Silver Lining During this Extreme Risk Aversion Investment Mindsets of Investors

How do Arbitrage schemes generate Returns?

- Roll Over of Arbitrage Opportunities (buying Spot/Selling Future - stocks or Index)

- Churning or Discount Arbitrage – explained separately below

- Interest on Fixed Deposits or on Debt Instruments

- Dividends from Stocks (bought in cash segment)

What is Arbitrage and How Does it Work?

- This class of investment gives market neutral returns without taking any directional exposures to the underlying stocks and shares

- For an investor this is nothing but a BUY and SELL transaction i.e. lending money which is secured and without taking any price risks

- Difference between the SPOT & FORWARD rate is nothing but interest rate (traditionally known as Badla)

- Earlier this opportunity was available by buying on one Exchange say BSE and Selling on another Exchange say NSE

- This is similar to Reverse REPO undertaken by RBI with Banks or SWAP transactions in the Forex market

- Difference between SPOT & FORWARD price is COST of CARRY or the interest rate

- In the Futures market, all the trades are done on the exchange either BSE or NSE to ensure performance. Hence minimal Credit Risk

During bull period of equity markets, Fund managers get good opportunities of locking in arbitrage returns and then unwinding the same on the expiry date or rolling it over to the next month (if next month gives similar opportunities of locking in arbitrage returns); thereby generating decent post tax returns in the hands of the investors

What is Churning or Discount Arbitrage and how does it generate Returns?

Even in times of bearish markets where arbitrage returns are low and futures are going into negative, Fund Managers have been able to generate decent returns. The said is possible when Fund Manager locks in lower arbitrage yields of 30/40 bps i.e. 4-5% p.a. and when the same stock future goes into negative on days markets correct, they unwind the position earlier than 30 days.

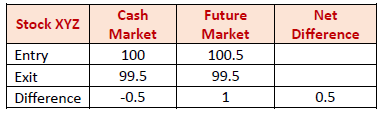

Let us understand this better with following example:

Day 1: Buy Cash @Rs.100 & Sell Future @Rs.100.50

On day 15 Future goes into negative and quotes at say Rs.99.50;

In such a situation the Fund Manager unwinds the position on day 15 and makes a clean Rs.0.50 on the whole transaction and that too in 15 days and lets the unwound position earn additional money market returns over next 15 days i.e. till the end of the month.

The above is called discount arbitrage (though not called officially, but is used as a common parlance in the Arbitrage Markets).

Why Arbitrage Schemes Now?

Past couple of years have been extremely traumatic and volatile for Debt markets (starting with IL&FS collapse in September 2018). This got accentuated in the months of March and April 2020 post Lock Down due to COVID19. Risk aversion reached its peak when even Banks preferred to invest their huge surpluses with RBI at Reverse REPO of 3.75% instead lending or investing in Corporate Bonds (including AAA rate Corporate Bonds). Trust deficit reached its peak when 6 schemes of an AMC got locked down.

Investors are wary of investing even in Liquid schemes or Ultra Short-Term Bond funds due to all the above events and circumstances. Many have in fact, redeemed out of these schemes; thereby showing extreme risk aversion to investing. Equity market corrections and COVID issue has also added fuel to fire.

In such circumstances, there is one Asset Class which is capable of fulfilling the investment needs and criteria of suck risk averse investors. Ideal for investment horizons upwards of 3 months plus. This Asset Class is Arbitrage Schemes. This fits the bill for all such risk averse Investors.

This has been one of my favourite asset classes since they were launched way back in 2004-2005 with 50:50% (50% arbitrage: 50% in money market instruments and treated as debt scheme those days) variant and then converted to 65:35% variants (65% arbitrage : 35% money market instruments) with Equity Taxation.

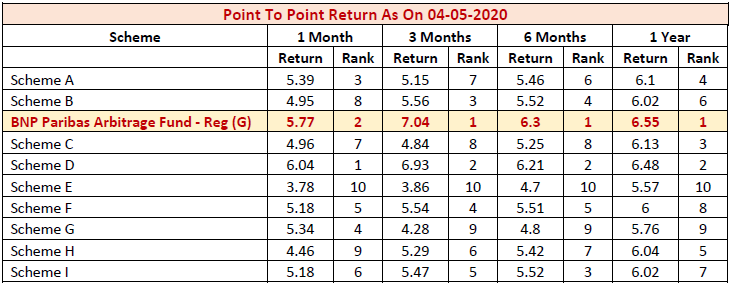

One of the AMCs which has been consistently doing a good job of managing this scheme and the scheme name is BNP Paribas Arbitrage Fund:

