Lessons Learnt form FT Saga:

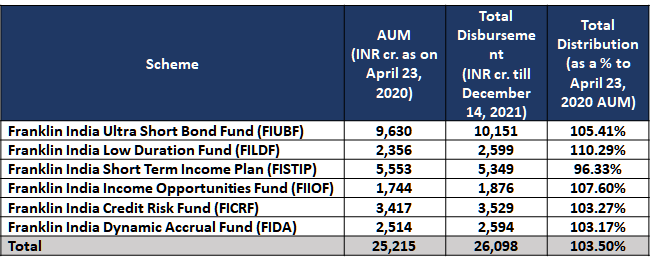

Before I start penning this note, let me give you the latest update on 6 Wound Up schemes of Franklin Templeton, disbursals thereof, total disbursement as % of 23rd April 2020 AUM and final returns till date of these wound-up schemes. Hopefully all funds will be fully paid back to investors over next couple of months and this saga will become part of history and forgotten. But before that happens, I wish to list out all the Lessons that we have and should have learnt from this saga which can then become a reference point for any such eventualities in future.

.png)

Following is data of total disbursement made till 14th December 2021 as % of the wound up AUM as on 23rd April 2020. As can be seen, all but one scheme has been paid in full by now:

I had penned a note on 7th May 2021 – on 1st Anniversary of scheme winding up and my detailed thoughts on the same. You may wish to revisit the same through this link: https://bit.ly/3m0gol3

Now let me talk about the lessons learnt in point format first and then elaborate on each of the points:

- Do not Panic

- Apply Common Sense and Logic

- Do not get swayed by negativity

- Be consistent in your Message

- Have Patience

- Show solidarity and unity among the Market participants; especially among AMCs and MFDs

- Trust the pedigree of the AMC and the Fund Manager in question

Now let me elaborate on each point:

1. Do Not Panic:

When there is crisis; first and foremost do not panic. If you panic, you will stop applying common sense and logic which is required for rational thinking and guiding your investors on the right path. When I learnt about the winding up of schemes in the evening of 23rd April 2020 – first thing I did was to contact the top management of FT and tried to understand their point of view. When I was satisfied with their explanations, I was quite confident that this was a temporary crisis due to illiquidity that had crept in post the lock down announced in March 2020. In fact, I came to know a little later that on one of the days prior to this winding up; there were no trades reported in the debt market for almost 30 minutes. This showed both risk aversion and illiquidity of the debt markets at that point in time. Intention was very clear – sacrificing liquidity for some time to safeguard capital of the investors.

Something similar had occurred when some of the AMCs, instead of selling shares of Essel which were part of LAS in some of the FMPs and return the funds under these schemes, concerned AMCs decided to sacrifice liquidity for some time by giving time to promoters to make good on their liabilities. Selling off shares was the easy option, but at a cost viz. selling them at huge discounts in the already illiquid market.

2. Apply Common Sense and Logic:

Because I did not panic, I started analyzing data gathered by applying Logic and Common Sense and hence I could pen a note for the benefit of all affected investors on the very day of schemes winding up and sharing it the next day i.e., on April 24’2020. Those interested in what I had to say at that time can read my article of 24th April 2020 through this link: https://bit.ly/30hYhzd.

Through this note, I was not justifying actions/inactions of the AMC or the Fund Manager but trying to control the controllable rather than trying to control the uncontrollable – which was the decision of the AMC which had decided to wind up the schemes for the reasons mentioned in my note. I could only control the actions/inactions of the MFDs and the Investors who needed proper guidance during such a time of huge crisis. I was also sure that going forward a lot of negativity will be created around this event and lot of misinformation will be spread which only impacts the interests of the affected investors. This was a once in 100 years Black Swan event which had no precedent that could have acted as a guide.

3. Do not get Swayed by Negativity:

As was expected, rampant negativity was spread around this event by all the affected and non-affected parties which included Media, independent journalists, MFDs, Investors, other AMCs, some unknown Activists who had no stake in the event and were trying to be a messiah for the affected investors without understanding implications of their actions. Unfortunately, negativity sells and garners more eyeballs. There were not many positive views around this event.

This was the time to spread positive messages for the investors and calm their nerves. The event happened at the most inopportune time during the COVID crisis when most needed their liquidity and needed positive assurances from their Advisors. A time when we should have made them understand a) why winding up was done, b) its implications if not done and c) how this was a temporary liquidity issue at a time when most Banks and other buyers were totally risk averse and finally d) they should expect to receive back their funds when markets stabilized and things returned to normalcy. RBI had immediately stepped and reduced interest rates, pushed banks to start buying/lending and various other measures. Unfortunately, many miscreants entered the saga and started spreading falsehoods, misinformation and misguided investors against voting for winding up of the schemes. This only delayed the whole process of investors receiving back their funds.

4. Be Consistent in your Message:

We needed to be consistent in our advice and messaging with the Investors. Many MFDs also started getting affected by the spread of negativity and gave confusing signals to their investors.If you see any of my notes (links of which I have shared above) and my Social Media interactions on Twitter and LinkedIn; I have been very consistent in my messaging for the benefit of investors, calming them when negative news was getting spread around and countering negative news with logical and practical rebuttals.

5. Have Patience:

Since the winding up, nothing was in the hands of MFDs or their Investors. They just needed to bide their time and have lots of patience. As can be seen from final results of disbursals which though happened over 18 months from winding up date; in reality it has happened over 12 months only. Rest of the time was wasted in long drawn court battles, voting, etc.

6. Show solidarity and unity among the Market participants; especially among AMCs and MFDs:

This was in fact need of the hour. Instead getting into “I told you so…”, “we do not have any credit issues in our schemes…” etc., we should have shown more mature behavior in backing the affected AMC and spoken one language – all in the interests of the Investors. Such events have happened in the past and may happen in future as well. It is better to spread positivity, comforting views by all the market participants including MFDs and AMCs. Investors were looking at positive bites to calm their nerves during the worst time that this event occurred. This was once a century Black Swan event with no precedents and hence all the more reason for a unified voice from the Industry.

7. Trust the pedigree of the AMC and the Fund Manager in question:

Last but not the least at least have trust and faith in an AMC and the Fund Manager with impeccable track record of helping investors create wealth. They have been in the Industry for more than 3 decades and shown exemplary results. Because the Investors believed in their ability to manage credit well, they trusted them with almost 75,000 crores in that space. How can a Fund Manager or the AMC become a villain overnight? How can we assume that they have some ulterior motives in such a highly regulated industry? How can we assume they can siphon off Investors funds? Lets not be judgemental straight away without giving them the benefit of doubt.

This is one of the most important lessons we need to learn – trust pedigreed AMC and the Fund Managers in question.

We hope such events do not occur in future. But if they do, please take some time out to read this note once again and then act or react.

With warm regards

MisterBond