Revisiting our call of investing in Banking & Financial as a defensive play in September 2024

On 18th September 2024, I had penned a note titled: POST FED RATE CUT CAN FINANCIALS BE THE NEW DEFENSIVE PLAY? Let us revisit that call and see how it has panned out and what is the outlook for this sector going forward as well:

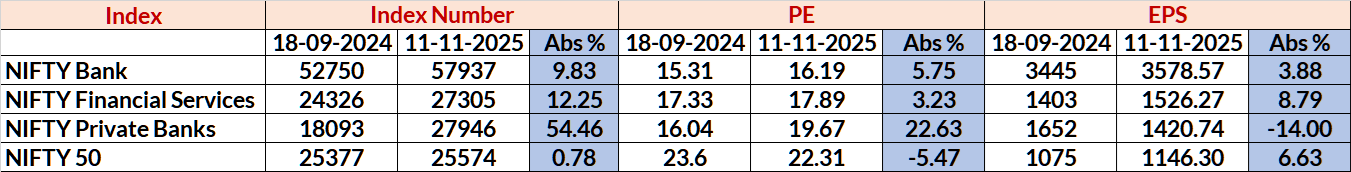

Banking and financials have outperformed NIFTY 50 over the past year, driven by their reasonable valuations and sector-specific tailwinds. NIFTY 50, on the other hand, has underperformed due to stretched valuations, resulting in negligible returns during the same period, as expected from such relative valuation differences.

Sector Performance and Valuations

- Over the past year, NIFTY Bank and NIFTY Financial Services indices rose by 9.83% and 12.25%, respectively, and NIFTY Private Banks by an impressive 54.46%, while NIFTY 50 delivered just 0.78% absolute returns.

- Banking and financial sector PE multiples show only moderate expansion, suggesting valuations remain attractive for further upside, especially when compared to the broader NIFTY 50 index, where the PE contracted and remains at elevated levels.

- EPS growth for Financials and Banks is positive, reflecting improved profitability. In contrast, Private Banks have seen an EPS decline despite strong price performance, likely signalling market anticipation of mean reversion and sector re-rating as private investment and credit demand recover.

FIIs Flows and Large-Cap Preference

- Foreign Institutional Investors (FIIs) historically first target large and mega cap sectors—primarily banking and financials—when allocating to India due to depth, liquidity, and favourable macro trends.

- With rising optimism about India's manufacturing push and private sector capex (China +1 strategy), lenders stand to benefit from expanded credit demand, improved asset quality, and higher profitability, making these sectors attractive for incoming FIIs.

Outlook

- Banking and financials are well positioned for continued outperformance if FII inflows accelerate and the manufacturing sector's revival translates into increased credit demand and productive asset creation.

- Based on the data, both absolute price returns and stable valuations suggest risk-reward remains favourable in these themes, while broader NIFTY 50 might still lag until its valuation normalizes or earnings growth materially accelerates.

- We are constructive on both Banking & Financial going forward as well

Disclaimer:

These are personal views of the author and for information purposes only. This note should not be construed as investment advice.