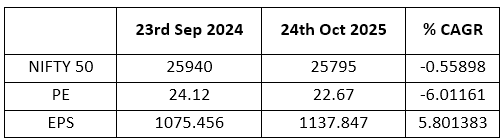

Indian equities have delivered no returns over the past year since it peaked on 23rd September 2024. Mid Cap and Small Cap indices have performed even worse than large cap index represented by NIFTY 50. This can clearly be a reflection of the muted earnings growth and overstretched valuations during this period. Earnings growth, represented by EPS of NIFTY 50 was a muted 5.80% over past 1 year:

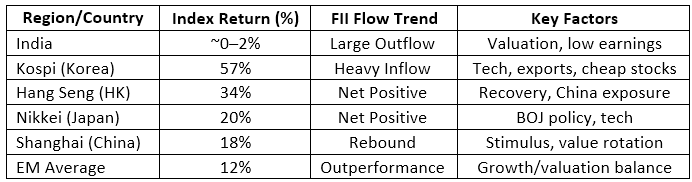

FIIs exit from Indian markets can be attributed to this lack of earnings growth and looking for better opportunities in other markets which were more reasonably valued than India, with good results:

Fed Rate Cuts and FII Flows

- The US Federal Reserve recently cut rates by 25 bps, and analysts anticipate up to two more cuts, providing impetus for increased global liquidity and risk appetite

- Lower US yields typically spur FII flows into emerging markets, as borrowing costs fall and the USD weakens relative to EM currencies

- India remains attractive due to macroeconomic stability—GDP growth above 6.5%, contained deficit, and manageable inflation—which is now leading FIIs to reassess their underweight stance

Domestic Earnings Outlook and Consumption Push

- Festive demand, tax and GST rationalisation, and targeted government stimulus are expected to drive a rebound in consumption, supporting better earnings growth for listed companies in Q3 and beyond

- Market observers believe the incremental risk-reward now favours India, and FII inflows could accelerate as valuation and earnings begin to recover

Early Signs of FII Re-entry

- FIIs had the highest underweight on India since 2009, but recent macro and policy trends point to a strong possibility of renewed allocations in the near term

- Stock indices have rebounded in October 2025, with promising volume trends and pick-up in FII activities recorded after Fed's rate cut and trade positive headlines

Overall, the combined impacts of supportive Fed policy, improving global trade relations, buoyant domestic demand, and more rational valuations have begun to turn the tide for FII flows, positioning Indian equities for stronger performance going forward.

NIFTY 50 earnings growth is expected to recover gradually, but sectoral themes like digital, innovation, consumption, and manufacturing are likely to deliver much stronger double-digit growth, well above the broader index's pace over the next few years.

NIFTY 50 Earnings: Slower but Improving

- Aggregate NIFTY 50 net profit growth is projected at 8–13% for FY26, with possible acceleration to 16% by FY27 as macro, tax, and GST reforms work through the economy

- Near-term NIFTY earnings are anchored by select sectors such as autos, financials, capital goods, and metals, but banking and consumer segments remain softer

Digital and Innovation: Strong Growth

- India's digital economy is expanding at nearly twice the rate of overall GDP and should reach 13.4% of national income in FY25, driven by platforms, intermediaries, and rapid uptake of technology solutions

- Sectors leveraging innovation—like IT services, data analytics, AI, and digital payments—are projected to sustain 20–30% earnings growth due to structural demand and cost efficiencies

Consumption: Steady Momentum

- Consumption—especially premium, discretionary, and rural segments—is forecast to maintain ~12–18% earnings growth, as GST rationalisation and income tax relief boost domestic demand

- Companies in retail, FMCG, travel, entertainment, and hospitality are seeing higher sales and margin expansion, aided by festive demand and income growth

Summary Table: Theme-wise India Earnings Growth, FY26–FY27

Focusing allocation on these high-growth themes can potentially deliver superior risk-adjusted returns compared to the NIFTY 50 basket over the next 2–3 years.

