Rally in precious metals, some of the global macros are screaming a big financial reset in the making. I will analyze these readings and the readers can draw conclusion as to what some of the asset classes like Gold, Silver, Oil, Currency, Debt are trying to tell us:

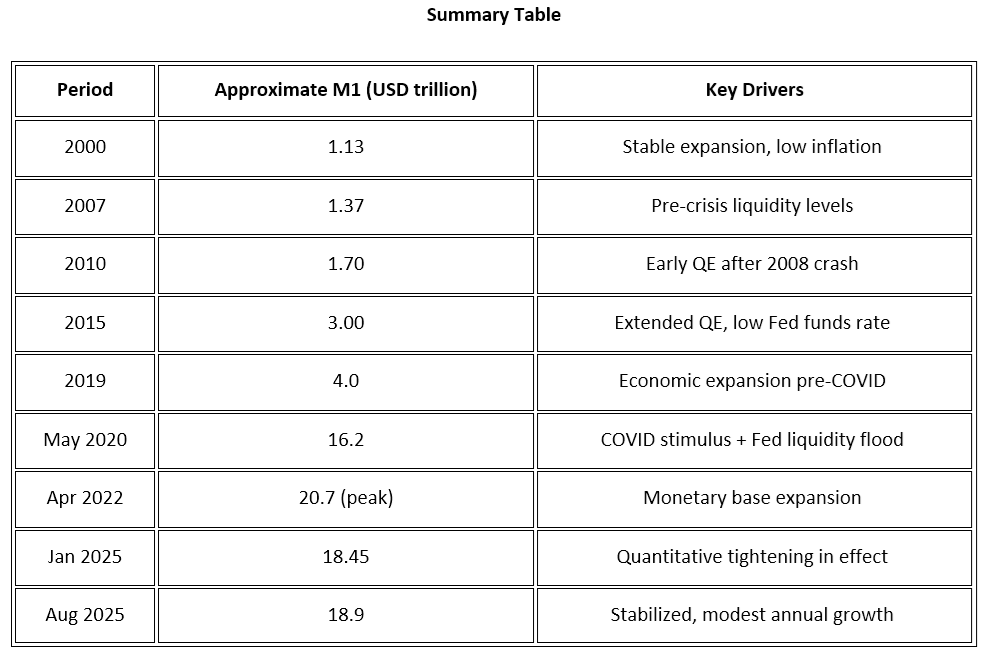

M1 Money Supply – Exponential Growth post GFC and COVID and its implications:

M1 (money in circulation, including cash, checking deposits, and other liquid assets) has undergone major structural changes in the U.S. over the past two decades. The historical progression can be summarized as follows:

Thus, total M1 money supply in the U.S. has grown approximately 14 times since 2007, with more than 70% of that rise explained by emergency COVID-era expansion and reclassification adjustments from 2020 to 2021.

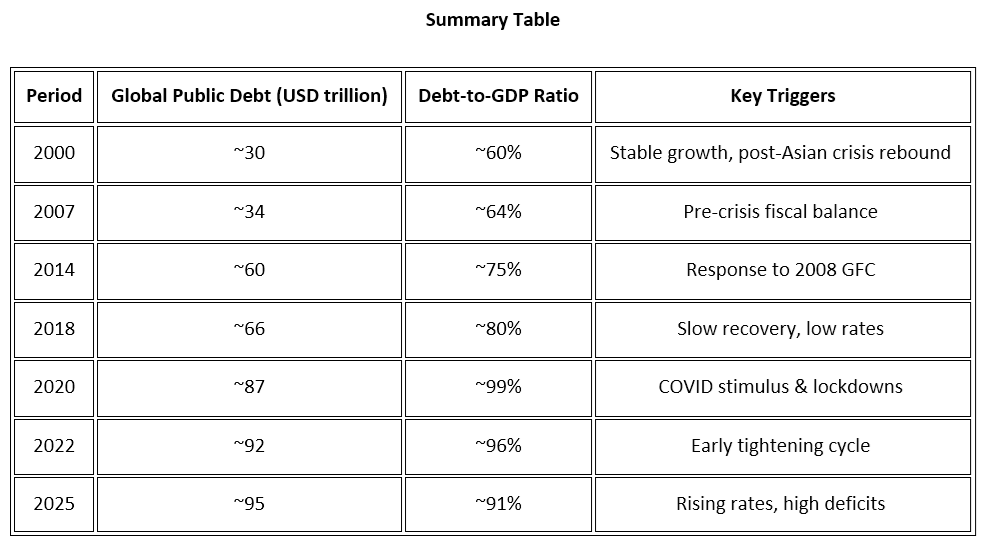

Global Government and Private Debt Expansion:

