Investors stuck between a Rock and a Hard Place

(Stuck between investing at wrong valuations and Regulator’s crackdown)

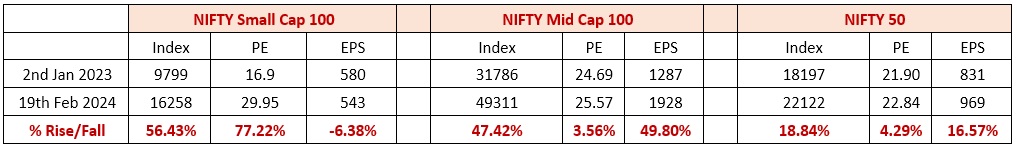

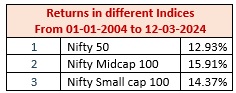

Above was the picture and returns in different indices over past year plus investment horizon. Most investors look at this data to decide on where they prefer to invest looking in the REARVIEW MIRROR. They throw caution to the winds and forget that investment returns are relative to their underlying valuations and they will revert to mean on both sides of the coin i.e. if markets have run ahead of valuations, they will correct and revert to long term mean or if markets have corrected and valuations have become cheaper, they will revert to mean by going up from these points. As I have been saying from time to time, markets are giving us signals on a daily basis but we tend to ignore them. Markets will give a reality check from time to time – and that time has arrived now.

As I am penning this note at 2:45 pm on 13th March 2024, Markets have corrected by 1.50% in Large Caps and by almost 5% in Small Caps and 4% in Mid Caps. These tables will look quite different if I would have incorporated data based on today’s market corrections. But I did not wish to wait till tomorrow to release this note for the benefit of the readers and investors. Market Regulator has cracked down on some of the operators in Small Cap space and given warning to AMCs to take corrective steps so that Investors do not suffer due to froth building up in this pace. Many AMCs have stopped inflows in their Small and Mid Cap schemes based on this. This causing further panic and adding fuel to fire.

Now let’s look at data of the same indices in a slightly more prudent way for the same period and see if it is telling us the same story of a different story:

As can be seen from above, narrative is totally different as is evident from the above table. Though NIFTY Small Cap delivered maximum returns of 56% over the period under consideration, valuations seen in conjunction with its earnings growth is totally out of sync. Earnings have contracted by 6.38%, but PE has gone up by a whopping 77%. This should have rung alarm bells for the investors before rushing into investing blindly.

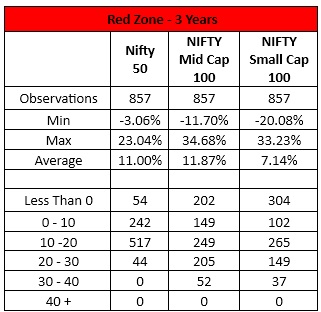

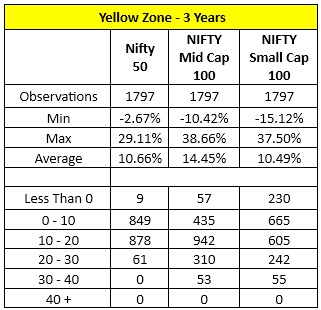

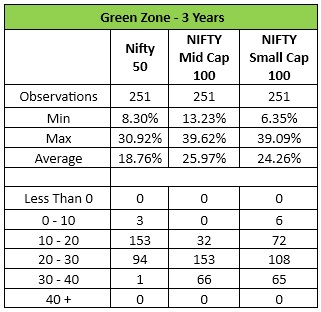

Now let us look at data of probability of earning decent returns in all 3 indices from January 2006 to now over any 3- year investment horizon (if invested in expensive, reasonable & cheap valuation zones):

Above data shows result for those who would have invested in any of the indices when markets were expensive (from 2006 to now) and held it for 3 years thereafter. Total number of observations which had completed 3 years during Red zone were 857. Only 6.65% (57/857) of NIFTY 50 were negative v/s 23.57% (202/857) observations of NIFTY Mid Cap 100 delivering negative returns and 35.58% (305/857) observations of NIFTY Small Cap 100 delivering negative returns during the same period. Also, drawdowns in Large Caps from expensive valuation zones are lower than those observed in Mid and Small Cap space.

In yellow zone – 0.50% of NIFTY 50, 3% in NIFTY Mid Cap and almost 13% in NIFTY Small Cap delivered negative returns over any 3 year periods. However, since number of observations are large, 3% observations delivering negative returns in Mid Cap is quite miniscule and can be ignored. However, number of observations delivering more than 20% is 20% (363/1797) in case of Mid Caps v/s 3.40% (61/1797) in Large Caps. Reason, why investors can start to look at investing in Mid Caps during this period of Yellow Zones (reasonable valuations).

And finally, as expected, none of the indices have delivered negative returns if invested during Green Zone periods (cheap valuation zones).

Historically, Mid Caps have out performed Large and Small Caps on an ongoing basis:

Moral of the story:

- Do not invest blindly by following BUY AT ANY PRICE mantra

- Respect market signals and invest based on your asset allocation theory

- Look at market valuations under each market cap bucket and invest accordingly

- Ideally, invest in Large Caps when markets are expensive or in stretched valuation zones, start investing in mid caps when market valuations become reasonable and may be invest in small caps (as tactical allocation) only when market comes into cheap valuation zones

- Create your own Large & Mid Cap or a Flexi Cap portfolio based on the above

- Do not get carried away with market returns – stop looking into rearview mirrors to decide on your investments

- Remember, market excesses – both on upside and downside are not sustainable, reversion to mean will happen under both scenarios

- Expect nominal GDP ++ returns from your equity portfolios, any expectations above that will only make you take irrational and risky investment calls

- Concentrate on a smoother, less volatile journey

I have designed a Flexi Cap Value Shastra as an investment strategy which allocates investor funds in different market cap buckets like Large, Mid and Small Caps. It gives a cue (based on market valuations) as to when and how much to invest in Large caps, when to start investing in Mid Caps and finally (if one wishes to have small caps in their portfolios) when to invest in Small Caps.

But according to me, creating a Large & Mid Cap Value Shastra strategy will give good results for investors. Intention is to a) deliver better risk adjusted returns, b) deliver better and smoother investment journey and c) manage to control emotions of Greed and Fear by incorporating philosophy of downside protection and being in right asset class (market cap) at right valuations.