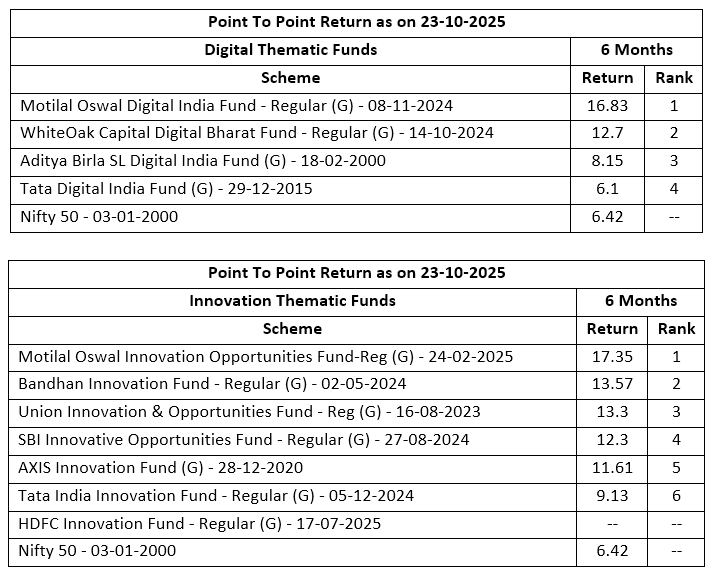

Investors seeking solid returns from Indian equities in 2025-2026 should indeed diversify beyond the NIFTY 50 and actively target higher-growth themes such as digital, innovation, consumption, and manufacturing. The recent performance of actively managed sectoral and thematic funds confirms that these strategies have consistently outperformed the NIFTY 50 benchmark, especially when aligned with structural trends and timely allocations.

Thematic & Sectoral Funds: Outperformance Evidence

- Several actively managed thematic and sectoral funds delivered annualized returns of 15–30%, far above the modest NIFTY 50 returns of about 2–3% in 2025

- Leading categories include manufacturing, infrastructure, digital innovation, technology, and consumption-driven funds, powered by PLI schemes, digital transformation, and vibrant domestic demand

Why Themes Beat Benchmarks

- Thematically focused active funds capitalize on targeted sector growth, rapid innovation cycles, government policy tailwinds, and can dynamically rebalance portfolios, unlike passively managed NIFTY 50 index funds

- Investors benefit from more robust earnings trajectories and broader opportunities not reflected within the NIFTY 50, which often lags transformative trends during periods of economic rotation

Strategic Takeaways

- Investors aiming to beat benchmark returns should increase exposure to actively managed funds within high-growth themes, as these remain better positioned to capture multi-year opportunity cycles than pure index funds in 2025

- A minimum investment horizon of 3–5 years is recommended for thematic strategies to realize full potential, as performance can be cyclical and theme-dependent

In summary, allocating across innovation-driven active funds and high momentum sectors is key to outperforming NIFTY 50 benchmarks, especially in a market environment shifting toward structural transformation

Indian equity returns are largely shaped by rotations across market caps, sectors, and thematic trends, all heavily influenced by macro factors and government policy shifts. Vigilant investors who monitor these cycles and adapt their allocation—whether to large, mid, small caps, or specific sectors/themes—are typically better positioned to capture outsized returns than those sticking with static, index-bound strategies.

Why Active Rotation Matters

- Macro factors—Fed rates, trade deals, fiscal and sectoral reforms—can trigger sharp shifts in capital among assets, requiring active rebalancing for optimal risk-adjusted returns

- Investors positioned ahead of policy-driven waves (e.g., infra and manufacturing, digital) have consistently captured superior returns outpacing the NIFTY 50

- Themes and sectors with strong tailwinds can generate multi-year alpha, whereas laggards may underperform even broad indices until cycles rotate back in their favour

DISCLAIMER:

These are views of the author. This is for information purposes only and should not be construed as an investment advice