Investors' Dilemma: "Jae to Kahan Jae?" Equity at historic High, Debt Yields at Historic Lows.

I had created a 3-part Video series in March 2020 Titled: “Investors Jae to Kahan Je – Investment Story brewing in Debt, Equity and Gold”. That was a time of problem of plenty in terms of Asset class selection by the Investors. Due to Equity Market crash, rising interest rates and uncertainty in Global context due to pandemic; all 3 asset classes were well poised from an investment point of view.

However, within a short span of 6-7 months (post March 2020); all 3 asset classes have peaked and are at their new highs: Equity Markets have recovered very handsomely on the back of Liquidity infusion of more than $10-11 trillion by Central Banks across the Globe as part of their Fiscal Stimulus package, Gold touched a new high due to uncertainty creeping in and even Debt Markets delivered very good returns due to Central Banks (including RBI) cutting interest rates to historical lows.

From here on, once again dilemma of Investors is: “Jae to kahan jae?” as all 3 asset classes have peaked and there is only one way for them to go i.e. downwards.

In this back drop I wish to speak about one of the Schemes in Debt market space which may be well poised (if positioned properly) to give right investment solution to the Investors.

Current Investment scenario in Debt space:

Post FT saga and earlier to that IL&FS fiasco, all Investors (including Banks) have become extremely risk averse. This is very evident from banks parking funds in Reverse REPO at 3.40% to the tune of Rs.6-7 lac crores instead of lending or investing in Bond markets in March-April 2020. Retail investors have shied away from investing in Credit space or Duration space and parking their surplus funds/emergency funds in pure Liquid schemes – even though they are earning only 2.50-3.25% p.a. returns.

Lot of emergency funds are also parked in this space. As we know emergency does not happen every day and most times, these funds stay invested for longer periods of time as well.

If MFDs can guide their investors to a better investment option which does not carry following risks; both Investors and MFDs (who earn pittance from these liquid schemes) may be in better position by recommending this scheme:

- This scheme will have no Credit Risk

- Entire portfolio will be in AAA Banking & PSU Debt

- Following Constantly Rolling Down in maturity strategy

- With residual maturity of only 18-24 months currently

- With higher YTM of 4.54%

- If held till maturity, Investors will earn this current captured Yield

- Becomes more like an Open-Ended FMP, earning current Net YTM if held till maturity

- RBI has already stated that they will adopt accommodative stance and intervene when necessary till June 2021

- By then the Fund will only have a Residual Maturity of less than a year – which in worst case scenario of reversal in rate cycle will protect Investor interests

- Hence, if RBI cuts interest rates for any reason, benefit will accrue to the existing investors

- Closer to maturity (few month before 18-24 months of residual maturity); if interest rates have gone up (as is expected over next 1-2 years); resets of next maturity will be on higher side for existing investors

- This will reduce their Reinvestment Risk as well. Most Investors are unaware of this risk. In this scenario, if interest rate cycle reverses, it can only benefit existing Investors by capturing higher Yield during reset period

Enough of suspense; name of the scheme is Axis Banking & PSU Debt Fund. It has all the positives with very little negative implications at current levels. This was launched as 4 Year Constantly Rolling Down as a strategy. Current rolled down period is 1.90 years with current YTM at 4.54%.

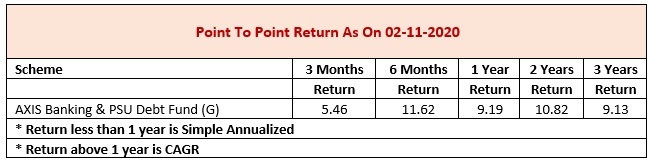

Above is Point to Point Returns of the scheme over past 3/6/12/24/26 months of the scheme.

- If an investor has 18-24-month investment (which they generally have but do not realise it); treat this as Liquid alternative which can earn better returns for the Investors without any Credit Risk

- If they hold it for next 18-20 months (like HTM), there will no Interest rate risk as well

- In next 18-20 months or even before that, the scheme will be reset as papers which were bought 4 years back (under constantly rolling down strategy) would be maturing and reset by buying new papers (maybe at higher YTM than the current one) – this will take away Reinvestment Risk as well

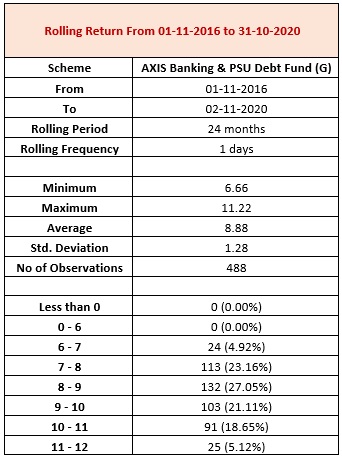

Also, following 2 Year Rolling Returns analysis will also show case performance of the scheme, consistency and lower standard deviation.

Do not make the mistake of comparing this scheme’s performance with the peer schemes as rest may be long term duration schemes v/s this scheme which is following constantly roll down strategy and repositioned as such with 4-year maturity papers in August 2016.

I had recommended another scheme from the stables of Axis Mutual Fund viz. Axis Dynamic Bond Fund. This also follows Constantly Roll Down strategy with no Credit Risk. They had bought 10-year papers to start with which is Rolling Down in its maturity. I had created a 6-part Video Series on the said Fund and recommended this very strongly. You can view these videos by clicking on this link:

https://www.misterbond.in/amccorner/axis-mutual-fund

Current Average Maturity of the said scheme is 5.90 years with current YTM of 5.63%. Returns of the said scheme (again with no Credit Risk) since January 2020 (date of my Video Creation): 13.90% p.a.