Match Needs with Solutions in Debt Space with Nippon India Mutual Fund Debt Schemes

It has been a turmoil filled 2019-2020 as far as debt markets are concerned. What was 2008-2009 for Equity markets has turned out to be 2018 onwards in Debt market space since IL&FS defaults and downgrades and thereafter many more defaults by well known names like DHFL, Essel Group, Cox & Kings, and many more.

Our job as advisors is to give smoother and less volatile journey to our Investors; especially in Debt Market space. However, we became part of the GREED of Investors and started chasing yields; thereby recommending Credit Risk Funds even to retail investors. That has created havoc in their portfolios and shaken their beliefs in Mutual Fund schemes.

If we had applied logic and common sense and then guided our Investors on the right path; we would not have come to this juncture. Our mandate was to beat the returns of Fixed Deposit albeit with lower volatility and visibility of returns (two important criteria why Fixed Deposits still continue to be popular Investment vehicles).

Current Debt Market Scenario:

- RBI paused further rate cuts, which had negative impact on interest rates

- RBI came with a surprise move of Operation Twist; wherein they bought 10-year G Sec (long dated) and sold less than 1-year G Sec papers had some soothing effect on the yields

- CPI above RBI’s comfort zone once again spoiled the party. There was sell off both in Corporate Bonds as well in G Secs

- With Budget around the corner, fear of fiscal slippage seems to be imminent

- With higher CPI, inflation monitoring has come back on RBI’s MPC radar

- This will leave very little room for RBI to tinker with rates even in last quarter of FY 2020

- Also, there will be higher issuances of G Secs, SDLs and Corporate Bonds in last quarter

- All this will ensure interest rates will remain range bound due to higher issuances with combination of RBI’s special operation

Recommendation:

- Investors should invest in schemes with high quality Corporate Bonds with shorter maturities of 2-3 years

- Elevated levels of rates in this segment will help in higher accruals in the portfolios with possibility of further spikes around the Budget time

- One should be ready with cash to take advantage of this opportunity

Nippon India Short Term Fund:

Nippon India Short Term Fund, DID NOT OWN any bonds which have Defaulted

An ideal scheme in current market context with shorter duration and no credit calls.

- The fund runs a moderate duration strategy, which is maintained in the range of 1.25 years to 2.25 years.

- Fund focuses on Accrual Income and will outperform in a bull steepening environment

- The fund manager while investing places emphasis on good credit quality assets. Around 70-100% investment would be made in up to 3 years assets and 0-25% between 3-5 years assets, 0-20% tactical allocation may be made to G-Secs / SDLs based on absolute yield and spread views.

- Due to their Conservative Investment Philosophy of not running higher Duration or not taking any Credit exposure, this fund was immune to any credit crisis.

