MisterBond’s Momentum SIP – another revolutionary idea from MisterBond

Let us understand how investors select schemes to start SIPs for their different goals:

- Generally, they look at recent past performance based on last 1 year/2 years/3 years point to point returns

- Then they select in which category of equity they wish to invest based on their time horizons (short to medium to long term) and their risk appetites like SIP in BAF, Large Caps, Mid Caps, Small Caps, Flexi Caps, etc.

- Then they start their SIPs in their selected schemes

- Invariably, top performing schemes of past 3 years go to the bottom of the performance table over next 3 years or so. However, since their goals may be for long term, investors tend to continue SIPs in the same schemes

.jpg)

-

Many may stop SIPs in underperforming schemes and restart in other schemes which may have performed well and this cycle of becoming Drivers on a Toll Naka – changing lanes in the hope they join the fast-moving lane continues – but in the bargain they invariably get stuck in slow moving lanes

- What is the answer or solution to this dilemma faced by investors to achieve their goals?

Answer is Momentum SIP of MisterBond:

MisterBond has devised a unique ranking model which ranks schemes based on rolling returns analysis over past 6 months, 1 year and 3 years – which takes into account not only consistency of performance but also momentum of recent past performances as well.

Rationale is that if a scheme has gained momentum in performance over past 6 to 12 months, it is likely that this momentum will continue over next 6 to 12 to 24 months as well.

How does Momentum SIP work?

- Look at the rankings of schemes of a specific category (like Large Cap, Mid Cap, Small Cap etc.) and start SIPs in the top 3 or 4 or 5 schemes based on these rankings

- Continue SIPs for next 6 months (one can revisit every 12 months as well. Our back testing is done based on revisiting rankings every 6 months)

- Revisit the rankings at these regular intervals of 6 months and see if your selected schemes where you had started SIPs are still in the top 3 or 5 in rankings

- If the same schemes appear in top 3 or 5 (based on how many SIPs you had started with – 3 or 5), continue SIPs in the same schemes for next 6 months

- However, if one of the selected schemes has gone out of top 3 or 5 and another scheme has entered in top 3 or 5 in terms of rankings, stop SIP in the scheme which has fallen out of top 3 or 5 and start SIP in the scheme which has entered in top 3 or 5

- Continue this for the length of the period for which you had intended to continue the SIPs to achieve some or many of your goals

- Remember, longer the tenor of the SIPs, better will be the results of Momentum SIP of MisterBond

- Minimum recommended SIP tenor is 5 years for Momentum SIP

What will Investors achieve through Momentum SIP?

- Intention of Momentum SIP is to beat industry average returns in SIPs of the category like Large Cap, Mid Cap, etc.

- It is also the intention to be in the top quartile of performance

- Difference between top performing and bottom performing SIP returns can be as high as 8% to 10% as well. Investor does not wish to be at the bottom of the performance chart and in the bargain not achieve many of their goals

- Momentum SIP will ensure that your SIP performances do not be at the bottom of the table as well

Some back tested results in Large Cap category of Momentum SIP of MisterBond v/s other Industry Large Cap schemes:

