I am sure by now most readers are aware of what Bharat Bond ETF is and what are its salient features. I have seen and read many notes on the same. Surprisingly, all are repeating the same i.e. what is ETF, how this Product has transparency, liquidity, visibility of returns, tax efficiency etc. However, none have so far highlighted the NEED-SOLUTION approach for Investors to look at and take an investment decision based on that. If you see this as another debt scheme or a product, there will be less traction; but if you see this as a NEED and a SOLUTION approach, you will get better perspective as to why you should look to invest in the scheme . Also, I will explain in detail the Concept of Constantly Rolling Down and how does it benefit the Investors.

As the name suggests it is an Exchange Traded Fund (if invested through Demat Accounts) or it can be Fund of Funds if invested through Mutual Fund Route. ETFs will have real time value based on valuation of underlying securities and hence investors can trade in the same based on market value. Under FoF structure; there will be daily NAVs of the said scheme based on which purchase or redemption can happen -just like any other Mutual Fund product.

Now let me explain to you the concept of Constantly Rolling Down and how does it benefit the Investors; especially in a steep yield curve scenario (like current one):

Unless you understand the Concept, you will not be able to comprehend the full implications of how to position the said scheme in your own portfolios. I have been saying this in almost all my sessions that one should not invest in any schemes blindly. You should not invest in the NFO as a debt scheme or a product; you should invest for different needs and position the said scheme as a Solution for those Needs.

Concept: Constantly Rolling Down strategy:

I am sure many of you have heard of March CD/NCD schemes following constantly rolling down strategy. In the month of March, Fund Manager buys next year March CD/NCD. In the month of April, he buys the same CD/NCD with residual maturity of 11 months. In the month of May, he buys CD/NCD with residual maturity of 10 months and so on and so forth. In a steep yield curve scenario, borrower tends to pay higher interest for longer dated securities (in this case 1 year) and lower yields for shorter dated securities i.e. lower yields for 11 months/10 months CD/NCD, etc. Hence, the Fund Manager locks in higher yields in the month of Feb/March and constantly rolls down the same. For example, if the Fund Manager say locks in 10% yield for 1-year March CD/NCD, in the month of May he may buy 10-month residual maturity CD/NCD at maybe 9.50%. So, those who invested in the month of March will not only get the benefit of higher coupon of 10%; but also, MTM capital gains in the month of May as 10 months CD has come off in yields to (in this example) 9.50%. Hence, the Investor has two options at this stage: 1) Hold till next March and earn 10% captured YTM or 2) exit in May and earn 10% captured YTM for two months and capital gains of 0.50% from March to May.

Let us take another extreme example which occurred in 2013. Those who had invested in March 2013 in the said scheme had captured YTM of almost 9%. In the month of August interest rates went up and the same March CD with residual maturity of 8 months jumped up to 12%. Naturally, investor in March would be sitting on some losses (9% interest rates jumping up to 12%). He had as mentioned above two choices 1) Hold onto investment till next March and he would have earned the captured YTM of 9% at the time of investment or 2) and, do more investments at 12% levels and his returns from August 2013 to March 2014 would have been locked in at higher yields. Redeeming out of the said scheme at that juncture simply did not make any sense as the Investors would be sitting on some losses at this juncture.

Unfortunately, since many were not aware of this Constantly Rolling Down concept and its repercussions on their portfolios, there was a redemption pressure in August 2013 from these schemes. That is the reason I am saying that one should not invest in anything blindly, understand Concepts before investing.

Now coming back to Bharat Bond ETF/FoF:

Above concept of March CD of 12-month maturity is being stretched to 10-year maturity of AAA rated PSU Bonds. Concept remains exactly the same i.e. at the time of NFO, Fund Manager will buy say 10-year AAA Rated PSU Bonds and capture very high yields (currently 7.85% - 10 year (Assumed Yield)). One year later, they will buy the same securities with 9 year in residual maturity and so on and so forth. Since the maturity period is 10 years long; the said scheme will have volatility as interest rates can fluctuate between soft to hard during this period. Those who invest in the NFO and hold it till maturity; their returns are more or less locked in. Also, since interest rates are high currently (almost 7.77% net yield on 10-year papers), probability of them softening over 3-5 years will be good and hence an Investor can expect good returns over next 3-5 years in this scheme with higher captured Yields + some capital gains.