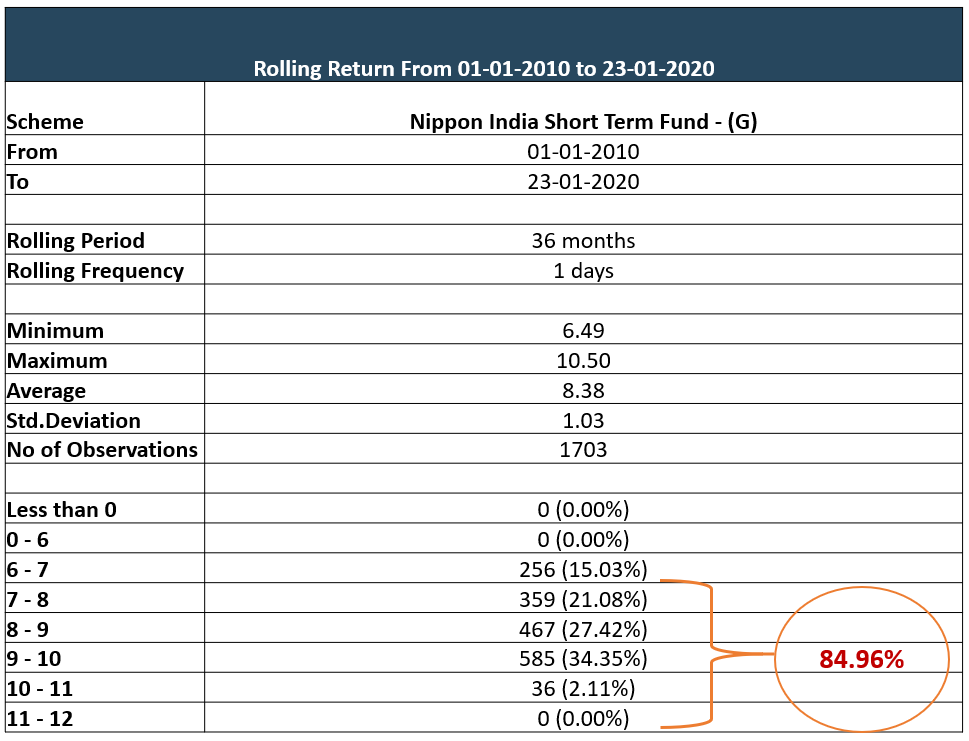

3 Year Daily Rolling Returns data of Nippon India Short Term Fund over past 10 years has delivered excellent returns to the Investors with almost 85% of the observations delivering 7% or higher CAGR.:

Another theme that can be looked at in the current debt market space is strategies following Constantly Rolling Down on Maturities.

Only if we understand certain Concepts used by the Fund Managers and identify which schemes follow these concepts with very little or no credit risk; will we be able to guide our Investors on the right path.

One such very popular (and my favorite) Concept is CONSTANTLY ROLLING DOWN ON MATURITY. Let us first understand this Concept in detail and then identify which schemes are using the same and how are these beneficial for our Investors. I have been an advocate of this Concept for many years now and schemes of many AMCs have used this based on my recommendations as well.

Now let me explain to you the concept of Constantly Rolling Down and how does it benefit the Investors; especially in a steep yield curve scenario (like current one):

Unless you understand the Concept, you will not be able to comprehend the full implications of how to position schemes following this Concept for your Investors and whether these schemes are suitable for your client requirements or not. I have been saying this in almost all my sessions that IFAs should not sell anything blindly. Unless you have conviction in the scheme/asset class/strategy, you will not have consistency in your advice. You should not sell products or schemes; you should sell Solutions for different needs of your Investors and that way you will be able to position them more effectively.

Concept: Constantly Rolling Down strategy:

I am sure many of you have heard of March CD/NCD schemes following constantly rolling down strategy. In the month of March, Fund Manager buys next year March CD/NCD. In the month of April, he buys the same CD/NCD with residual maturity of 11 months. In the month of May, he buys CD/NCD with residual maturity of 10 months and so on and so forth. In a steep yield curve scenario, borrower tends to pay higher interest for longer dated securities (in this case 1 year) and lower yields for shorter dated securities i.e. lower yields for 11 months/10 months CD/NCD, etc. Hence, the Fund Manager locks in higher yields in the month of Feb/March and constantly rolls down the same. For example, if the Fund Manager say locks in 10% yield for 1-year March CD/NCD, in the month of May he may buy 10-month residual maturity CD/NCD at maybe 9.50%. So, those who invested in the month of March will not only get the benefit of higher coupon of 10%; but also, MTM capital gains in the month of May as 10 months CD has come off in yields to (in this example) 9.50%. Hence, the Investor has two options at this stage: 1) Hold till next March and earn 10% captured YTM or 2) exit in May and earn 10% captured YTM for two months and capital gains of 0.50% from March to May.

Let us take another extreme example which occurred in 2013. Those who had invested in March 2013 in the said scheme had captured YTM of almost 9%. In the month of August interest rates went up and the same March CD with residual maturity of 8 months jumped up to 12%. Naturally, investor in March would be sitting on some losses (9% interest rates jumping up to 12%). He had as mentioned above two choices 1) Hold onto investment till next March and he would have earned the captured YTM of 9% at the time of investment or 2) and, invest more at 12% levels and his returns from August 2013 to March 2014 would have been locked in at higher yields. Redeeming out of the said scheme at that juncture simply did not make any sense as the Investors would be sitting on some losses at that point in time.

Unfortunately, since many were not aware of this Constantly Rolling Down concept and its repercussions on their Investor portfolios, there was a redemption pressure in August 2013 from these schemes. That is the reason I am saying that one should not sell anything blindly, understand Concepts before recommending any schemes and have conviction to have consistency in your advice.