Global government debt has expanded dramatically over the past 25 years, reflecting successive crises—from the 2008 financial collapse to the COVID-19 pandemic—followed by record fiscal stimulus and rising interest costs. The trends for each broad period are summarized below. Global debt overall (public + private) reached a record $338 trillion in 2025, of which governments accounted for roughly 28–30% of the total.

In summary, global government debt has nearly tripled since 2000, with most of the increase occurring after 2008 and especially in 2020, as central banks financed pandemic relief. Despite post-pandemic fiscal tightening, total sovereign debt in 2025 continues at historically elevated levels above 90% of world GDP.

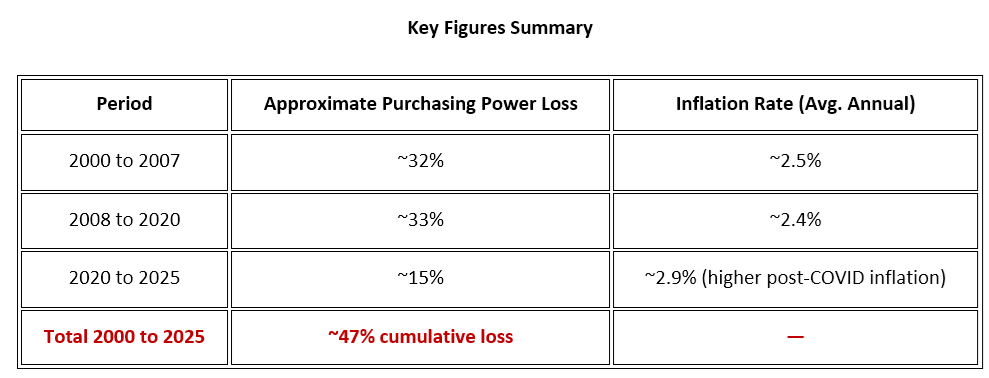

Impact of Rising M1 and Global Debt on erosion of Purchasing Power of Fiat Currencies:

The purchasing power of the U.S. dollar has declined significantly over the specified periods due to inflation, which erodes the real value of money over time.

Post-COVID Period (2020 to 2025)

After 2020, inflation surged due to pandemic-related supply chain disruptions and stimulus measures, causing a sharper decline in purchasing power. Between 2020 and 2025, the dollar lost around 15% of its value, resulting in approximately $0.85 in 2025 purchasing power for every dollar in 2020. Cumulatively, from 2000 to 2025, the dollar has lost roughly 47% of its purchasing power.

This means that prices are nearly 1.88 times higher in 2025 than in 2000, and a dollar today buys roughly half of what it could two and a half decades ago. The accelerated inflation in recent years post-COVID has eroded purchasing power faster than in the earlier 2008-2020 period.

Thus, the U.S. dollar's loss of purchasing power over these time frames reflects the impact of ongoing inflation, fiscal policies, and economic shocks, which have substantial implications for savings, investments, and cost of living.

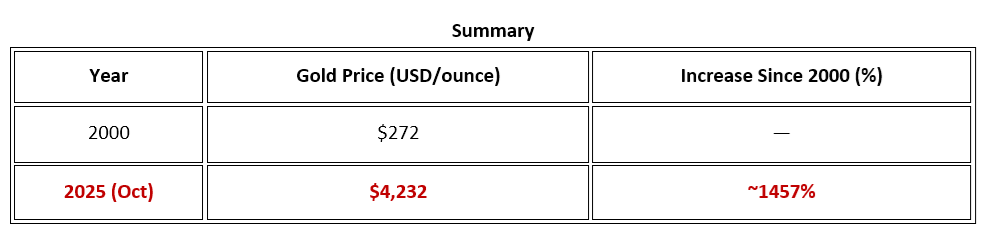

Gold rising from the ashes during the same period:

From 2000 to October 2025, gold has experienced a substantial increase in purchasing power terms when measured in U.S. dollars.

