As I am writing this note, NIFTY has scaled 17,857 and Sensex has touched 59,985 (as on October 28'2021). No one in their wildest imagination would have thought of such stupendous rallies in some of the Asset Classes since the outbreak of COVID19 in March 2020. That was a month of Doom and Gloom and most experts had predicted very long recession from thereon.

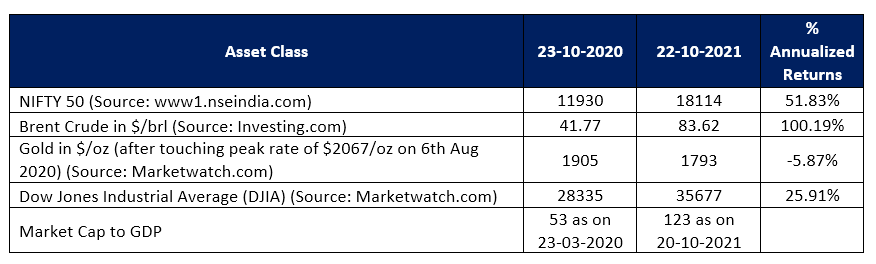

Let us analyze journey of some of the more popular asset classes over past 1 year; returns generated and their current valuation metrics

As can be seen from the above table, valuations are at historic highs and according to many experts – overstretched as well. All this can be attributed to Asset bubbles getting created due to sheer size of liquidity pumped in by most Central Banks across the Globe to counter the impact caused due to COVID19 lockdowns and to boost demand and revive sinking economies.

Now is the time to relook at your Asset Allocation with a magnifying glass and look to reallocate some of your client investments to align with current market valuations in different asset classes. Multi Asset theme which has started becoming popular is the way going forward as well.

What do Multi Assets theme do?

Multi Assets invest in different asset classes which are negatively correlated like Gold & Equity; Debt & Equity. If one asset class underperforms; another asset class will perform and vice versa. All of us by now are aware of the findings of a survey: 92% of investor returns are generated by proper asset allocation and only 8% can be attributed to stock selection, timing, etc. (Source: “Determinants of Portfolio Performance II, An Update by Gary Brinston, Bran D Singer and Gilbert L Beebower, Financial Analyst Journal – May-June 1991”).

Selection of proper asset classes is also of paramount importance to ensure better overall portfolio returns. Currently, following asset classes form part of multi asset themes:

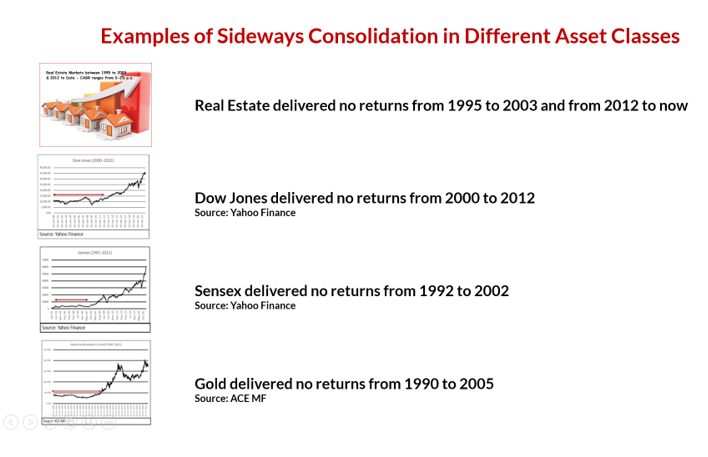

Also, reason of having multi assets in an investor’s portfolio is also due to the fact that some of the asset classes have long duration of sideways consolidation. Not many are aware that investors lose more money in sideways consolidation than in correction periods. Some of the examples of sideways consolidation in different asset classes can be the following:

Now lets us talk about some of the popular Asset Allocation strategies:

Many investors resort to doing their own asset allocation: either dynamic asset allocation by switching from debt to equity and vice versa based on certain criteria to gauge how expensive or cheap are Equity valuations. And some of the investors follow a fixed Asset Allocation like 60:40 in favour of Equity or Debt based on their age criteria.

In either instance, investors refrain from taking any interest rate or credit calls on the debt portion (rightly so) as Debt is only temporary parking vehicle which gets switched into Equity as and when equity valuations become cheaper. In current low interest rate regimes across the globe; this allocation to Debt generates very negligible returns and hence drags down the overall performance of investor portfolios.

In such a scenario, what is the new Dimension that we can add to Investor portfolios?

What is REIT?