Now let us identify which schemes are following this Concept from the basket of Nippon India Mutual Fund:

- Nippon India Nivesh Lakshya Fund (26 + Year G Sec Paper)

Inception: July 2018: Gross YTM 8.11% - Average Maturity: 26.39 years

December 31’20219: Gross YTM: 7.11% - Average Maturity: 25.08 Years

- Nippon India Floating Rate Fund: (3-3.5-year AAA or Equivalent Securities)

December 31’2019: Gross YTM: 6.82%

As can be seen from above, both these schemes follow this strategy with no credit risks. One invests in long dated 25 year + G Sec papers and is rolling it down; whereas the other scheme invests in shorter dated AAA rated securities and will be rolling this down. Both will need to positioned for different needs and requirements of your Investors.

Nippon India Floating Rate Fund

Fund Strategy – Forward Outlook

- The Fund invests predominantly in securities issued by Public Financial Institutions/ HFC/ NBFC/ Private Sector Corporate & in Government Securities

- Rating Profile: Portfolio comprises of only AAA rated/ equivalent securities

- They intend to construct the portfolio with a maturity of 3-3.5 years and would gradually roll-down the duration as we go along

- The Fund aims to capture the prevailing yields available in assets maturing in early CY 2023

- Portfolio intends to run a modified duration of 2.80 – 3 years

- Portfolio would roll down in terms of maturity over a period of time

- The Fund is best suited for investors looking for gross yield in range of 7.00-7.25% over the investment horizon of 3 – 3.5 years

- Ideally, any debt scheme should be held for 3 year plus for Indexation benefit and lower LTCG Tax

- Ideal investment horizon should be 2-3 years

- Hence, if one invests in this scheme, it can be treated as Open Ended FMP with an option to exit before 3 years if interest rates soften and investors need funds before 3 years or treat it as 3-year FMP wherein returns are more or less visible

Now Let’s talk about Nippon India Nivesh Lakshya Fund

How do we Position Nippon India Nivesh Lakshya Fund?

Before I get into how to position this scheme for different needs of the Investors; let me first highlight one very important risk which most Investors and Advisors miss out on. That Risk is REINVESTMENT RISK.

Most investments, even in debt space are only for 3-5-year (including Fixed Deposits). Little do Investors realise that every time these investments mature, there is always that reinvestment risk – which means that rates at which you will get to reinvest on maturity may be lower than their earlier locked in returns. Bank Fixed Deposit data reveals that FD rates have fallen by more than 50% over past 22 years. Imagine if there was FD for say 25 years and the Investors had locked in higher double digit returns available those days and held onto that till date.

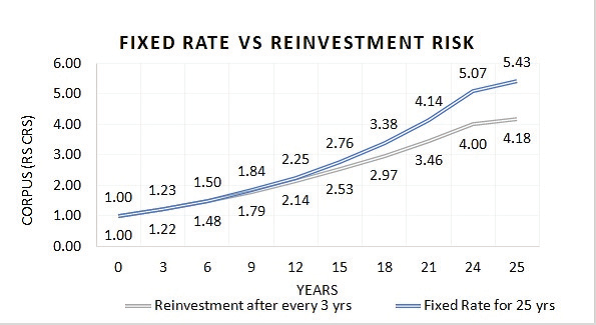

To give you an example: assuming that interest rates soften by 250 bps over next 25 years. Investor A invests in 3-year Fixed Deposits and renews it every 3 years v/s Investor B who locks in his returns through investment in Nippon India Nivesh Lakshya for next 25 years.

Difference in their portfolios is as much as Rs.1.25 crores on original investment of Rs.1 crore as shown in the chart below:

Now let us talk about how to pitch this as NEED-SOLUTION approach:

Need: Investment in Debt for long term (Core Portfolio):

Current Solution: PPF (15 years)/ Fixed Deposits (5-10 years)/ Mutual Fund schemes (3-5 years), Tax Free Bonds (10 years)

Alternate Solution: Nippon India Nivesh Lakshya (25 years plus)

This can be the core portfolio in debt space for any investor with no credit risk, better tax efficient returns and high liquidity. Of course, as explained, it will have volatility as part and parcel of the portfolio. Tell your investors to wear blinkers (like race horses) and continue to hold the investment through ups and downs of the interest rate cycles. Also, post PMC Bank fiasco, lot of Investors are wary of investing in FDs with banks as well. This product will ensure diversification + Liquidity (which depositors of failed PMC Bank did not have)