Gold Price Increase (USD terms)

- In 2000, the price of gold was approximately $272 per ounce.

- By October 2025, gold prices have surged to around $4,232 per ounce.

- This represents an increase of over 1457% in gold’s dollar price over 25 years.

Comparison to Inflation

- While the U.S. dollar lost about 47% of its purchasing power over the same period, gold increased nearly 15 times in nominal terms.

- This shows gold's role as a strong store of value and inflation hedge, significantly outpacing the erosion of dollar purchasing power.

Hence, gold has gained substantial value against the dollar, preserving and increasing investors' real purchasing power dramatically over the last 25 years, especially during periods of economic uncertainty and inflationary pressures.

The concern that the U.S. might have to debase or devalue its currency to manage its large and growing debt burden—currently estimated around $37 trillion at the federal government level—is a topic widely debated among economists and policymakers.

BRICS Nations shift towards bilateral trade – Start of De-dollarization:

The BRICS nations’ growing shift toward bilateral trade settlements and gold-backed frameworks marks a significant strategic pivot away from US dollar dependence, underlining a structural challenge to the dollar’s reserve hegemony. This transformation is being driven by multiple interlinked developments across trade, monetary policy, and central bank reserves.

BRICS Shift to Gold-Linked Trade

BRICS members—Brazil, Russia, India, China, and South Africa—are developing infrastructure that enables cross-border trade settlement in their national currencies, using gold as the underlying benchmark rather than the US dollar. This multi-currency system weighs member nations’ currencies against each other based partly on their gold reserves, encouraging accumulation of gold as a means to strengthen currency credibility within the bloc. The approach is not meant to replace the dollar globally but to create a parallel settlement system insulated from sanctions and Western financial networks.

Central Banks Boosting Gold Holdings

Global gold accumulation by central banks has reached historic highs. Purchases exceeded 1,000 tonnes annually in both 2023 and 2024, with 2025 continuing the trend despite slower official buying due to price appreciation. According to the World Gold Council, gold’s 60% appreciation in 2025 has outpaced major currencies and sovereign bonds, reflecting its growing appeal as a politically neutral reserve asset. India’s central bank, for example, crossed the $100 billion mark in gold holdings in October 2025, its highest ever, with gold now forming nearly 15% of India’s total reserves, the largest share since 1996–97.

U.S. Policies Accelerating De-dollarization

De-dollarization is also being accelerated by U.S. tariff and sanctions policies. President Trump’s 2025 “Liberation Day” tariff plan, imposing sweeping import duties on BRICS economies, triggered coordinated moves among these countries to deepen financial independence and reduce dollar exposure. This has intensified the use of local currencies and gold-linked settlements within the bloc.

Implications for the USD and Gold

While BRICS leaders, including India’s foreign minister, emphasize they do not seek to replace the dollar outright, their actions are clearly diluting U.S. financial influence. Gold, serving as a sanction-proof and neutral store of value, has effectively begun functioning as a “reserve anchor” once again. As more central banks reduce their US Treasury exposure—China and Japan have already trimmed holdings—the share of gold in global monetary reserves may continue to climb, further boosting demand and price stability for the metal.

In essence, gold is re-emerging as a de facto neutral reserve currency, with the BRICS bloc’s gold-linked trade models and continued central bank accumulation signalling a multipolar reserve system that could reshape global financial dynamics over the coming.

The world is indeed witnessing what analysts describe as the most profound financial realignment in nearly a century—one where the US dollar’s dominance as the global reserve currency is being eroded, and gold is steadily resurfacing as the ultimate anchor of monetary confidence. This phenomenon, often dubbed a “global financial reset,” is being catalyzed by debt saturation, persistent fiscal deficits, and diminishing trust in fiat systems.