- A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing properties

- REITs generate a steady income stream for investors and provides capital appreciation too

- Most REITs are publicly traded like stocks, which makes them highly liquid (unlike physical real estate investments)

- REITs invest in most real estate property types, including apartment buildings, cell towers, data centers, hotels, medical facilities, offices, retail centers, and warehouses

Reason I prefer investment in Global REITs offering v/s Domestic REITs is the number of themes Global REITs invest and capture v/s domestic REITs only capturing limited opportunities in Commercial and/or Residential properties.

Global REITs invest in very interesting themes like the following:

- Logistics – warehousing theme

- Senior citizen homes, self-storage which are popular concepts globally

- Build to rent sectors due to unaffordability in expensive urban areas

- Grade A environment friendly office spaces are bouncing back post work from home is reducing

- People are going on vacations/staycations with a vengeance – great opportunity in hotel sector rebounding

- Delivery promises within 15-30 minutes has opened opportunity of storage facilities within residential complexes instead of only centralized warehousing on outskirts

Investors can then convert their 60:40 allocation of Equity:Debt to 60:20:20 Equity:Debt:Global-REITs. Now let me explain what are the advantages of investing in Global REITs?

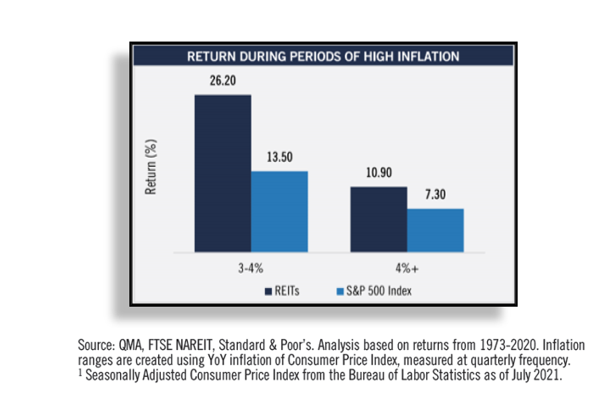

REITs outperform stocks during high inflation periods:

- As explained earlier, there are inflationary pressures globally. An ideal time when REITs can start to outperform Bonds and Stocks

- Real estate rents and value tend to increase when prices go up – as many leases are tied to inflation

- A natural hedge against current inflationary environment

- Above table highlights how REITs can outperform stocks in different inflation environments – alpha of 3.60% to 12.70% over stocks

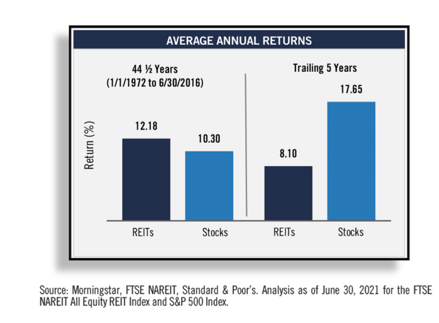

Other reason for possible outperformance by REITs over stocks is theory of Reversion to Mean:

- Over past 44 ½ years, REITs Index has outperformed S&P 500 by nearly 2%

- Past 5 Years, REITs has underperformed stocks by 9.50%

- REITs will have an edge over stocks due to possible reversion to mean due to high inflation

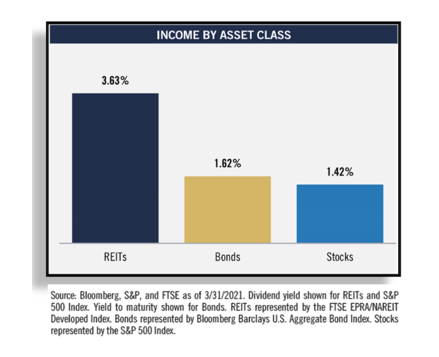

REITs can Offer higher Income than Bonds and Stocks:

- In current low yield environment, REITs can deliver higher Income

REITs has Outpaced Inflation:

.png)

- This is a very powerful data which shows that income generated from REITs has outpaced inflation in 39 years out of past 41 years

- Hence, a very good hedge against inflation; especially in current rising inflationary environment

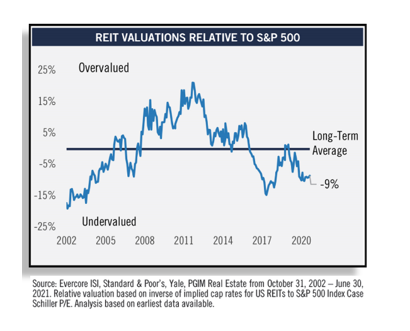

Bonds and Stocks are in Overvalued Zones:

- Even from valuation perspectives; REITs are undervalued compared to Bonds and Stocks

- A great entry level for investors

A Good Diversification into Under Owned Asset:

.png)