Need: Lock in returns and have visibility

Current Solutions: Fixed Deposits (5-10 years)/ Fixed Maturity Plans (3 years)

Alternate Solution: Treat Nippon India Nivesh Lakshya Fund like open ended FMPs. Whenever (currently before Budget or even post Budget), if interest rates rise, invest at that time, hold till maturity (or earlier if interest rates soften from the date of your investments) and earn higher tax efficient returns with visibility as well

Need: Meet Long Term Goals like Education, Marriage, Retirement corpuses

Current Solutions: PPF, Endowment Policies, SIP in Equity MFs

Alternate Solution: Both the debt options above are not able to beat inflation with limited liquidity. As we are aware, Equity SIPs have not been for long term. Statistics have revealed that due to volatility attached to this asset class, many SIPs get discontinued during severe market corrections. Otherwise a great source for meeting long term goals if Investors control their emotions. Invest in Nippon India Nivesh Lakshya and generate higher, tax efficient, inflation beating returns to meet different goals of the Investors

Need: Follow Asset Allocation strategy between Debt and Equity

Current Solutions: Equity Funds and Liquid/Credit Risk Schemes, Ultra Short-Term Bond Funds

Alternate Solution: Equity MF schemes + Nippon India Nivesh Lakshya Fund

Under Asset Allocation strategy when one asset class is riskier and more volatile (Equity) then why should one take unnecessary Credit Risk in the other Asset Class which is Debt? Invest in Nippon India Nivesh Lakshya and be a passive investor in the Debt space

Need: Regular cash flows

Current Solutions: Interest on Fixed Deposits

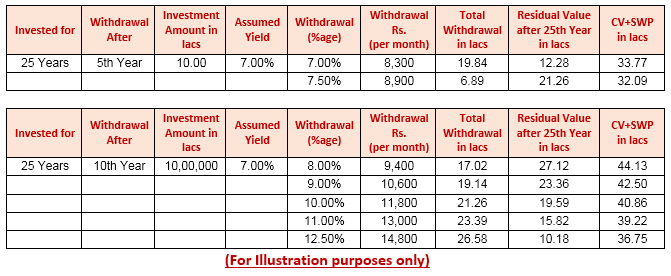

Alternate Solution: Deferred Systematic Withdrawal from Nippon India Nivesh Lakshya Fund

This is a very powerful way of pitching Nippon India Nivesh Lakshya. Differed Annuity helps Investor to build a cushion in initial years without withdrawing any funds. Thereafter, the Investor can start withdrawing at certain % p.a. (which can be much higher than the locked in returns if deferred for more years) as can be seen from the second table above. Here, the Investor has not withdrawn any funds for first 10 years, built a sizeable cushion in the portfolio and is still able to withdraw at as high as 12.50% p.a. without dipping into principal (as is evident from the column of Residual Value which in this case is Rs.10.18 lacs on original investment of Rs.10 lacs) .

This should be pitched to even young Investors of say 25-35 years of age, who do not need any cash flows in the initial years and they can start withdrawing from say 35-45 years of age. This becomes their 2nd source of Income. As legendary Investor Warren Buffet has said: “Never depend on a single source of Income. Create a second source of Incomeâ€. We can guide young investors to allocate their debt portion in this scheme and create an opportunity to generate second source of Income through this Deferred Annuity concept.

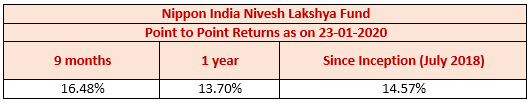

I am not an advocate of showing Point to Point returns; however, since this scheme has short track record since July 2018, I can only show P2P over last 1 year and since Inception returns. I had recommended this scheme during NFO and subsequently in May 2019 as well.

Hence as explained above, one can look to invest in these 3 schemes of Nippon India Mutual Fund with different investment horizons and as different NEED-SOLUTION approach. This will get the Mind Share and Wallet Share of your Investors without taking any Credit Calls:

- Nippon India Short Term Fund – with 3-year plus investment horizon

- Nippon India Floating Rate Fund – with 2-3- year investment horizon

- Nippon India Nivesh Lakshya Fund - with very long term 10-25-year investment horizon