I recently Tweeted saying that Advisors can build their entire Mutual Fund practice by embracing only Dynamic Asset Allocation Funds (DAAF) instead of investing in Market Cap Bias schemes like Large Cap, Mid Cap, Small Cap or by investing in Sectoral Funds like Pharma, Infrastructure, etc. Got a lot of positive response (and very few negative) to that. I attribute this positive response to the current Market correction and volatility. Till January 2020, many were not even aware of this category. Only when Markets turn volatile, bearish, uncertain is the time when talk of this category gets noticed and talked about. Most media – print and television have started highlighting virtues of this Category and become proponents of the same.

However, those who follow me, read my articles, attended my lectures or Webinars or seen my Workshop videos are aware of my thoughts on this category since past 8-10 years. I have always treated this category as ALL SEASONS STRATEGY which can work well in any Market conditions and also deliver happy investing experience.

When I request some of the AMCs to bring such a scheme (DAAF) in their basket; their counter argument is that AMC mandate is to manufacture products and Asset Allocation is the job of Advisors or Investors. They should do this job rather than depending on AMCs to take cash calls or manufacture Asset Allocation schemes.

My humble suggestion to all these AMCs and to the Mutual Fund Industry at large is that it is our joint responsibility of all Market participants to give a smooth and less volatile Investment journey to the Investors. Even Regulator, should allow AMCs to take cash calls in their Equity schemes to protect the interests of the Investors. They may need to tweak their existing guidelines for the same. AMCs must offer DAAF or equivalent schemes in their baskets, Advisors must adhere to Asset Allocation – either at Portfolio level or invest in DAAF if they are not able to instill discipline within themselves or in their Investors and finally, Investors must understand importance of Asset Allocation/DAAF in their portfolios and not get carried away with their GREED in chasing returns, market caps, sectors, etc. They should aim to create wealth slowly, steadily, with less volatility and mishaps like current one and finally come out on top.

For the Industry to achieve all this, there will have to a change in their mindsets by moving away from traditional Mantras like BUY & HOLD, SIP KARO BHOOL JAO and DO NOT TIME THE MARKETS. These are counter productive mantras which have not worked in favor of the Investors. On the contrary, BUY & HOLD Investors are like that RABBIT who gets out of the RACE and the proverbial TORTOISE (DAAF) wins the race. We will have to embrace new Mantras of MisterBond (yours truly) of DOWNSIDE PROTECTION and BE IN THE RIGHT ASSET CLASS AT RIGHT VALUATIONS.

Please note that I am including both types of DAAF scheme in this note viz. Pro Cyclical and Counter Cyclical. Intention is Downside Protection which is demonstrated by both models.

Coming back to the main theme of this Article viz. Can Advisors build their entire MF Practice from DAAF Schemes? What are the advantages and what will we achieve for our Investors? Can it generate decent returns? Can it protect us on Downside? Is it for all classes of Investors?

Let us take the major advantages of this category. I am calling this category ALOO KI SABZI IN INVESTMENT THALI – BLENDS WITH ANY INVESTMENT STRATEGY:

What do we achieve through DAAF?

- Manages Asset Allocation

- It manages Value Based Investing i.e. Invests-Disinvests at right valuations

- Buy Low – Sell High – constant profit booking (or through Pro Cyclical model which will reduce Equity exposure during Bearish Trends and increase the same during Bullish Trends)

- Thereby not creating Abhimanyus who are stuck in Equity Chakravyuha without any Exit options

- Downside Protection

- Average 50% in Equity and 50% in Debt with Equity taxation – no need for separate debt allocation

- No need to time the Markets both for Entries as well as or Exits

- Participates in Upside during Bullish Markets

- Protects Downside during Bearish Markets

- Delivers returns even during stagnant Market period due to Buy Low- Sell High strategy

- One can use it under SIP, STP or Lump Sum strategies

- Can be recommended for any Age Groups – be it youngsters or Senior Citizens

- Can be used effectively for tax efficient cash flow creation for Senior Citizens through SWP

- Practically all Fund Houses have this scheme in their baskets – called Dynamic Equity or Balanced Advantage Funds

