FT Winding Up Saga – The Conclusion – All’s Well that Ends Well

I had penned 3 articles on the captioned subject and done innumerable Social Media interactions through Twitter and LinkedIn and given my thoughts, observations and suggestions – only keeping in mind the best interests of the Investors at heart.

Those who wish to revisit these articles in chronological order may click on following links to get clear picture of what I had said on the very first day post winding up, how things panned out a year later and finally showcasing on how – what I had predicted in terms of outcomes – have all come true:

- First note on 24th April ‘2020 – a day after winding up - https://bit.ly/3Pmu9WT

- Note on 1st Year Anniversary of FT Saga on 7th May’2021 - https://bit.ly/3SLJCCW

- Note on Lessons learnt from FT Saga on 16th Dec 2021 - https://bit.ly/3zVE0gB

It was a very difficult chapter in the history of Mutual Fund Industry. Not only from the Investors point of view – whose funds were stuck when they needed them the most during lock down due to COVID but also for various different reasons as well.

- This phase showed the lack of depth in the debt markets – when liquidity dried up totally – there were absolutely no buyers of any debt securities in the market post pandemic and announcement of lock down. Banks were willing to earn lower returns and bear losses by parking their funds with RBI under Reverse REPO window rather than investing even in G Secs or AAA rated Corporate Bonds. In Equity, at least one gets some liquidity at some valuations – but same is not the case in Debt due to lack of depth in debt market space

- This phase showed lack of unity in the Mutual Fund Industry among all their participants – most in the industry had started blame game, pointing fingers, whispering in hushed tones: I TOLD YOU SO, WE DON’T HAVE SUCH CREDITS, etc. instead of calming nerves of MFDs, their Investors and supporting the concerned AMC in their worst crisis period

- This phase showed lack of understanding of debt markets and workings of Mutual Fund Industry in general – MF Industry is the best regulated industry in our country. All that the Fund Manager was asking was to give him some time to unwind the positions in an orderly manner when markets turned normal – just to get best value for investors in these schemes. He had a choice of raising his hands, sell securities at whatever value possible (maybe 30-50 cents to a dollar) and return lower amounts to the Investors. No one could have questioned him as these are open ended schemes with clear risks of liquidity, interest rate risk and liquidity risk as well.

I believe there will be no such comparable precedent in the Financial Markets in the world, where an event of such massive proportion would have occurred and by the end of it, investors would have got practically all their funds back with very decent returns in the shortest possible time (approx. 2 years)

- This phase showed lack of empathy towards both the Fund Manager and the concerned AMC - Even the Fund Manager and his family were not spared. Many threats, abuses were hurled at him and his family for doing an honest job in the best interest of the investors. He had everything to lose (his name, reputation, goodwill) and nothing to gain by delaying the refund process. AMC took brunt on all fronts – commercial (by winding up 6 schemes with letting go of almost Rs.70,000 crore corpus) and reputational risk – but did what was in the best interests of the investors and stuck by it against all odds.

A star Fund Manager with decades of rich experience behind him, pioneer of accrual funds with lower credits and high yields was maligned and was not given a chance to conclude this saga in an orderly fashion.

Most are giving credit to the SEBI appointed AMC for selling securities and getting best value for the unitholders. But credit must be given where it is due viz. the Fund Manager who invested in these securities with robust structures which could be sold and best values delivered for the unit holders. If credits were bad or structures were inadequate, even the best-appointed liquidator could not have managed to achieve what they have achieved in 6 wound up schemes – in the shortest possible time.

- This phase showed the ugly underbelly of social media – each trying to spread negativity without the slightest of concern for the affected hapless investors – It was a free for all to malign the Fund Manager and the AMC – whether you understood the whole situation, whether you understood how Mutual Fund industry works, or whether you understood how debt markets work or not. Just because negativity sells, most were spreading misinformation and misguiding investors. Instilling fears that their funds will never be recovered – at best only 20-30% of the funds will be recovered and rest will be lost. Another wrong narrative was - Funds will only come back to them over 5-7 years – if at all. And each of these so-called influencers, well-wishers and messiahs of investors had no stake in the game but only trying to show how concerned they were for the investors.

- This phase showed the maturity level of Investors. Inspite of negative noise, investors showed resilience, applied logic and common sense and remained patient – and voted YES for winding up against the misguided advices of various Social Media influencers and some Organisations – the so-called Messiahs of the investors. They saw through wrong narratives of these non-interested unscrupulous elements who were misguiding them. Finally, their patience has paid off.

- This phase showed the importance of good Advisors – most Mutual Fund Distributors (MFDs) stood by their investors thru thick and think during this difficult phase of their investors. They guided them and goaded them to vote YES for winding up – by explaining this once in a century Black Swan (COVID Lock Down) event which had occurred due to which the AMC had to take this harsh decision to safeguard the interests of the investors. MFDs’ role and importance cannot be emphasised enough during this difficult phase. They in their own ways helped investors to pass these difficult times, hand holding them and finally ensuring they came out of these turbulent times.

- This phase has ensured that in future no AMC will stick their necks out to protect the interests of the Investors – Looking at the negative responses to the genuine efforts of the AMC to protect the interests of the investors (same was the case with another AMC and their efforts to safeguard interests of the investors in their FMP fiasco); I personally believe, no AMC in future will stick their neck out. They will pass on the negative impact of any such event/s on to the investors and raise their hands. This is one of the worst fall outs of this saga.

To conclude, as I have mentioned in the beginning – ALL’S WELL THAT ENDS WELL:

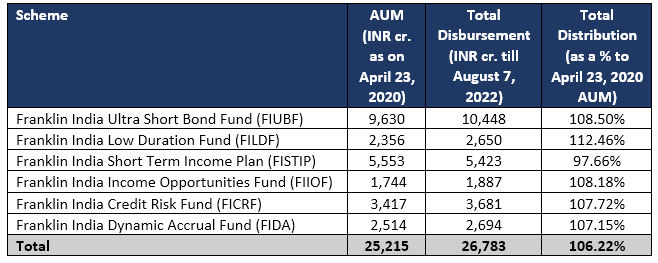

Let us see values that were locked on 23rd April 2020 in each of the schemes, what did investors get till date and how entire saga has come to a HAPPY ENDING – albeit at the cost of liquidity to investors for some time:

- The total amount distributed, in aggregate, will be Rs. 26,783.27 crores amounting to 106% of the AUM in the 6 schemes as on April 23, 2020

- 5 out of 6 schemes have returned over 100% of the AUM at the time of announcement of winding up on April 23, 2020

- 4 out of 6 schemes have liquidated all performing assets. There is only one issuer with three performing securities remaining to be liquidated in the other two schemes

- The total amount disbursed so far ranges between 97% and 112% of the respective AUM values of the six schemes as of April 23, 2020 (see table for details)

- Further, at the time of each distribution, the Net Asset Value of each of the schemes was higher than it was on April 23, 2020