- Global REITs becomes a great Geographical and Currency diversification for investors

- Rising CAD and falling INR also adds to the overall returns under this asset class

- Also, most investors have limited allocation (except for their own residential properties) to real estate as an asset class

- Global REITs adds a new dimension to an Investor’s portfolio – which hitherto was not available to Indian investors

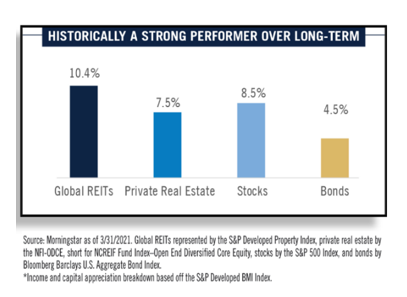

Performance of Global REITs v/s Bonds and Stocks:

- To capture opportunities beyond traditional commercial & residential property themes

- Historically a strong performer over long term – with 40% coming from Income and 60% from capital appreciation (Source: PGIM Real Estate. Income & Capital appreciation breakdown based off the S&P Developed BMI Index)

What are Options for Investors in REITs under Mutual Fund space?

- There are two fund houses who offer REITs under FoF structures – investing in local real estate (Indian context)

- Only PGIM is offering a FoF under Global REITs space through an NFO which is opening on November 15’2021

- PGIM is one of the Top 2 Global Real Investment Manager with more than $190 bln AUM, 51 years of experience and presence in more than 32 offices worldwide

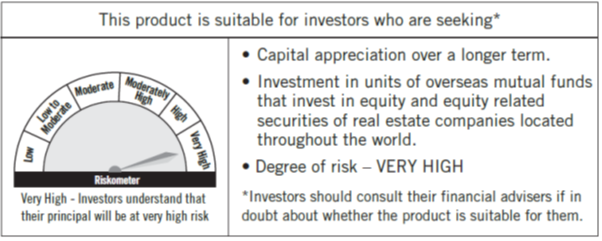

Why Invest in PGIM India Global Select Real Estate Securities Fund of Fund NFO?

- India’s first Real Estate Fund of Fund

- Invests in Global opportunities – in themes that are not available in India

- Potential hedge against inflation due to the timing of their NFO

- Opportunities in Global real estate now available to Indian retail investors as well – an under owned asset class

- Dual alpha of high income and capital appreciation

- Currency and geographical diversification and also diversification beyond just commercial and residential properties

- High illiquidity of this asset class made highly liquid through the mutual fund route

What are Potential Risks?

- Pace of reopening of economies across the globe

- Rental growth may take in secularly challenged sectors like office/retail

- COVID induced tenant bankruptcies

- Labor shortages and pressure on margins due rising labor costs

- Risk of new variants of COVID and subsequent impact

I would surely recommend to add this asset class in your investor portfolios. Sheer timing of the NFO is also very opportune as other asset classes are at over stretched valuations, inflation is on the rise (as explained good for REITs), valuation of REITs v/s Bonds and Stocks and possible reversion to mean – where REITs can outperform going forward. Also, a good inflation hedging tool with higher income and possible capital appreciation. INR depreciating also adds to the investor’s overall portfolio returns due to currency diversification.

DISCLAIMER

PGIM India Global Select Real Estate Securities Fund of Fund

(An open-ended equity fund of fund scheme investing in

PGIM Global Select Real Estate Securities Fund)

Investors will bear the recurring expenses of the scheme, in addition to the expenses of the underlying scheme. The Information contained herein is provided by PGIM India Asset Management Private Limited (the AMC) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. However, the AMC cannot guarantee the accuracy of such information, assure its completeness, or warrant that such information will not be changed. The information contained herein is current as of the date of issuance* (or such earlier date as referenced herein) and is subject to change without notice. The AMC has no obligation to update any or all of such information; nor does the AMC make any express or implied warranties or representation as to its completeness or accuracy. There can be no assurances that any forecast made herein will be actually realized. These materials do not take into account individual investor’s objectives, needs or circumstances or the suitability of any securities, financial instruments or investment strategies described herein for particular investor. Hence, each investor is advised to consult his or her own professional investment / tax advisor / consultant for advice in this regard. The information contained herein is provided on the basis of and subject to the explanation, caveats and warnings set out elsewhere herein. These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Distribution of these materials to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part without the prior consent of the AMC, is prohibited. The views of the Fund Manager should not be construed as an advice and investors must make their own investment decisions regarding investments / disinvestments in securities’ market and / or suitability on the basis of their specific investment objectives and financial positions and using independent advisors as they believe necessary.

The Product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when actual investments are made.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

With warm regards,

Sunil Jhaveri (aka MisterBond)