At the end of 10th year, just like FMPs, maturity proceeds will be paid back to the Investors along with accrued interest.

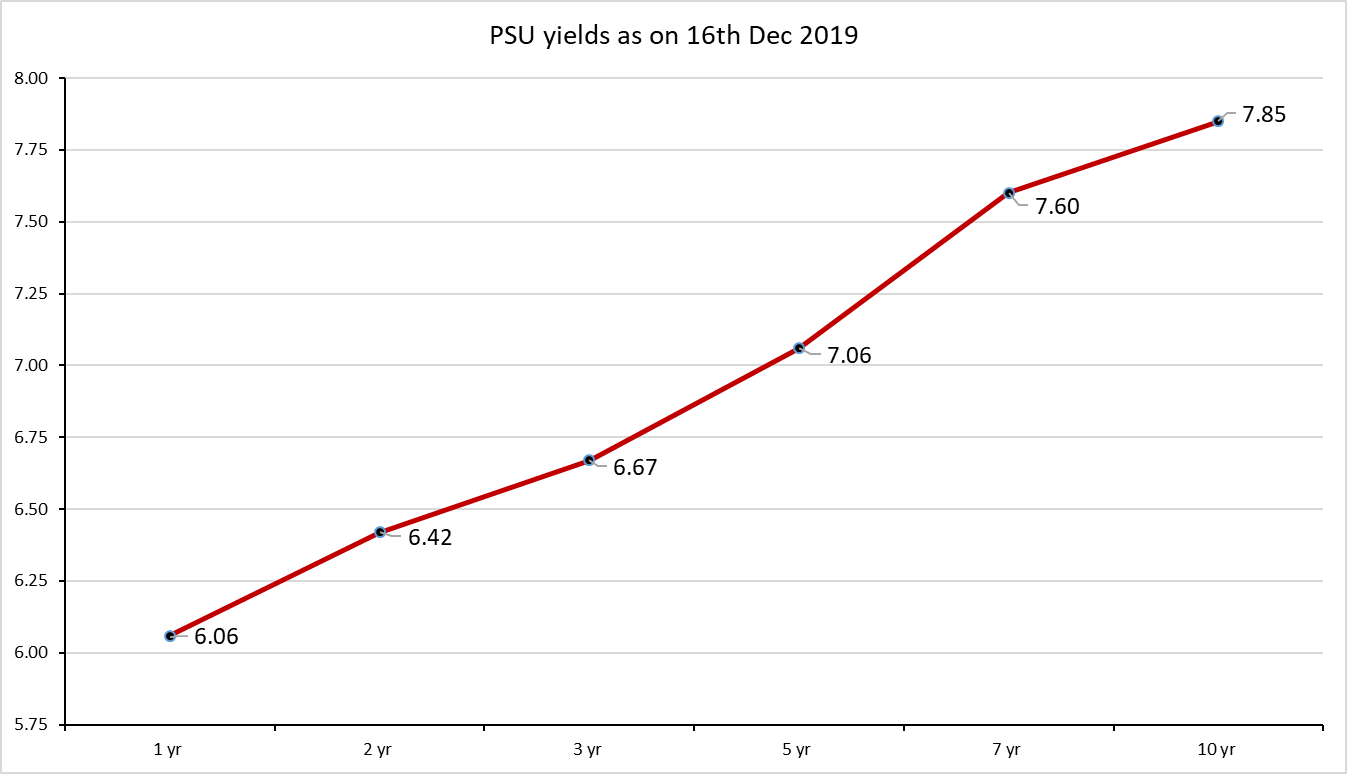

As can be seen from the Yield Curve below; assuming interest rates remain the same, someone who invests at NFO time will capture a high gross yield of 7.85% (Assumed Yield). Post 5 years, the said bond would have rolled down to 5 years in residual maturity. Assuming that the same yield of 5-year paper is prevalent at that time; the investor earns accrual of 7.85% (Assumed Yield) over next 5 years and capital gains of 0.79% (7.85-7.06) if he wishes to exit post 5 years of his investments. This gives rise to much better returns due to accrual and capital gains. If, however, interest rates on 5-year paper has gone up (post 5 years of NFO); there can be some small capital loss as well. In such a scenario, investor can hold the Scheme till its maturity and nullify any adverse interest rate movements in his portfolio.

That may give rise to investment opportunity for additional purchase from the same investor or fresh funds from new investors.

Now, one can invest in this NFO with proper understanding and your eyes open. Investors should not panic during volatile periods due to change in interest rate scenarios. You will be better equipped if you have understood the above concept and its repercussions on your investments when markets turn against you at some points in time.

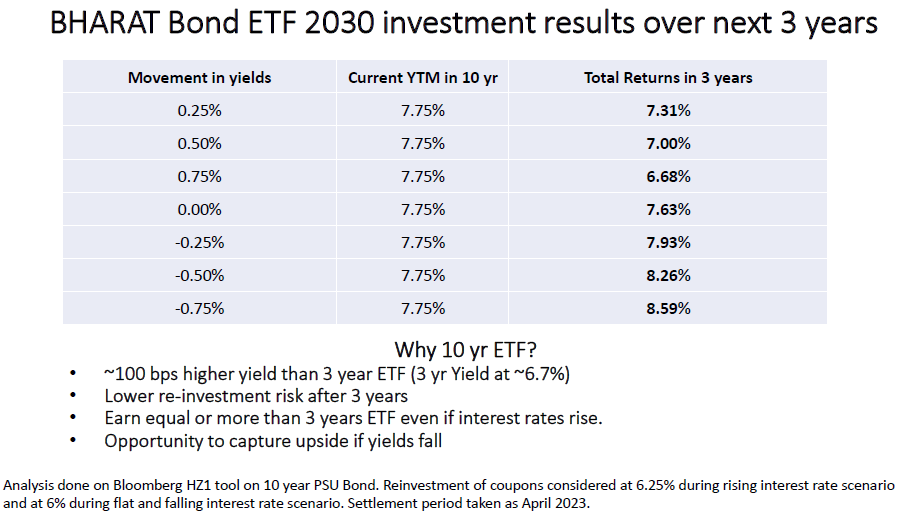

