Curious case of NIFTY50 Scaling New Highs & NIFTY50 PE Cooling Off

I am penning a note after quite some time. Reason for this note was once again my curious nature (JIGYASA – A DESIRE TO LEARN). Of late I have noticed that NIFTY50 has been scaling new highs but its PE (Consolidated Trailing 12 months) has come off significantly. It is also reflecting in my Algo number and the Equity band it recommends - from 0% in Equity, it is now showing 30% equity allocation in Equity in rising markets.

This got me thinking and did my own research with inputs from an explanatory note circulated by DSP Mutual Fund (when Market PEs were changed from Stand Alone basis to Consolidated basis -will write more on this as well) and inputs from Mr. Manuj Jain, Senior Product Specialist at ICICI Prudential Mutual Fund.

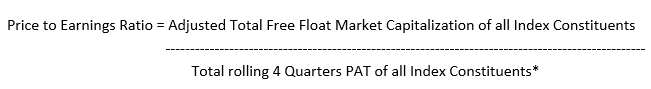

Let us first understand impact of change in PE calculations by NSE from Stand Alone to Consolidated Earnings:

*Earlier Earnings were calculated on Standalone basis of results declared only by the Indian operations of these companies. Now they have to declare earnings on consolidated basis (including all their subsidiary companies – located anywhere in the world).

This has had some positive impact on cooling off NIFTY50 PE to start with when this impact was taken into account in March 2021. Many companies are profitable at Group level where consolidated earnings for such Companies is much higher.

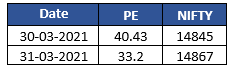

When this was introduced in March 2021; in spite of NIFTY50 levels at similar levels on March 30 and March 31’2021; NIFTYPE fell substantially and had this one-time positive effect of switching from Stand Alone to Consolidated Earnings system on NIFTY50 PE:

As per the note circulated by DSP Mutual Fund, out of NIFTY50 Stocks, it had predicted almost 39 Stocks to have better Consolidated Earnings v/s Stand Alone Earnings; thereby having positive impact on NIFTY50 PE (PE coming down), 9 to have worse Consolidated Earnings v/s Stand Alone Earnings; thereby taking PEs of these stocks up and 2 Companies to have no change. This note was circulated in February 2021. Thereafter, as seen above, NIFTY50 PE came off from a high of 40.43 on 30th March 2021 to 33.20 on 31st March 2021.

Now, let me throw some light on current phenomenon of NIFTY50 PE cooling off in spite of NIFTY50 scaling new highs every day and reasons thereof:

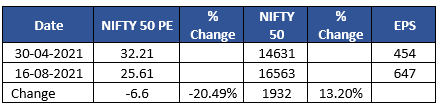

I have been stating for quite some time that for such high PEs to revert to mean; either Markets will have to correct or Earnings (EPS) will have to go up. As is evident from above table; though NIFTY50 has gone up by almost 13.20% (in absolute terms) from April 2021 to August 2021; NIFTY50 PE has come down by 20.49% from 32.21 to 25.61. This is justified with EPS going up from 454 in April 2021 to 647 in August 2021.

What has changed so dramatically for EPS to grow so rapidly when economy has just started limping back on its feet from the huge negative impact of the Pandemic? This can be explained to the base effect of last 4 quarter earnings and its impact. Let us divide the quarters from April 2020 as follows:

Quarter 1: Apr 2020 to Jun 2020

Quarter 2: Jul 2020 to Sep 2020

Quarter 3: Oct 2020 to Dec 2020

Quarter 4: Jan 2021 to Mar 2021

Quarter 5: Apr 2021 to Jun 2021

All of us are aware that 1st quarter of April 2020 to June 2020 was a total lock down period with no economic activities anywhere in the country and its negative impact on Earnings of the NIFTY50 companies.

When we replace 1st quarter (EPS is based on rolling 4 quarters earnings) and add 5th quarter or part of 6th quarter from July to August 2021 as well to calculate last 4 quarter earnings, things look dramatically different. These 4 quarters will exclude the lower base of April to June 2020 quarter and we will add positive impact of April 2021 to June 2021 quarter and even till date to August 2021 - almost entire economy has opened up and economic activity has gone up substantially (4 quarters now starting from July 2020 to June 2021 or 4 quarters starting from September 2020 to August 2021). That base effect and results of last quarter of opening of the economy with huge positive impact on earnings is reflected in current EPS as shown in the table above.

This should explain to the readers the curious case of Markets going up and NIFTY50 PE coming off at the same time.

I hope this has thrown some light on this paradoxical situation of diametrically opposite directions of Markets going up to PE going down (whereas, generally, there is positive correlation between direction of Markets and PEs).

If markets remain listless at current levels, then the positive impact of growing EPS can revert current high PEs to cool off. Alternately, as and when Markets correct, PEs can come off from current highs and revert to mean. Only time will tell.