- Not all BAFs may be DAAF. One or two schemes are called BAF but are aggressive Hybrid schemes. Careful of selecting such schemes and AMCs

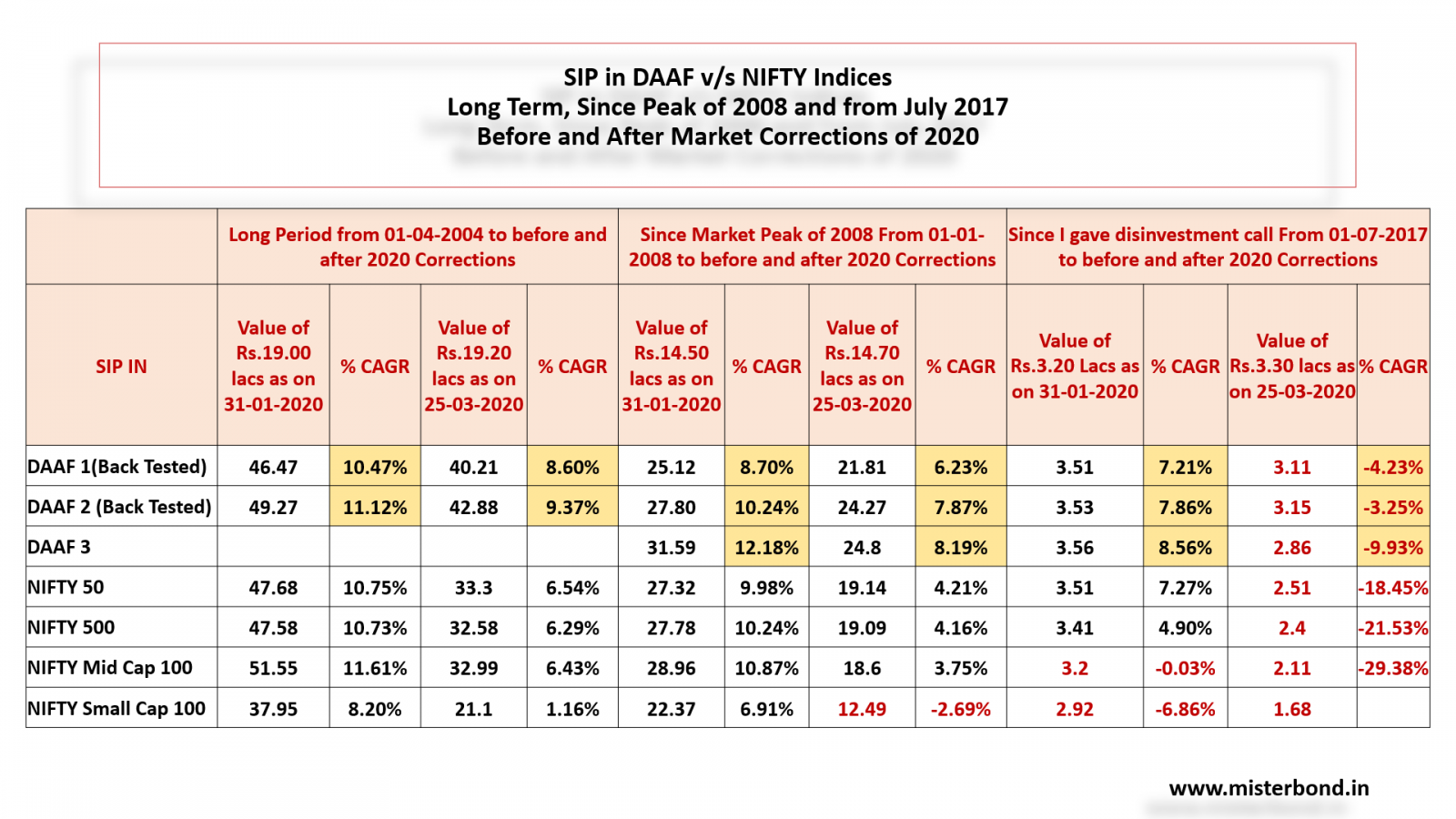