The Fading Dollar Order:

The US dollar now represents roughly 57–58% of global foreign exchange reserves, down from over 70% two decades ago, underscoring a long-term structural decline in its hegemony. Accelerating de-dollarization, led by BRICS nations and other emerging economies, reflects disillusionment with the “weaponization” of the dollar through sanctions and its reliance on mounting U.S. debt issuance to sustain consumption-driven deficits. As confidence erodes, many central banks are treating the dollar as a transactional medium, not a permanent store of value.

Gold’s Resurgence as the Ultimate Reserve:

As of mid-2025, global central banks collectively control around 36,700 tonnes of gold, for the first time surpassing U.S. Treasury holdings in aggregate value—roughly $4.5 trillion in gold versus $3.5 trillion in Treasuries. This record allocation (about 27% of total reserves) signals a historic shift in central bank strategy: a conscious pivot from paper promises toward tangible, debt-free assets. The World Gold Council notes that 95% of surveyed central banks expect to increase their gold reserves over the next year, reflecting deepening scepticism toward fiat instruments.

Structural Case for a Gold-Centric Reset:

The drivers behind this monetary reorientation are clear:

- Excessive Sovereign Debt: U.S. public debt exceeds $37 trln, with no credible fiscal consolidation in view.

- Currency Debasement: Persistent money supply expansion and negative real yields have damaged long-term faith in fiat currencies.

- Geopolitical Fragmentation: Nations facing sanctions risk are opting for neutral assets—principally gold—to safeguard sovereignty.

- Trade Realignment: BRICS and allied blocs are exploring gold-linked settlement systems that bypass the dollar, effectively reinstating gold as a trade anchor.

The Mechanics of the Coming Reset

Economists describe this transition as a “monetary revaluation reset”, potentially involving formal gold re-pricing to rebalance sovereign balance sheets. Modelling exercises suggest price levels between $5,000 and $10,000 per ounce if gold were partially reinstated as a reserve-backing asset. The IMF and global institutions may oversee the interim, with Special Drawing Rights (SDRs) serving as a temporary bridge asset before a multipolar reserve system stabilizes.

Gold’s Role in the Next Monetary Order

The unprecedented accumulation of bullion by central banks, commercial institutions, and sovereign wealth funds positions gold as the neutral core of the next financial order—a store of value immune to the inflationary bias, political manipulation, and structural fragility of fiat systems. In effect, as confidence in “fat currencies” wanes, gold is transforming from a hedge into the restored baseline of credibility in the international monetary framework.

This century’s financial reset, therefore, is not about replacing the dollar with another fiat currency—it is about restoring trust through tangibility, with gold once again forming the foundation of global stability.

Generational shift in asset allocation philosophy by Wall Street Institutions:

The recent embrace of gold by major Wall Street institutions marks a generational shift in asset allocation philosophy—one that signals the mainstream financial world is finally acknowledging gold’s structural role in a high-debt, low-trust monetary era.

Morgan Stanley’s 60:20:20 Portfolio Revolution:

Morgan Stanley’s Chief Investment Officer Mike Wilson has formally introduced what he calls the “60/20/20 Portfolio”—an allocation model of 60% equities, 20% bonds, and 20% gold, replacing part of the bond exposure with the yellow metal.

Wilson declared in September 2025 that the traditional 60/40 equity-to-bond split has become “obsolete—or worse, a death trap,” citing bonds’ declining ability to hedge inflation and market volatility. The new model recognizes gold as the ultimate “anti-fragile” asset capable of outperforming both equities and treasuries in an era of stagflation, deglobalization, and chronic fiscal stress.

This institutional endorsement is unprecedented among Wall Street banks. Earlier, gold allocation had been popular primarily among macro hedge funds like Bridgewater (Ray Dalio) or DoubleLine (Jeff Gundlach). Morgan Stanley’s formal adoption effectively mainstreams gold as a core portfolio pillar and reflects increasing recognition of monetary debasement and currency risk as portfolio-level considerations.

Jamie Dimon’s Gold $10,000 Call:

Even Jamie Dimon, traditionally a gold skeptic, recently shifted tone. Speaking at Fortune’s Most Powerful Women Summit in October 2025, the JPMorgan CEO said:

“It could easily go to $5,000 or even $10,000 in environments like this.”? Dimon’s remark—unusually candid for a banking chief long associated with fiat markets—reflects serious institutional concern about inflation, geopolitical fragmentation, and the global debt bubble. He noted that while he personally doesn’t hold bullion due to carrying costs, “this is one of the few times in my life where it’s semi-rational to have some in your portfolio.”

