SANTOSHONOMICS - Simplicity is the Ultimate Sophistication

I attended a power packed Knowledge Summit organized by Franklin Templeton AMC at Surajkund, Faridabad on July 27-28. There were many celebrity speakers including Rajdeep Sardesai, Swaminathan Iyer and host of others at this two day event. However, my favorite session was the one conducted by Santosh Kamath, Managing Director of Franklin Templeton, Fixed Income. This article may seem like a fan paying tribute to his idol; in some ways that won’t be too far from truth.

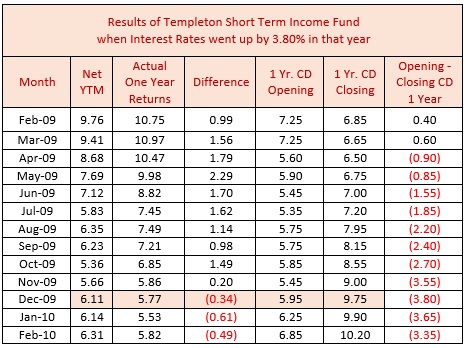

Most in the industry do not know my real name but know me as MisterBond (pen name given by Vijay Venkatram of Wealthforum). However, many may not know that my GURU in the debt markets from whom I have learnt a lot through many personal interactions, telephonic and mail conversations is none other than Santosh Kamath. I think he joined FT in 2006 and my initial interactions were few and far between. But first real interaction happened when one of his schemes viz Short Term Income plan delivered close to his captured YTM returns over one year period even in the year when 1 year CD rates went up by 400 bps (4%). Many in the industry will not question a good performance; but I have a habit of analyzing both good and bad performances.

I follow three life lessons of Indra Nooyi (Chairperson Pepsico) – one of them being “remain a lifelong student and don’t let that curiosity dieâ€. Student in me and my curiosity led me to analyse his scheme in a total different perspective which no one had done so far. When I showed results of my analysis, even Santosh was surprised that his schemes perform like a formula which I derived from my research of performance of his schemes viz. Returns to Investors = YTM (captured at the time of investment) – Expenses ratio +/- 50/100 bps.

To illustrate this further if the Gross YTM is say 10%, Expense ratio is say 1% = Net Captured YTM = 9%; in a rising interest rate scenario during that one year, the scheme may deliver 50 bps less than the Net Captured YTM; in this case 9% - 0.50% = 8.50% or if the interest rates soften during this period then Returns = 9% + 1% = 10%. I had created following table of his Short Term Income plan during 2009-2010 period (of course, now rest of the industry follows similar way of show casing the same. But don’t forget who show cased this first ).

That gave birth to what we commonly refer to as ACCRUAL schemes in the Mutual Fund Industry. For the first time there was predictability in debt schemes (so far Debt schemes were more like interest rate trading calls either at shorter end or at the longer end – with no predictability and huge volatility), less volatility and finally could give serious competition to the most preferred investment vehicle viz. Fixed Deposits. Most in the industry hailed this asset class and started investing their client funds in this new asset class.

Any strategy to succeed takes a lot in this competitive world. For it to sustain for long time at peak is even more difficult. For it to come back to the same level after it retraces from the top is the most difficult part. Santosh has seen all three phases and for him to have the same passion along all these phases is commendable.

Now fast forward to March 2016. A big event happened in the debt markets which shook the confidence of both Advisors as well as the Investors. Same Advisors who were loving each and every scheme of FT started writing obituary of both FT AMC and their Debt schemes and that of Santosh Kamath as a good Fund Manager. Industry was about to kill an asset class which had given Mutual Fund debt market schemes an identity in their Investor portfolios. When JSPL downgrade happened, all hell broke loose and Advisors/Investors started running helter-skelter in search of answers and how to exit these same ACCRUAL schemes which had become darling of the Investors. We were about to convert a credit issue into a huge liquidity issue by putting redemptions and repeat the same mistake which we as an Industry had committed during Lehman Brother crisis of 2008.

This article is to understand Santosh Kamath’s style of investing and his detractors will gain a lot of insight as what goes on behind the scenes to give consistent performance.

I wish to take a lot of credit for bringing sanity back in our Industry by writing a series of articles on this issue (1, 2, 3, 4) and advocating to stay patient, not take any action, if at all invest more (against Industry call of redemption). One year later I followed up with one more article and pointed out as to how those investors benefited who stayed put or invested more. Many Relationship Managers of FT AMC from different regions met me at this Conclave to personally thank me for penning these articles. These articles helped them in thwarting negative publicity the Fund House had attracted due to this credit downgrade event.