Also, Investors should be aware of how their returns will change based on different interest rate scenario post their investments. Interest rates can go up or down and its impact on returns is shown below:

I am sure all of you have seen and read the presentations, PDF notes, attended sessions on launch of this scheme’s NFO. So, for the sake of not repeating, I will not touch upon scheme attributes and other features.

Let me touch upon how this can be positioned for different needs of Investors and convert the entire positioning of the scheme to Need-Solution approach to get better understanding:

Need: Investment in Debt for long term (Core Portfolio):

Current Solution: PPF (15 years)/ Fixed Deposits (5-10 years)/ Mutual Fund schemes (3-5 years), Tax Free Bonds (10 years)

Alternate Solution: Bharat Bond ETF/FoF (10 years)

This can be the core portfolio in debt space for any investor with no credit risk, better tax efficient returns and high liquidity. Of course, as explained, it will have volatility as part and parcel of the portfolio. At such times wear blinkers (like race horses) and continue to hold the investment through ups and downs of the interest rate cycles. Also, post PMC Bank fiasco, lot of Investors are wary of investing in FDs with banks as well. This product will ensure diversification + Liquidity (which depositors of failed PMC Bank did not have)

Need: Lock in returns and have visibility

Current Solutions: Fixed Deposits (5-10 years)/ Fixed Maturity Plans (3 years)