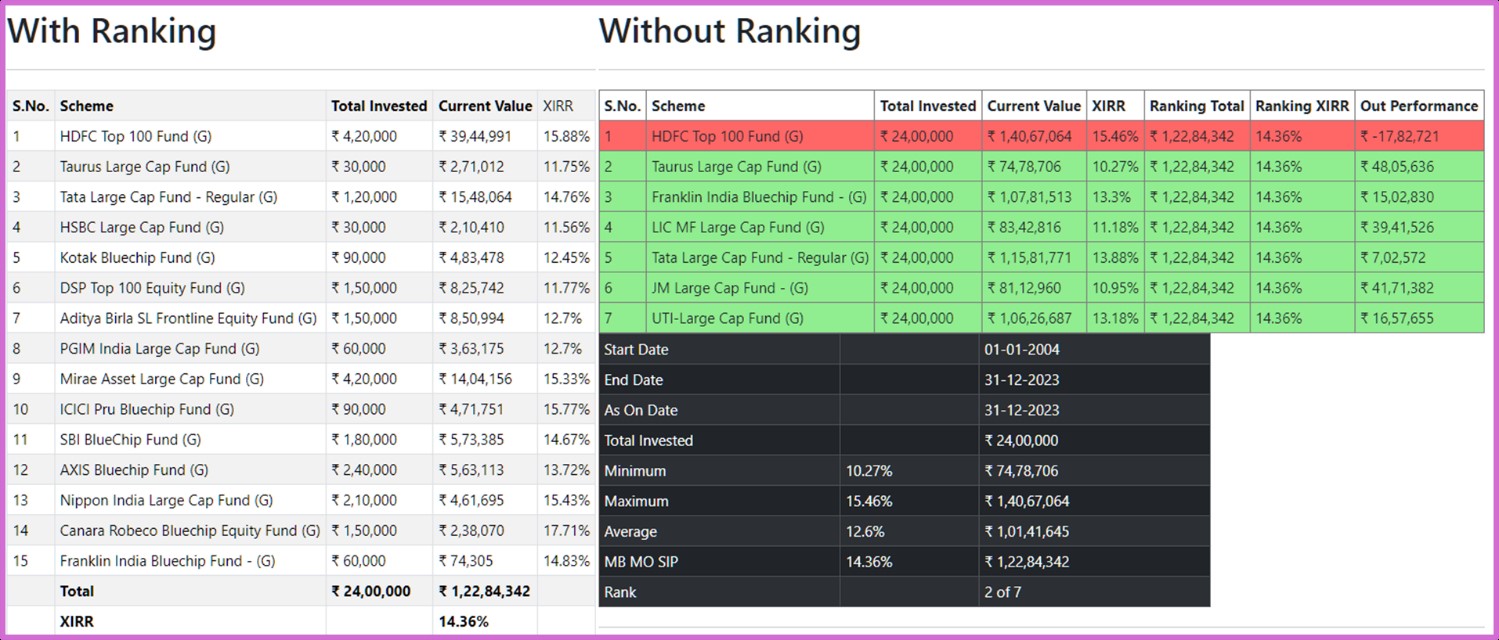

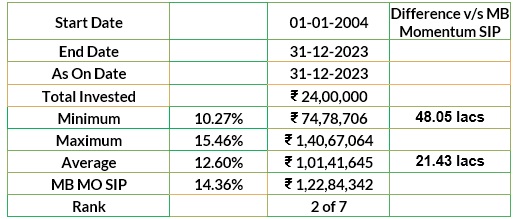

- Above table shows number of schemes which were in existence since 2004 (in this case 7)

- In this example we have selected top 2 performing schemes and started SIPs in the same from 2004 to 2023

- Many new schemes would have come along the way from 2004 onwards, which were selected for SIPs based on their rankings over every 6 months

- Minimum return was 10.27% and CV of that scheme was Rs.74.78 lacs on invested amount of Rs.24 lacs

- Average was 12.60% with CV of 101.41 lacs

- Momentum SIP delivered XIRR of 14.36% with CV of 122.84 lacs (beating average by a good margin) and ranked 2nd out of 7 schemes under consideration

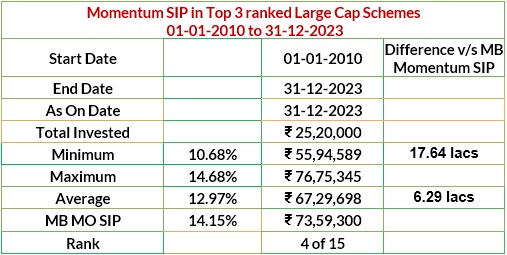

Results of MisterBond’s Momentum SIP v/s other Large Cap schemes from 01-01-2010 to 31-12-2023 with selection of top 2 ranked schemes for SIPs:

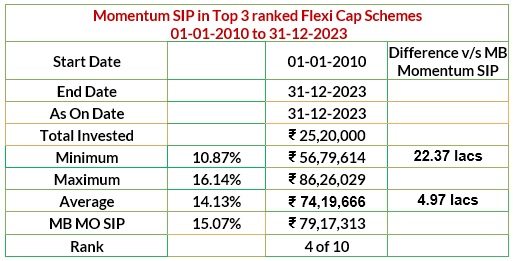

Results of MisterBond’s Momentum SIP v/s other Flexi Cap schemes from 01-01-2010 to 31-12-2023 with selection of top 3 ranked schemes for SIPs:

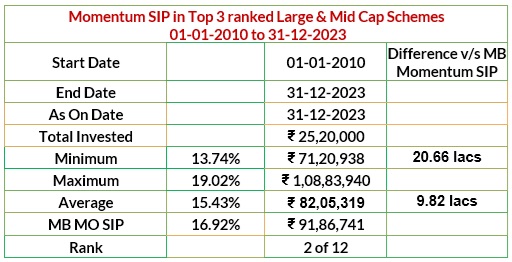

Results of MisterBond’s Momentum SIP v/s other Large & Mid Cap schemes from 01-01-2010 to 31-12-2023 with selection of top 3 ranked schemes for SIPs: