas are Products and Schemes of some of the AMC

As an author he has penned two books viz. “Make Your Destination a Journey to Remember – Through Financial Planning” an easy guide for Investors to maneuver their way through complex world of Financial Planning and Investments and the second one Titled “Pearls of Financial Wisdom” a Bible for anyone who is in Mutual Fund Business. Combined sales of both books is more than 25,000 copies.

His articles and his professional journey are motivational, thought provoking and always evokes positive vibes for his readers and friends. His awe inspiring video of his story from “HERO TO ZERO TO HERO” (available for viewing on the Home Page of this website) motivates many IFAs across the country who are currently confused due to too many Regulatory changes affecting their MF Business. In words of another IFA friend “I am a big fan of yours. This video has increased my faith and trust in our industry. Cleared all my doubts; I am in best field and can do anything. Your Story is very inspiring for everyone”.

His articles and views always have a different twist and positive messages even in worst of crisis which is evident in a series of articles he wrote during JSPL and Amtek Auto Debt Downgrade and Default fiascos. His Letter to the Editor of The Economic Times shows how passionate he is about his profession and has the ability and courage to speak on behalf of the entire IFA Community. These articles are available on this website under the head ARTICLES. He contributes towards the betterment of the MF Industry without any strings attached and without any expectations Comment by one of the IFAs to his article on JSPL Downgrade reads as: “The most amazing analysis from the most amazing analyst you will ever come across....views very different from momentum followers...an eye opener...Sunil Jhaveri Sir (MisterBond) should be made the guru of all IFAs...lot to learn from him....if IFAs follow him rigorously they are bound to create great wealth for themselves and their clients”

Such responses, love, respect and request for him to become a Mentor for the IFA Community has helped him create this Advisor 2 Advisor (A2A) Platform through this website.

He has received following awards in the recent past:

At Wealthform Conference in July 2016:

For contributing Best Articles – voted by the IFA Community

Oracle Award for Best Mentor – For Empowering IFAs across the country

At MFRT Conference in 2017:

MFRT Award for Excellence in Training and Empowering MF Industry