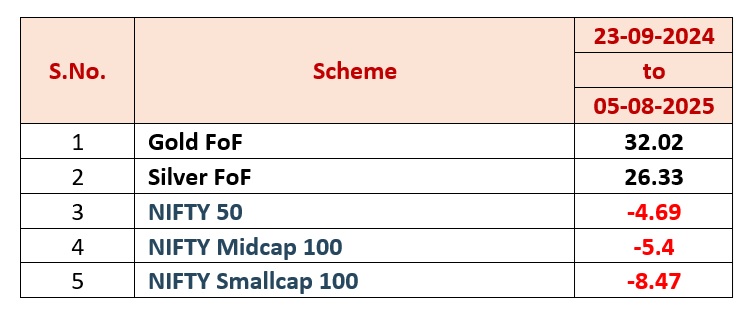

I had penned an article titled Diversification – the new Buzz word on 26th September 2024. That was the peak of the markets post which it had started sliding down. Prior to that I had penned an article in August 2024, Time to Look Beyond Equity, wherein I had mentioned about market valuations becoming stretched, to reduce exposure (or do some profit bookings from Mid Cap and Small caps) and increase exposure to Gold & Silver. Both the calls of reduction of exposure to mid and small caps and adding Gold & Silver in investor portfolios turned out to be BANG ON calls.

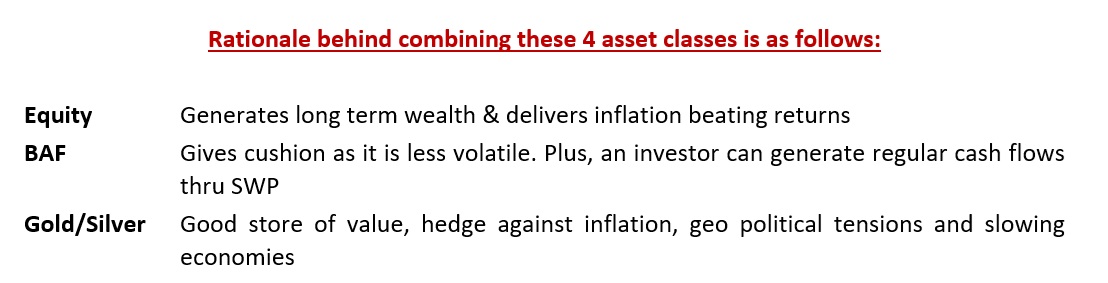

However, that got me thinking. Is it possible to time such tactical calls so accurately every time? What if they go wrong or given at wrong timings? Won’t that affect performance of investor portfolio returns? Also, of late (post COVID), I have realized the importance of adding precious metals in investor portfolios. I have studied them in detail over past few years and how they are extremely important for every investor portfolio during a) geo-political tensions (like current situation), b) global slow downs (again like current situation) and c) hedge against inflation and being good store of value when investors lose confidence in the fiat currencies like Dollars due to humongous Government debt and printing of currencies.

There is a very popular investment strategy in the US viz. 60:40 – which invests 60% in Equity & 40% in Debt and rebalances the portfolio at regular intervals; thereby keeping ratio static at 60:40. However, of late due to sudden rise in interest rates, there is erosion on 40% of the portfolio due to capital loss on debt. Prior to interest rate hikes in 2021-2022, yields were at near zero for the longest time; which once again affected the 60:40 portfolio through lower yield on 40% of the portfolio. In short, this strategy has grossly underperformed.

At first, I toyed with the idea of replacing 40% debt with 40% in Gold and creating 60:40 Equity:Gold strategy. Though back tested results were extremely encouraging, there would have been periods of underperformance when Gold prices went sideways or downward as well for a considerable number of years. Since price of Gold is at an all time high, results of this strategy would have given excellent results. Also, not many would like to take such concentrated bets of two asset classes – though negatively co-related (when equity does well, gold underperforms and vice versa. Of late, there seems to be positive co-relation when both asset classes are doing well).

Based on these back tested data, plus requirements of many investors to get regular cash flows post their retirement or even before that for various reasons, I thought of adding one more asset class viz. Balanced Advantage Fund to the equation and create the Ultimate Asset Allocation strategy.

Ideal allocation while building the portfolios should be 60:20:10:10 in favour of Equity:BAF:Gold:Silver. However, the same can be customized for individual investors based on their own needs and goals. For senior citizens, this ratio can be 20:60:10:10 in favour of Equity:BAF:Gold:Silver. Higher allocation to BAF can help them in creating tax efficient cash flows through SWP from BAF.