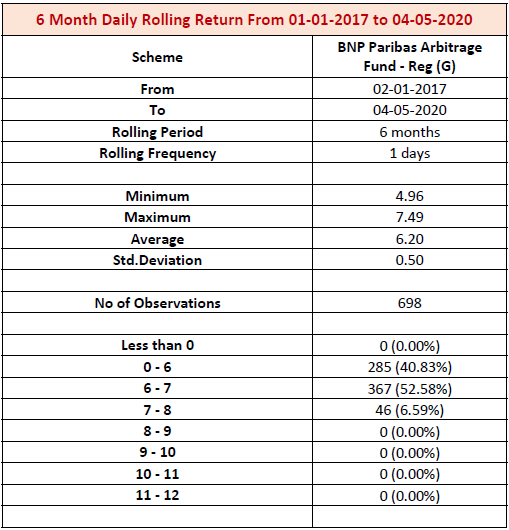

Following is 6-month daily rolling returns analysis of this scheme:

Major advantage of investing in this scheme:

- No credit risk. BNP Paribas Arbitrage Fund invests their Debt portion in Fixed Deposits – hence non-MTM portfolio

- Equity component: 100% hedged portfolio – Buy Stock in Cash and Sell same Stock in future; hence no market directional call

- Equity taxation with 15% short term gains tax (if exited before 1 year of investment), long term gains tax at 10% (for more than 1-year investment horizon)

- Does well in Bullish and Volatile Markets like current situation

Things to Remember:

- This scheme will have daily MTM impact when markets go up or down

- Which means; post locking in arbitrage, if markets go up; arbitrage opportunities tend to expand (something similar to interest rates going up) and hence generally, NAVs tend to go down and vice versa

- Ideally, do not redeem in between dates due to this MTM impact

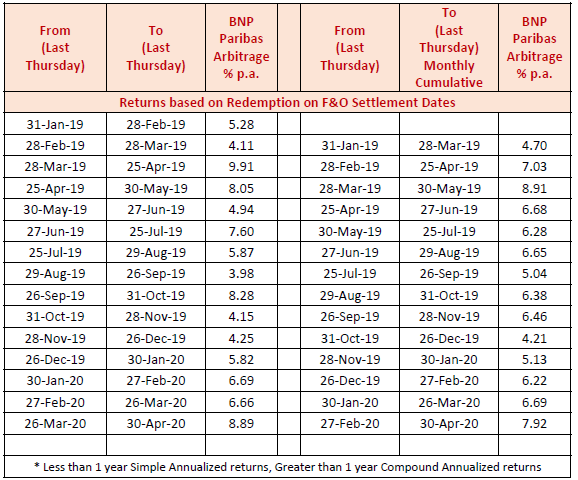

However, if one exits/redeems only on last Thursday which is the F&O Settlement dates, spot price and future prices converge and delivers the captured arbitrage returns i.e. you cannot have negative returns if redeemed on these dates:

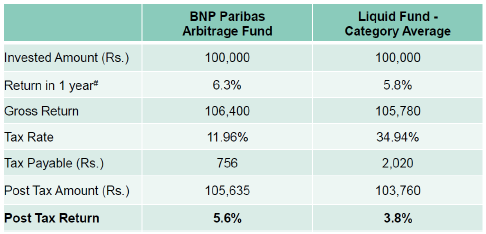

Let us analyse this on taxation and returns perspective v/s Liquid Schemes:

During bearish periods of equity markets (when arbitrage opportunities are scarce); even if these schemes generate say liquid fund kind of returns; they are still better off due to tax arbitrage as well.

How do you Position this Scheme for Investors?

- You can also use this as Debt portion under Asset Allocation strategies

- Use it for parking short term funds from 3 months plus for better risk adjusted and tax efficient returns

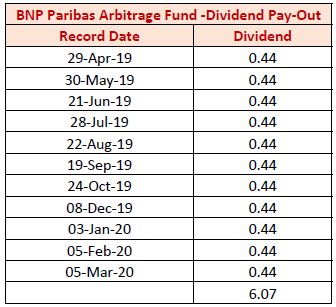

- Also, one can use this for generating monthly cash flows through Dividend Pay-out options.

There is a regular dividend pay-out history as follows:

*Post April 1'2020, dividend will be taxed in the hands of the Investors at applicable tax slabs.

I strongly recommend Advisors to use this scheme for not only risk-averse Investors but also for risk taking investors for their different needs as mentioned above.