At FT Perspective Conclave at Surajkund, Santosh presented one PPT which showed how he and his team have delivered consistent returns of 9.50-10% over various debt market cycles. 1/3/5/10 year returns of most of his schemes including Short Term Income, Income Opportunities and Corporate Bond Fund have been between 9.50-10% p.a.; irrespective of interest rate scenarios which were fluctuating like a yo yo. This speaks volume for the strategy that he has created and adopted.

As the saying goes “Great Minds Think Alikeâ€; I have always advocated investment in ACCRUAL schemes for retail investors and advised never to invest funds of Retail Investors in Duration, Income or Dynamic Bond funds. Similarly, I have never seen Santosh giving interest rate calls by recommending investments in schemes other than ACCRUAL.

When I conduct workshops for IFAs and Investors, one slide which I show case is 5 rules of successful investing. One of the Rules is “Never Outguess Markets – debt or equityâ€. Same message was conveyed by him to the audience present. He showed a similar data of REPO Rate of RBI and asked this question: “Can you guess what different schemes of FT would have delivered at different points in time based on the RBI rates?†Naturally, no one could guess. The point that he was driving home was that Advisors and Investors in ACCRUAL space should be more interested in knowing the Captured YTM of the scheme at the time of investment rather than what is RBI likely to do in their Monetary Policies. Post 3 years, returns should be in the band of Gross and Net YTM of the scheme or as mentioned above by me as a Formula.

Simple point to understand from the above is that stop listening to the noise in the markets, stop out guessing what RBI is likely to do, concentrate on understanding strategies behind the ACCRUAL schemes and ensure that your Investors stick with their recommended investment horizons. In the intervening periods (based on interest rate movements), these schemes may underperform; but over that 3 year investment horizon they will deliver returns as discussed above.

Now let’s talk about Credit Quality of their Portfolios:

In this connection, he shared following points for the audience to consider:

- Most of the A rated papers are either Asset Back Debt with some collateral like shares of the Promoter Company with 200-250% margins or with Guarantees from strong Promoter Companies or Securitized Debt by investing in a pool of say Car Loans, Home Loans etc.; thereby spreading the risk across many borrowers

- FT identifies long dated papers of a Company with say residual maturity of 6 months that may have A rating v/s the same Company issuing a 6 month Highest Rated CP. Logic says that both the securities are issued by the same Company with similar residual maturities. Due to lower ratings of long dated security of the said Company; lender tends to get higher YTM v/s selecting a similar tenor highest rated CP with lower YTM

- In the past 5 years; out of all their exposures to A rated papers only two of the securities were downgraded v/s others either retaining the same rating or getting upgraded. Even out of these two securities which were downgraded, one of them later got upgraded. This is a phenomenal track record of identifying right securities by the FT team

- Finally, his argument was that these ratings are an opinion of the Credit Rating agencies. FT relies more on their own stringent internal norms than relying on these Rating Agencies. Those who have read my series of articles which I had written during the downgrade fiasco will recall that one of these was titled “Can we rely on Credit Rating Agencies?â€

- When I conduct workshops for IFAs across the country, I am asked this question very frequently: “What is your view on credit quality of FT schemes?. My simple and straight forward answer to this is that I do not question the Fund Managers on selection of their securities. I only question them on strategy and concepts they use to construct these schemes and whether they are sticking to that mandate that they have explained to me

- It is like asking an Equity Fund Manager as to why he/she invested in a particular script. Do we ever question an Equity Fund Manager this?

How does FT Manage to consistently Capture Such High YTMs of 10% and above? What is the Magic Formula?

There is no magic formula. Simple answer is that they identify these borrowers earlier than the rest. That gives them an edge over others to negotiate far higher Coupons. He showed many such Securities which FT had identified ahead of rest of the Fund Houses and how other Fund Houses invested in the same securities maybe 1-2 years down the line at much lower coupons.

Once other lenders line up to lend to a borrower; naturally borrower is in a position to negotiate a far better rate. This gives rise to a huge compression in the portfolios of FT schemes which would have lent to the same borrowers at much higher coupons; thereby generating huge capital gains with higher accruals as well.

So my humble suggestion to all in the Industry is that one off Credit Downgrade/Default should not take away years of hard work of either the Fund House or the Fund Manager. Please apply logic and common sense in your Advisory practice and guide the Investors on the right path instead of becoming part of the herd mentality of the Investors. By no stretch of imagination am I suggesting that Credit Downgrades or defaults may not happen in the future. Even if they do, this is part and parcel of risks attached to investments in debt as an asset class. But benefits of diversification will help cushion such events and accruals will help in recovering such temporary losses and hair cuts.