Precious Metals Rally – 2025 Precious Metals Rally Compared with 1980 and 2011 Rallies

These are the four most dangerous words – THIS TIME IT’s DIFFERENT. How different is it this time around and why?. I will analyse rallies of 1980, 2011 and current one in terms of prevalent macros at respective times and how this time can be different.

But before I delve into this, let me admit, that being a student of teachings of Mr. Warren Buffett, till 2020, even I used to believe that Gold is not an asset class that should be considered for investments as it earns no income and is non – productive asset class. He dabbled in Silver on a few occasions due to its demand as an industrial metal. I used to recommend starting SIP in Gold, as soon as a child was born to convert that portfolio into jewellery at the time of weddings, etc. – more of a social compulsion allocation in Indian context.

However, my perception of Gold as an asset class for investments changed due to following two WhatsApp forwards:

- 10 bars of gold could buy you a house in the USA in 1930s. Same 10 bars of Gold can buy you a house in the USA in 2025 as well

- 1990 – 1Kg Gold = Maruti 800

2000 – 1 Kg Gold = Esteem

2005 – 1 Kg Gold = Innova

2010 – 1Kg Gold = Fortuner

2019 = 1 Kg Gold = BMW X1

2025 – 1 Kg Gold = Defender

2030 – 1 Kg Gold = Rolls Royce (assumed)

That got me thinking of the importance of owning Gold as an asset class for investments. Above showcases that Gold is a good store of Value and a great hedge against inflation. It is not that the price of houses have gone up from 1930 to 2025, it is the erosion of purchasing power of the USD from then to now due to higher borrowings by the Fed, deficit spending by Governments, excess printing of dollars due to which investors have lost confidence in fiat currencies and are attracted to invest in Gold which has limited supply, no third party risks and a great store of value.

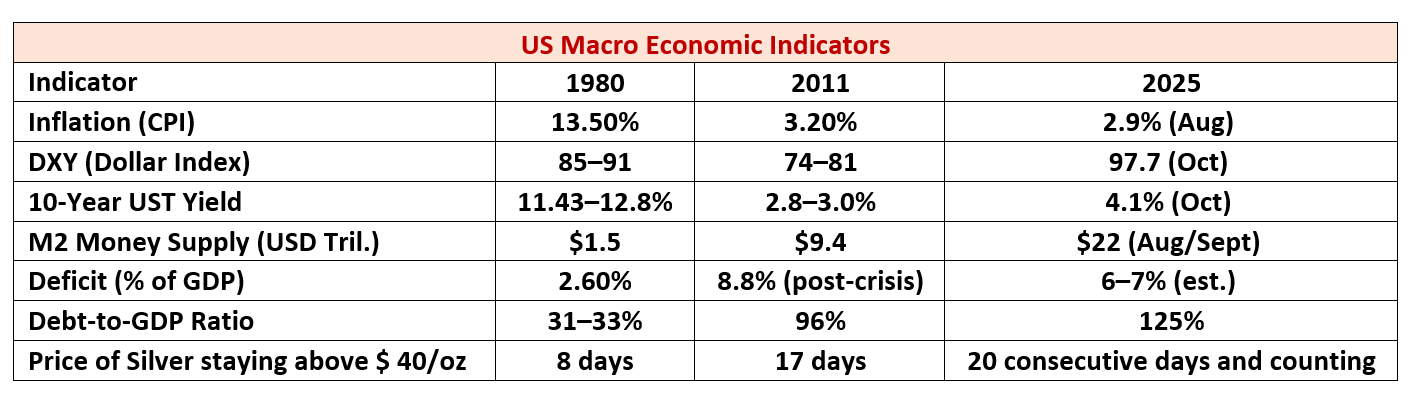

Now let us come to the point, what were different macros at play at different times:

Precious Metal Rally: Context and Drivers

- 1980: The spike in precious metals, especially gold and silver, followed years of high inflation (often above 13%), oil shocks, and a collapse in confidence in fiat currencies. Gold and silver were seen as a hedge against double-digit inflation and geopolitical volatility. The silver price surge was partly due to the Hunt brothers’ attempt to corner the market, pushing prices near $50/oz before a dramatic crash. This was the period of Hunt Brothers and their manipulation

- 2011: The rally stemmed from the aftermath of the Global Financial Crisis. Quantitative easing, U.S. credit rating downgrade, debt ceiling debates, and fears of currency debasement led to a rush for safe havens. Silver again approached $50/oz; gold hit nearly $1,900/oz in a short-lived spike

- 2025: The current rally is driven by persistent, if moderate, inflation, geopolitical uncertainty, wars (Ukraine, Middle East), and distrust in fiat currencies amid high debt levels. Unlike past episodes, the 2020s rally is steadier—with less media hype—amid global realignment and central banks diversifying reserves. The pace is more gradual than the manic rushes of the past

As is visible, some of the major contributors for the current rally can be attributed to the following:

- De-dollarization drives by various Central Govt after seizure of Russian assets

- Central banks buying both gold & silver

- Very high debt to GDP ratio combined with very high fiscal and trade deficits

- Trump tariffs and its aftermath

- Geo-political tensions across the globe

- Falling Dollar Index

- Very high M2 – Money Supply and excessive dollar printing post COVID

- Inflation trajectory on the rise due to Trump tariffs, supply chain disruptions

- 5th year of supply deficit of Silver v/s demand for growing industrial use

- Gold is like the Large Cap and Silver can be compared to Mid-Caps. First leg of rally starts in Large Caps (Gold) and then Mid-Caps (Silver) takes over and gains momentum