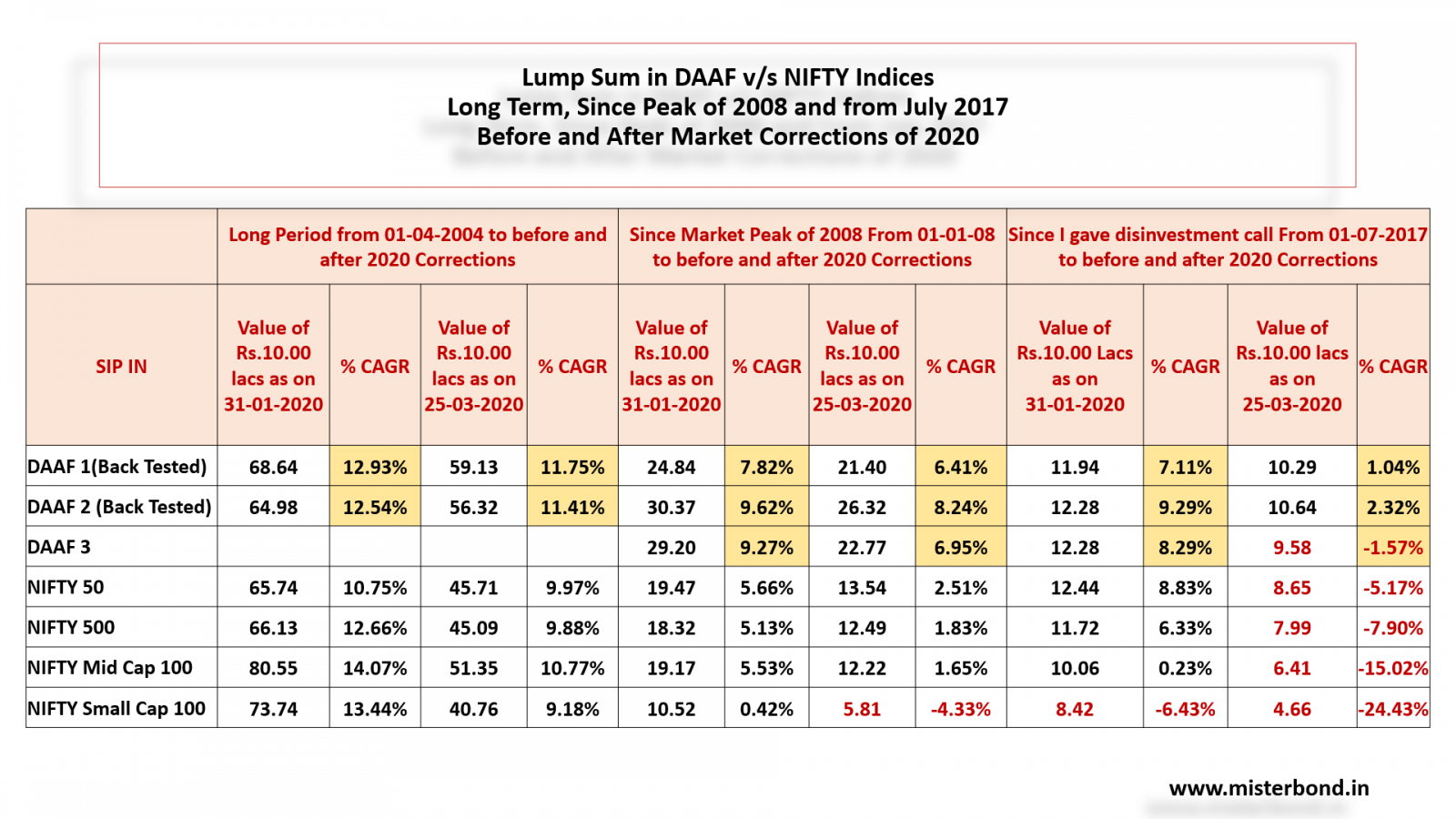

Let me now show case how investment in some of these schemes under SIP or Lump Sum under different time periods. Reasons for selecting these time zones are:

- From 01-04-2004 to 31-01-2020 – Long enough period before Market Crash

- From 01-04-2004 to 25-03-2020 – Long enough period after Market Crash

- From 01-01-2008 to 31-01-2020 and 25-03-2020 – from peak of Market in January 2008 to before and after Market crash of 2020

- From 01-07-2017 to 31-01-2020 and 25-03-2020 – from the date when I had recommended Exit from Equity as an asset class to before and after Market corrections of 2020

- I have considered both SIP during these periods and Lump Sum as well so that no one can argue that may be Lump Sum investments could have worked vs/ SIPs

- I have taken examples of 2 DAAF schemes (based on their back tested NAVs) and one actual scheme which has been in existence since past 10 years or so

- One of the DAAF Schemes (back tested example) is of Pro Cyclical scheme and other two schemes are Counter Cyclical

- I have taken examples of both models to show case that both DAAF strategies are capable of delivering good Investor Experiences

- Compared them with all segments of the Market viz. Large Cap (NIFTY 50), Multi Cap (NIFTY 500), Mid Cap (NIFTY Mid Cap 100) and Small Cap (NIFTY Small Cap 100)

Following Data is for Lump Sum Investments over different periods as explained above:

Conclusions:

- DAAF has performed equal to or better than Buy & Hold and SIP Karo Bhool Jao under any Market period (before or after corrections, over longer or shorter investment horizons and even from dates of Markets when they were their peaks in previous Market Cycles)

- Less volatile and much smoother Investment experience to Investors

- NO need for timing Markets, Exits or Entries

- Statistics reveal that Investors stay invested in Equity as an asset class for not more than 2-3 years. This category could have converted short term Investors to Long Term Investors

Please draw your own conclusions as Investors or as Advisors whether is it worth your while to try predict which segments of Markets will do well or underperform and switch from (i.e. if you are capable of judging these trends) Large Cap to Mid Cap to Small Cap and vice versa and become like Drivers on a Toll Naka who leave their lane (which may not be moving fast enough) to realise that they are now stuck in the 2nd lane and their 1st lane has started moving faster; thereby not create wealth anywhere?

Be truthful in answering queries to whether as Advisors are you capable of giving timely disinvestment calls, be proactive rather than being reactive, protect downside, participate in the upside, successfully manage both GREED and FEAR of yourselves and your Investors and in general give smooth, less volatile, happy investing experience to your Investors.

If the answer to above questions is NO; consider building your Advisory practice purely from DAAF category of schemes and manage all of the above and beyond. Rest is for readers to make their own conclusions.

Markets have still not come out of this major correction phase and AMCs have started giving aggressive Investment calls in the most volatile segment (as seen from above data) viz. Small and Mid-Cap schemes.

My humble suggestion to all AMCs is as follows:

- Either you call yourselves as Manufacturers or call yourselves as Advisors as well

- If you call yourselves as Manufacturers; please stop giving Investment/Disinvestment calls

- Instead provide solutions which will act as your thoughts on the market through schemes like DAAF

- You may wish to replicate your own Large Cap, Multi Cap, Mid Cap, Small Cap and Sectoral schemes into DAAF based on your own internal valuation matrix applicable to each segment

- Which means each Equity should have a corresponding DAAF version of the same scheme

- This in turn will take investment and/or disinvestment calls automatically

- Even SEBI should allow this segment to thrive and remove unnecessary restrictions like DAAF should have minimum 30% in Equity. Why? Why can’t they be 0% to 100% in Equity based on Valuation matrix?

To end, skeptics will even start a debate on Passive Fund selection in my note v/s Actively managed Funds (which are supposed to deliver alpha). Before this debate crops up, my humble suggestion is that this is just a thought for those who are not able to manage Asset Allocation well as well not able to manage Greed and Fear of Investors and themselves. If you like the suggestion, embrace it, if not, ignore it because I do not wish to get into any arguments or discussions on this. These are my beliefs based on 35 years of experience in Finance line and 25 years in Mutual Fund space. I have conviction and hence Consistency in my Advice.