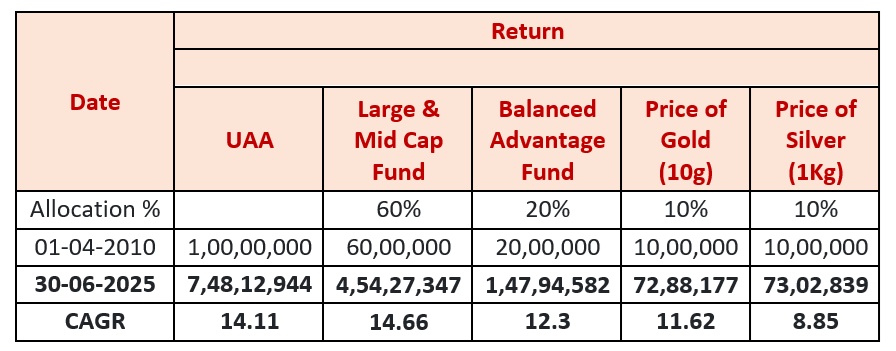

Once the portfolio is built to the desired level of asset allocation (in the above example 60:20:10:10 – Equity:BAF:Gold:Silver), re-balance the same every year to bring market valuation differences to reflect this static ratio. If one continues to show this discipline YoY and does re-balancing to the required asset allocation ratios, the results are quite astounding:

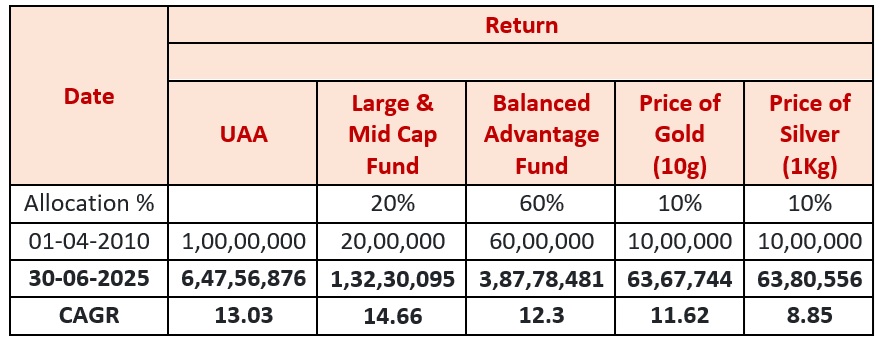

Above shows the result of the Ultimate Asset Allocation (UAA) strategy of 60:20:10:10 by investing in one Large & Mid Cap Fund, BAF of the same AMC, Price of Gold and Price of Silver. Overall UAA returns are 14.11% p.a. with Rs.1 cr invested on 1st April 2010 growing to Rs.7.48 Crs under UAA strategy.

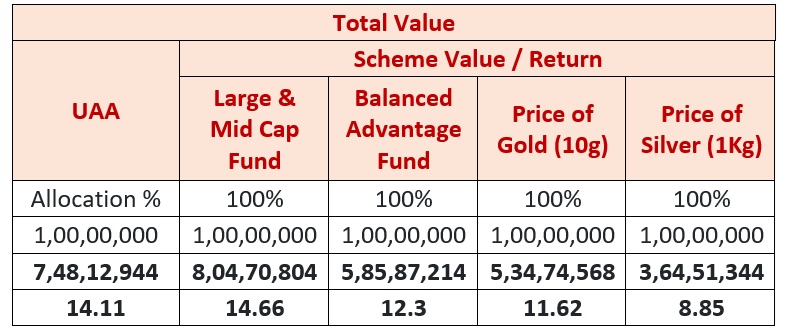

If funds were invested under each asset class (like Rs.1 cr either in L&M scheme or Rs.1 Cr invested in BAF or, Gold or Silver over the same period), results would be as under:

Results would be as follows for a senior citizen if she would have opted for a ratio of 20:60:10:10 in favour of Equity:BAF:Gold:Silver:

Instead of trying to time markets or take tactical calls in different asset classes, ideal is to pre select your ideal asset allocation, create a portfolio around it, re-balance it every year to the desired ratios and continue this exercise YoY. You will realise, that your portfolio will generate decent long-term returns with less volatility and will perform in all market conditions due to negative co-relation of different asset classes.