- World order is changing, financial reset is happening

- Fed rate cutting cycle

- Both rallies in Gold and Silver are different cues from what S&P500 and Nasdaq rallies are indicating. As Peter Schiff has tweeted on X: Silver traded above $48, a new 14-year high. A 65% increase in the price of silver so far in 2025 is not consistent with an economy on a glide path t 2% inflation. In fact, it is a clear warning that Americans need to prepare for the greatest inflation in the US history

Caveat

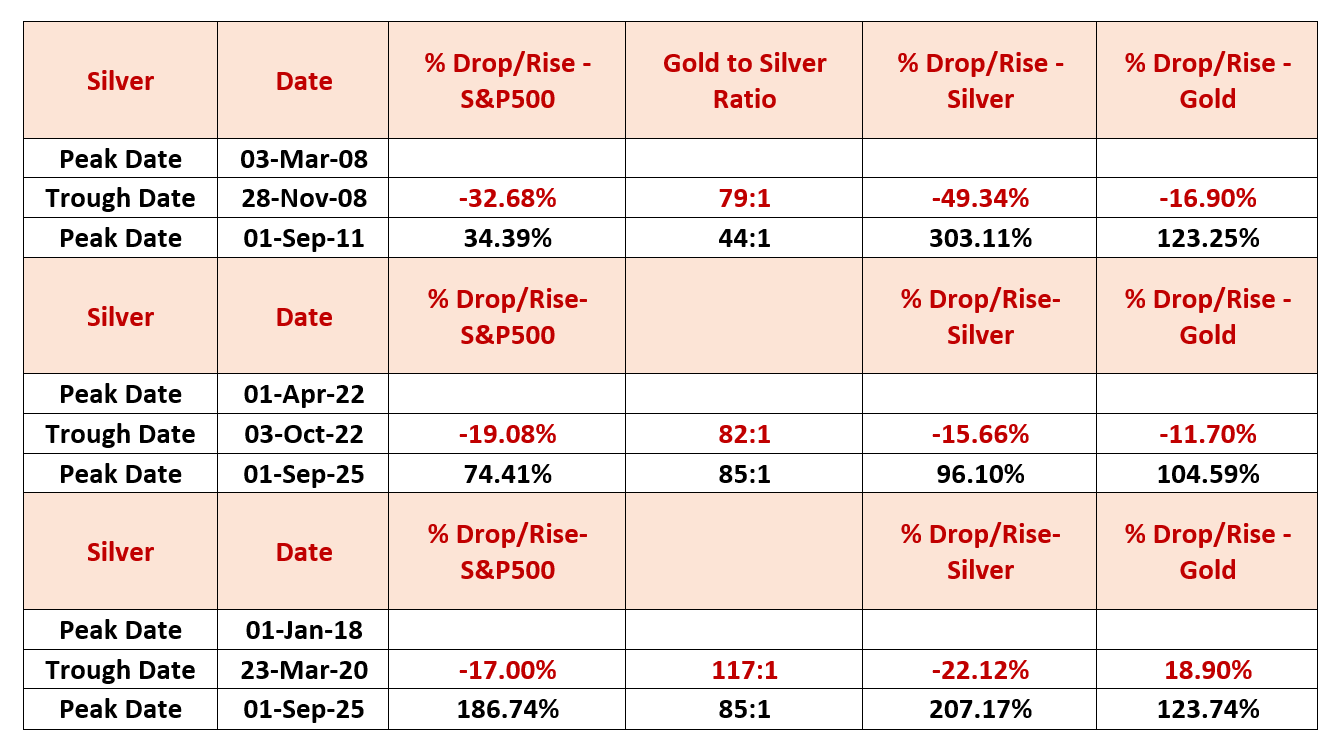

First and foremost, let me reiterate the downside. If markets in the USA correct, all other asset classes correct along with that and may be to the same extent. However, rally in precious metals thereafter, goes to the next level:

Once this is established that precious metals are in a structural bull run (even Technicals in Silver of the longest Cup and Handle formation points towards that), let us understand how to position both Gold and Silver in an investor’s portfolio.

Rule of 80:50 states that whenever Gold to Silver ratio (Price of one oz of Gold/Price of one oz of Silver) goes above 80, Silver is supposed to be undervalued and at some point, will start outperforming Gold. Whenever, this ratio goes below 50, Gold is supposed to be undervalued, time to become overweight in Gold and lighten position in silver.

There is major resistance for Silver at $50/oz from where it had retraced twice in 1980 and 2011. There will be some profit booking at Silver at $50/oz and for Gold at $4,000/oz. However, according to me those should be buying opportunities.

Conclusion:

The 2025 precious metals rally is more extensive, less speculative, and happening under high but contained inflation, weakening dollar index, interest rate cuts by Fed and record debt. The drivers are more structural (systemic doubts, global realignment) than panic-induced or purely inflationary. Ideally, investors should have at least 20% of their portfolios in Gold & Silver (realign Gold and Silver weightages as stated above by using 80:50 rule). These positions should be held forever (till you do not need to dip into this corpus for any of your requirements) and ride volatility with intermittent realignment of weightages between Gold and Silver. Due to Silver at near historic highs, one should brace for volatility. Only once it settles above $50/oz with enough volume and time, can this go up to a higher level from thereon.

Disclaimer:

These are the views of the author. This note should not be construed as an investment advice. This is for information purposes only