Lessons Learnt????? Time to Adopt New Investment Mantras?????

S&P Sensex touched an all time high on 14 January 2020 of almost 41,952. Global markets; especially US markets were also having a dream run. Though Indian markets continued its dream run (perceptibly) due to polarized market rally of few top 10-15 Large Cap stocks, broader markets were in the turmoil zone. Most experts were predicting S&P Sensex to be above 42500 and NIFTY 50 above 13000 levels by March 2020.

With this back ground, let me start my narrative of this article and my own thoughts on where we went wrong, what should have been our role as Advisors, should we have only listened to the Experts and not applied Logic and Common Sense to our Advisory practice and finally should we have continued to believe in the old adages like Buy and Hold, SIP Karo Bhool Jao and Do Not Time the Markets?

MisterBond’s Smart Investing strategy (ALGO designed by taking into account trailing NIFTY 50 PE and PB) gave a call of exiting from Equity (aggressive) as an asset class and recommended to invest in Dynamic Asset Allocation Fund (DAAF) (conservative) category way back in July 2017. Markets as I said, continued to rally – though polarized where Mid and Small Cap stocks were correcting but few Large Cap stocks were going through the roof and driving S&P Sensex and NIFTY 50 to higher and higher levels.

Due to this many Advisors and Investors who were following MisterBond’s Smart Investing strategies kept on doubting the rationale of investing only in DAAF category either through Lump Sum, SIP or STP during this period. I kept on show casing data on how DAAF was performing better than Mid Cap, Small Cap and Multi Cap categories in spite of this perceptible market rallies. I kept on telling Advisors who were subscribers to my platform viz. www.misterbond.in one of the most popular Hindi rap songs: APNA TIME AYEGA. Thankfully, most Advisors following my strategies kept patience and continued on this course and style of investing.

Come end February and beginning March, all markets including Indian markets are in huge correction mode. Many are blaming this on ongoing CORONA VIRUS issue. But according to me, these are all the excesses of past two and half to three years that are getting corrected and having mean reversion. Corona Virus is just an excuse for markets which were over stretched and going up only based on Liquidity with no correlation to underlying Fundamentals which were on constant decline only.

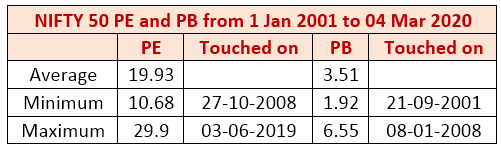

Let us look at some NIFTY 50 PE data over different periods and how they were interpreted to suit some of the narratives by the Experts.

From 01 January 2001 to 04 March 2020, NIFTY 50 PE and PB data was as follows:

Let us break the markets into different periods from July 2017 to now and see what Experts suggested we do v/s what MisterBond’s Smart Strategies suggested and performed:

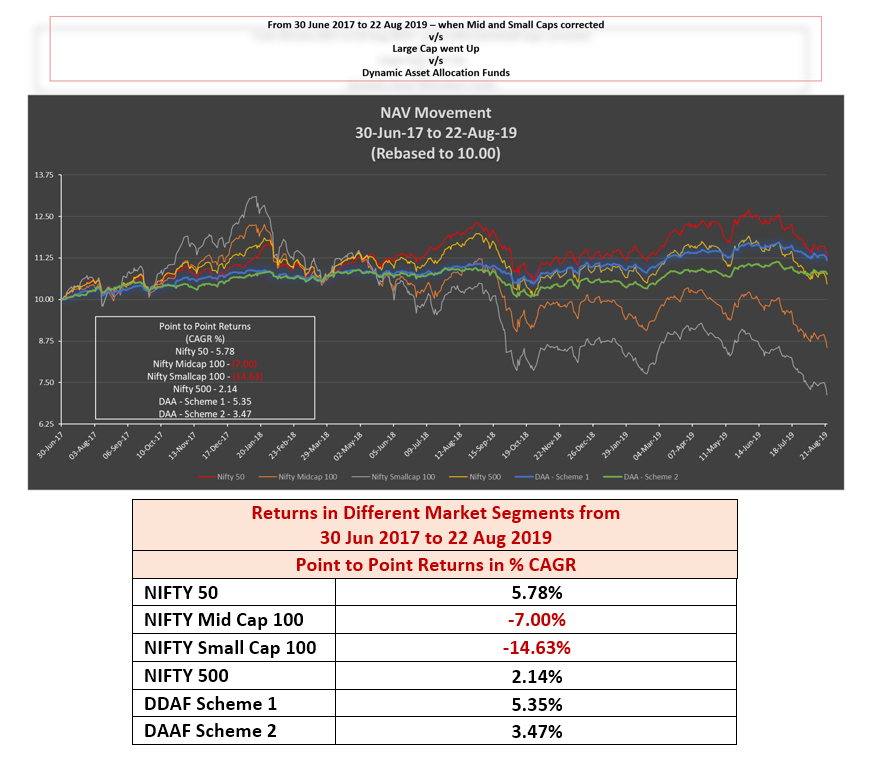

Period 1: 30 Jun 2017 to 22 Aug 2019: When Mid and Small Caps corrected but Large Caps went up:

This was the period when perceptibly Equity Markets were doing well due to polarized nature of 10-15 Large Cap stocks driving Stock Market Indices to higher and higher levels but underlying broader markets like Mid Cap and Small Cap were correcting. This was period when as mentioned above, many Advisors who were following MisterBond’s Smart Investing strategies had doubts in their minds on the rationale of staying invested in DAAF category v/s Equity. Lot of data crunching convinced them to stay on the path of MisterBond’s Smart Investing strategies.

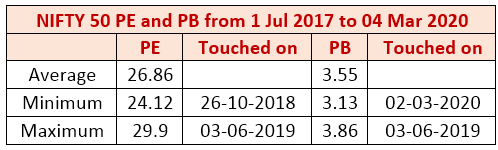

During this period NIFTY 50 PE and PB data was as follows:

Reasons given for this was that markets are rerating PE and PB and higher PE and PB may be the new norm in the markets. MisterBond’s Algo continued to treat this period as RED Zone i.e. expensive valuation zone and continued giving triggers to be in Conservative Asset class (DAAF) and not take any fresh positions in Aggressive Asset class viz. Equities.

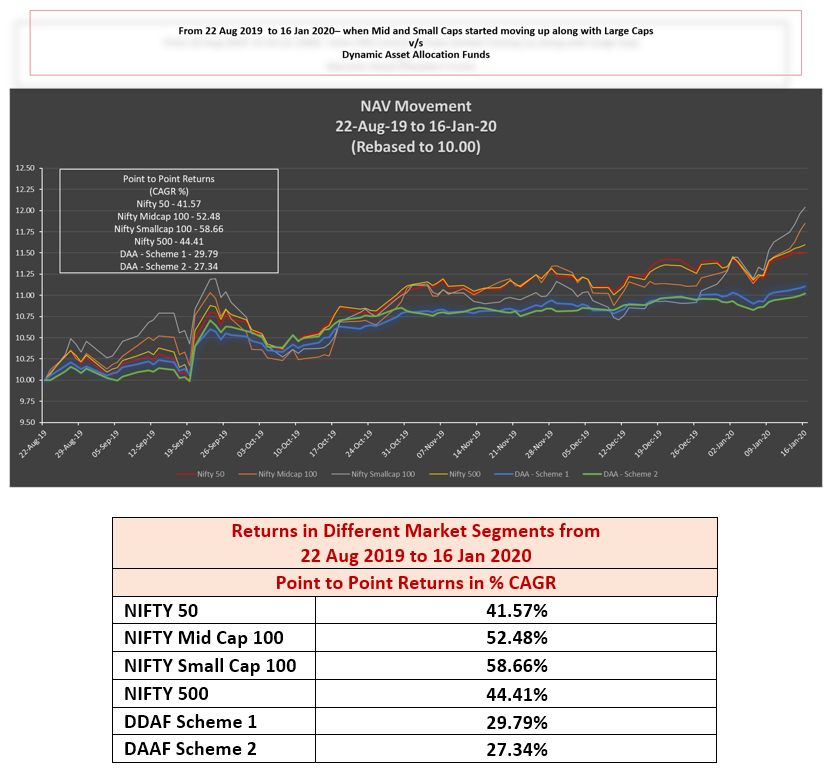

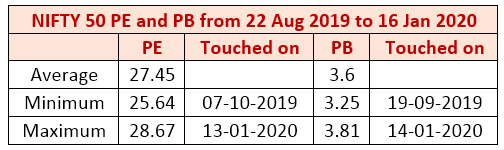

Period 2: from 22 Aug 2019 to 16 Jan 2020: when Broader Markets started doing well:

This was the period when post corrections in Mid Cap and Small Caps, Experts recommended investing in these segments. For a brief period of four months this segment delivered good recovery and returns. Of course, during this phase, even DAAF delivered excellent returns as is evident; though lower than other market cap bias segments.

Here the market narrative was that going forward, Mid and Small Caps will continue to do well even if Large Caps correct due to stretched valuations of the Large Cap segment.

My argument against this was and is that if S&P Sensex and NIFTY 50 correct; even Mid and Small Caps will correct and they cannot have isolated rallies during such corrections.

Due to this rally in broader markets, overall valuations only got further stretched and MisterBond’s Algo continued to give a call of staying in DAAF v/s Equity. Many felt that they were missing out on Mid and Small Cap segments due to this strategy. They even asked me to create separate Algo for Mid-Caps and Small Caps and hopefully give a BUY call based on that. However, I stuck to my belief of only following guidance given by NIFTY 50 and continue Smart investment journey based on these numbers rather than creating separate Algos for different Market Cap biases.

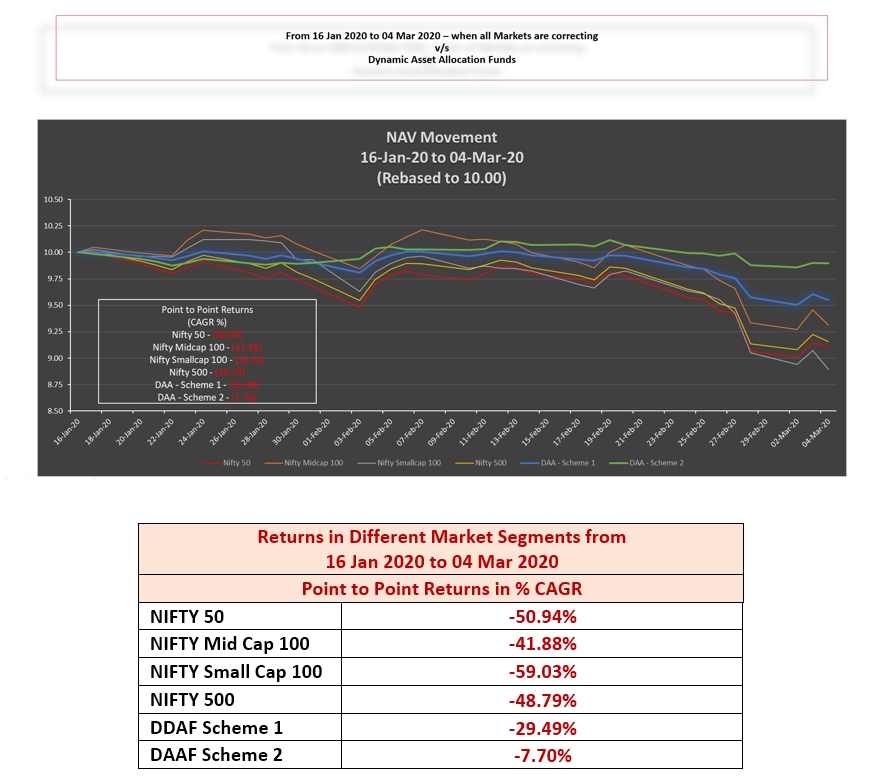

Period 3: from 16 Jan 2020 to 04 Mar 2020: when all markets including Global Markets went into correction mode:

This is the period when there is Global meltdown along with Indian market melt downs. Overall, broader markets are correcting on the back drop of CORONA virus issue. But according to me this was waiting to happen. Markets were going up only on liquidity bubble with no correlation to Fundamentals. Worldwide asset bubbles were getting created due to easy liquidity which is now coming to haunt us.

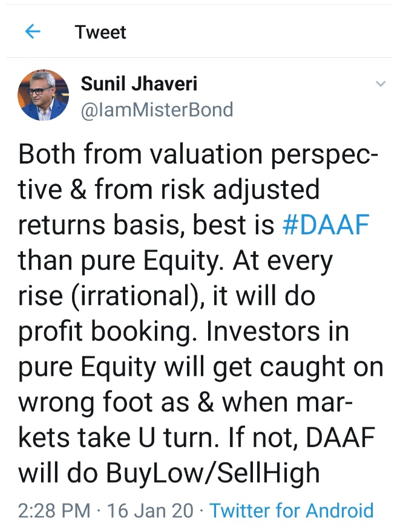

I have been stating this on various Social Media that either markets have to correct or Earnings have to grow for PEs to be rerated. We were not seeing earnings growth and hence natural corollary was that markets had to correct and come off the excesses created over past few years. As late as January 16’2020 I had Tweeted the following. I do not know how many took cognizance of this advice:

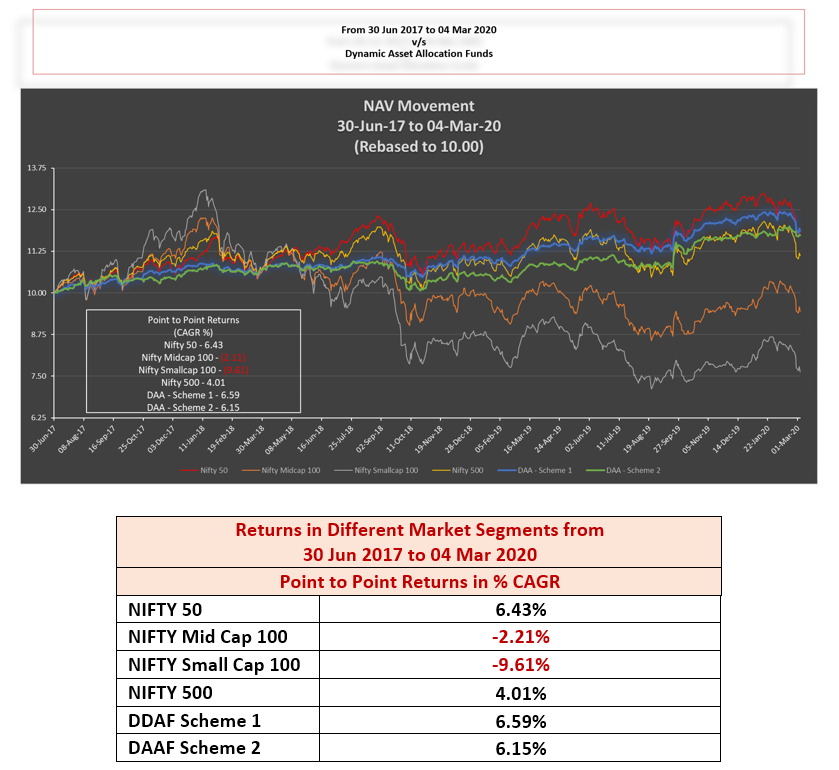

Finally, let us see the markets from 01 July 2017 to now and see how did our call of getting out of Equity and investing in DAAF pan out:

Please keep in mind that all the data is till 04 March 2020. As I am penning this article today i.e. on 06 March 2020, S&P Sensex is already down 1000 points and NIFTY 50 by almost 300 points. Impact of this correction is not reflected in all the above returns tables.

It is amply clear from the table above that our call of switching from Equity to DAAF was the right call which would have given a much smoother and less volatile journey to the Investors.

Imagine the situation of two sets of Investors from the time the markets have started correcting from end February onwards: first investor who was sitting in DAAF with 50-60% in cash and another investor who was sitting on 100% in Equity.

First investor was hoping for market correction as he wanted his cash to be reinvested at better valuations in the current market carnage v/s the other investor who is only seeing his portfolio bleed with may be no incremental cash flows to take advantage of current market corrections and nor will he have the guts to invest further. MisterBond’s Smart solutions have not only delivered great investment journey with less volatility but worked around the Investors’ behavior of GRRED and FEAR.

So, LESSONS LEARNT and QUESTIONS that the Mutual Fund Industry participants viz. AMCs, Advisors and Investors have to answer are the following:

- Are the old Mantras like “Buy and Holdâ€, “SIP Karo Bhool Jao†and “Do Not Time the Markets†right mantras or do we need to revisit these and adopt “DOWNSIDE PROTECTION†and “Be in the Right Asset Class at Right Valuations†– Mantras propagated by MisterBond as our new Mantras?

- Is it wise to bracket Investors as AGGRESSIVE or CONSERVATIVE (as most aggressive investors become most conservative when markets go against them and vice versa) or should we be bracketing our Investment strategies as AGGRESSIVE or CONSERVATIVE based on Market Valuations?

- Having burnt our Investors’ fingers by taking them to Market Cap bias like Large, Mid and Small cap categories, should we stick to Multi Cap category and let the Fund Managers decide on this break up?

- As advisors should we be concentrating on Upside participation or should we be concentrating on Downside protection first, reduce drawdowns and let the investments bounce back faster with better investment journey?

- Did the Advisors know when to give disinvestment calls from Mid and Small Cap schemes? If not, then why did they give investment calls under such volatile categories?

- Should the Advisors blindly follow the so-called Experts and their calls on where they see NIFTY, SENSEX numbers and base their advice accordingly or should they apply common sense and logic, apply some strategies and then guide their Investors on the right path?

- And finally, can Advisors afford to be REACTIVE all the time and give excuses of CORONA virus, Market melt downs, etc. or should they be PROACTIVE in their advisor practice?

I am sure all the above learnings will be forgotten when all this will be behind us and Markets will bounce back. But according to me this is the time to change our mind sets and adopt new Mantras of DOWNSIDE PROTECTION and BE IN THE RIGHT ASSET CLASS AT RIGHT VALUATION strategies of MisterBond (your’s truly).

Those who wish to know more about Smart Investment strategies of MisterBond can write to me directly at sunil@misterbond.in and subscribe to his Platform. This is a first of its kind B2B Platform for all Mutual Fund Advisors for Knowledge enhancement through his workshop videos (more than 80 such videos on different topics in the Mutual Fund Industry), his Articles and finally his Trigger driven, Smart Investment solutions.