Alternate Solution: Treat Bharat Bond ETF/FoF (both 3 year and 10- year versions) like open ended FMPs. Whenever (currently during NFO or even post NFO), if interest rates rise, invest at that time, hold till maturity (or earlier if interest rates soften from the date of your investments) and earn higher tax efficient returns with visibility as well

Need: Meet Long Term Goals like Education, Marriage, Retirement corpuses

Current Solutions: PPF, Endowment Policies, SIP in Equity MFs

Alternate Solution: Both the debt options above are not able to beat inflation with limited liquidity. As we are aware, Equity SIPs have not been for long term. Statistics have revealed that due to volatility attached to this asset class, many SIPs get discontinued during severe market corrections. Otherwise a great source for meeting long term goals if Investors control their emotions. Invest in Bharat Bond ETF/FoF and generate higher, tax efficient, inflation beating returns

Need: Follow static Asset Allocation strategy between Debt and Equity like 50:50 or 60:40, etc.

Current Solutions: Equity Funds and Liquid/Ultra Short-Term Bond Funds

Alternate Solution: Equity MF schemes + Bharat Bond FoF

Need: Regular cash flows

Current Solutions: Interest on Fixed Deposits

Alternate Solution: Deferred Systematic Withdrawal from Bharat Bond FoF (10-year product)

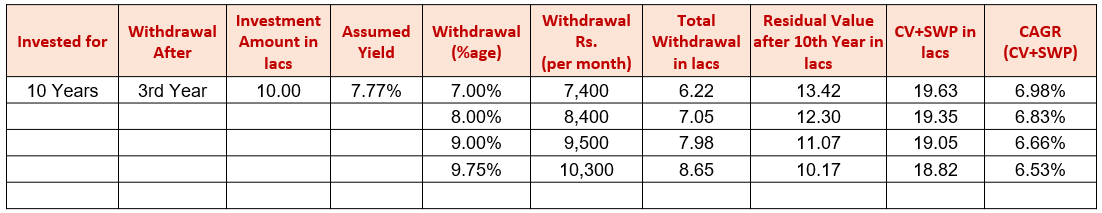

Deferred Annuity after 3 Years:

Following Table shows Systematic Withdrawal at different rates from the said scheme under FoF structure (from 7% to 9.75% p.a.) and residual value on maturity post the SWPs. SWP beyond 9.75% will erode your capital i.e. residual maturity value post 10 years can be below investment value of Rs.10 lacs. Someone who is keen on regular cash flows can opt for this option which will also be a very tax efficient way of generating regular, assured cash flows:

For Illustration purposes only

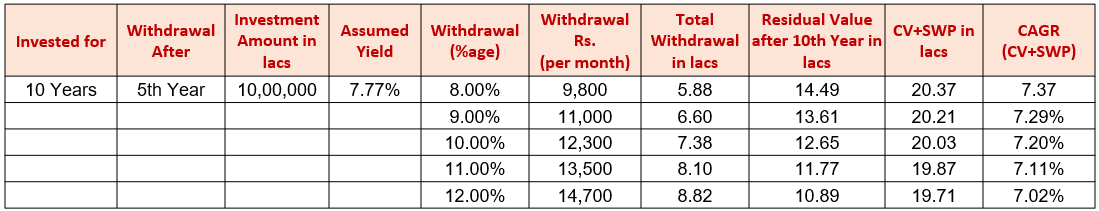

Deferred Annuity after 5 Years:

Following Table shows Systematic Withdrawal at different rates from the said scheme under FoF structure (from 8% to 12% p.a.) and residual value on maturity post the SWPs. SWP beyond 12.75% p.a. will erode your capital i.e. residual maturity value post 10 years can be below original investment value of Rs.10 lacs. Someone who is keen on regular cash flows can opt for this option which will also be a very tax efficient way of generating regular, assured cash flows. This table shows that longer you defer your annuity, investor will have option to create higher cash flows due to in built cushion:

For Illustration purposes only

I wish Edelweiss AMC all the very best for a successful NFO launch and wish to thank them for launching a great product at right time.