Dimon’s view aligns with recent trends: gold crossed $4,300/oz in mid-October 2025 after rising nearly 60% year-to-date, outpacing all traditional asset classes. A Bank of America survey found that nearly 43% of global fund managers now rank gold as the “most crowded trade”, overtaking U.S. tech heavyweights.

Retail and Institutional Awakening:

This institutional re-rating of gold coincides with surging retail participation in precious metals globally. In India, gold hit record highs of 1,22,000 per 10g for 24K gold—an all-time high reflecting both inflation fears and currency weakness. Wealth managers now increasingly recommend precious metals exposure not as a short-term hedge, but as a strategic reserve asset embedded into long-term portfolio design.

Wealth management firms across the U.S., Europe, and Asia are now converging around similar frameworks—allocations of 10–25% in gold (and in some high-net-worth mandates, silver)—as part of a new “Resilient Portfolio” model for the post-dollar era.

In short, the global investment community once dismissive of gold as “archaic” is now repositioning it as a core currency substitute—a tectonic philosophical and practical shift that marks one of the most profound reconfigurations of wealth strategy in modern history.

The convergence of three major forces — central bank accumulation, institutional portfolio rebalancing, and rising retail participation — is collectively propelling gold toward what could become its status as a “neutral reserve” asset across all investor classes.

Rise of Dollar and Gold – Signals Deep Financial Stress:

When both the US dollar and gold rise together, it often signals deep financial stress or a transition in the global monetary system rather than a normal market trend. Historically, these two move inversely, but their simultaneous strength tends to appear during crises or when confidence in fiat systems is eroding. Traditionally relationship of Gold and the US dollar is an inverse relationship. Since gold is priced in dollars, a stronger dollar typically lowers gold demand globally, while a weaker dollar boosts it. This dynamic reflects their usual competition for safe-haven capital.

In recent years, that inverse correlation has periodically broken down. Notably, during 2023–2025 both gold and the dollar surged together — gold above $2,400–$4,000 per ounce and the dollar index above 108. Analysts attribute this to several converging forces; safe-haven convergence. Heightened geopolitical risk (Ukraine war, Middle East conflicts, fiscal stress) has driven investors to seek refuge in both assets simultaneously — gold for intrinsic value, the dollar for liquidity and global reserve status. Central bank diversification: Large-scale gold accumulation by non?Western central banks (China, Russia, BRICS members) shows a strategic shift away from overreliance on dollar reserves, cushioning gold despite dollar strength.

Fiscal confidence erosion: Rising US sovereign debt and deficits cause investors to fear long?term dollar debasement even as they temporarily seek dollar liquidity, creating a dual rally. Periods when gold and the dollar rise together are uncommon and widely viewed as systemic warning signs. HSBC’s precious metals chief described such dual rallies as “always a bad sign,” suggesting that both assets are reflecting deeper instability or a breakdown in market confidence. Bloomberg analysts similarly interpret gold’s surge amid dollar strength as evidence of eroding trust in the fiat-based reserve system.

Thus, while it does not mean the “dollar system” collapses overnight, such movement is indeed interpreted by many analysts as a precursor of structural stress in the global monetary order — where both traditional safe havens are being tested simultaneously.

The Road Toward Gold as a Neutral Reserve

If these forces persist, gold could soon occupy a permanent, balanced role across portfolios:

- For central banks: a politically neutral, non-sovereign reserve asset

- For institutions: a core stabilizer in strategic asset allocation

- For retail investors: a universal wealth-preservation instrument

The outcome may resemble a passive consensus where gold becomes an “equalizing” tier of capital — immune to counterparty risk, trusted globally, and embedded universally in portfolio construction frameworks. This evolution marks a potential redefinition of modern reserves, signalling a transition from fiat dominance toward tangible neutrality in global wealth architecture.

Disclaimer: These are personal views of the author. This should not be construed as an investment advice. This for information purposes only.