A scheme with superlative performance hidden away from limelight

Generally, you will not see my notes or recommendations on Equity Schemes. But here I am making an exception and writing about one specific Equity scheme from the stable of PPFAS Mutual Fund viz. PPFAS Long Term Equity scheme.

While playing golf with Neil Parikh, one of the Founders of the Fund House, we got to talking about his Scheme performance and philosophy of investment. That conversation intrigued me and on my return to my office, I started doing my own bit of analysis of the said scheme on different parameters.

What came to light was nothing short of pleasant shock and surprise. I tried analyzing this scheme from all conceivable angles to find some weakness, some faults, some negative surprises. From all angles I was left disappointed that nothing untoward or negative came out of my research (actually I was happy that this scheme passed all my filters and tests).

If you have read my articles, you will realise that I do a lot of number crunching to convince myself of the merits of a scheme or an asset class. I will not discuss about stock selection, fundamentals, etc. Purely on the numbers and my own filters, I have analyzed this scheme’s performance.

Only caveat is that this scheme is in existence since past 6 years and hence not long enough period which would have seen multiple business cycles- both domestically as well as internationally. Though, this scheme has witnessed volatile periods during 2015-16 melt down and current volatility and downward trend since January 2018; same cannot be said about US Markets.

My Criteria of analyzing the scheme:

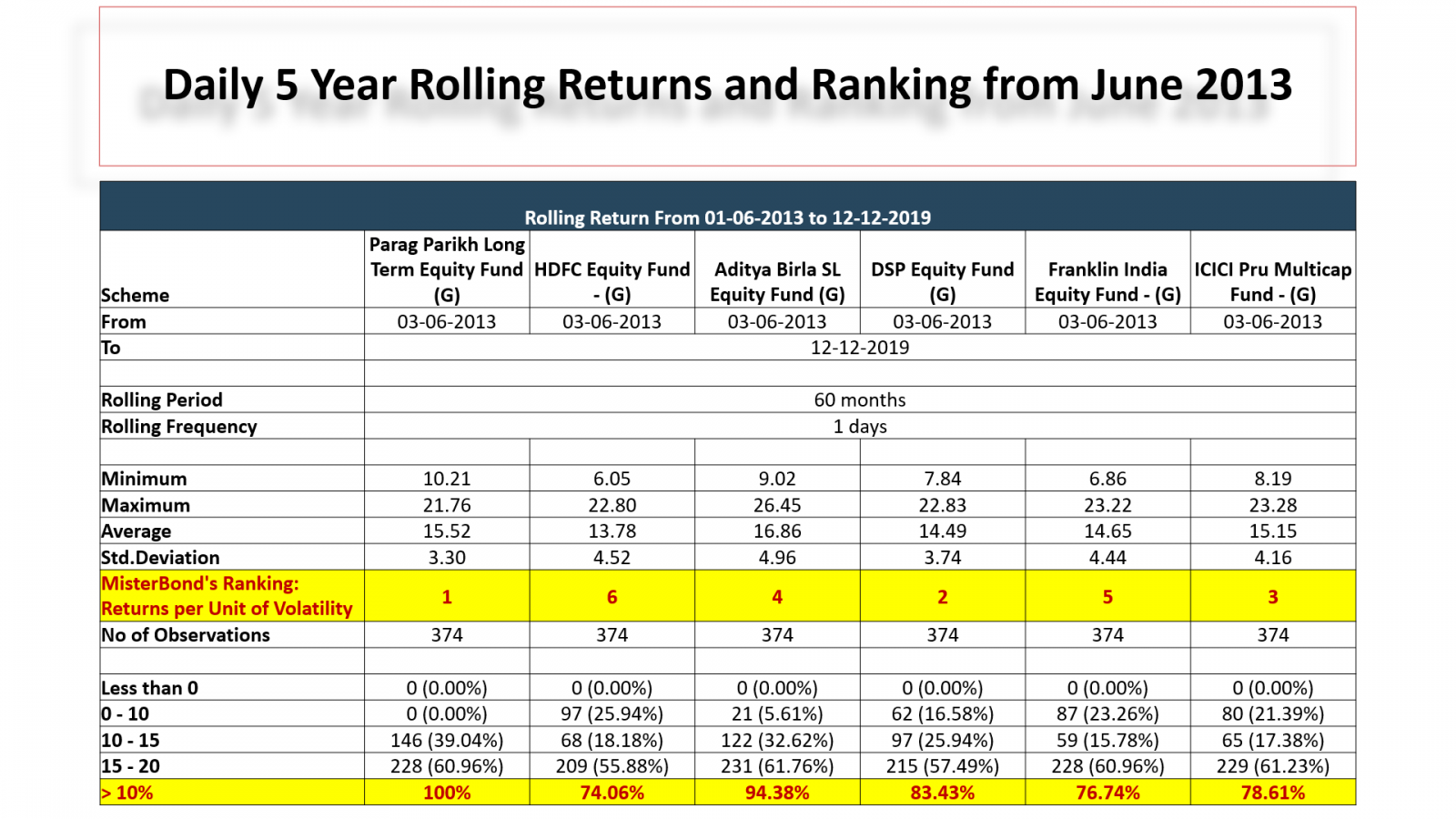

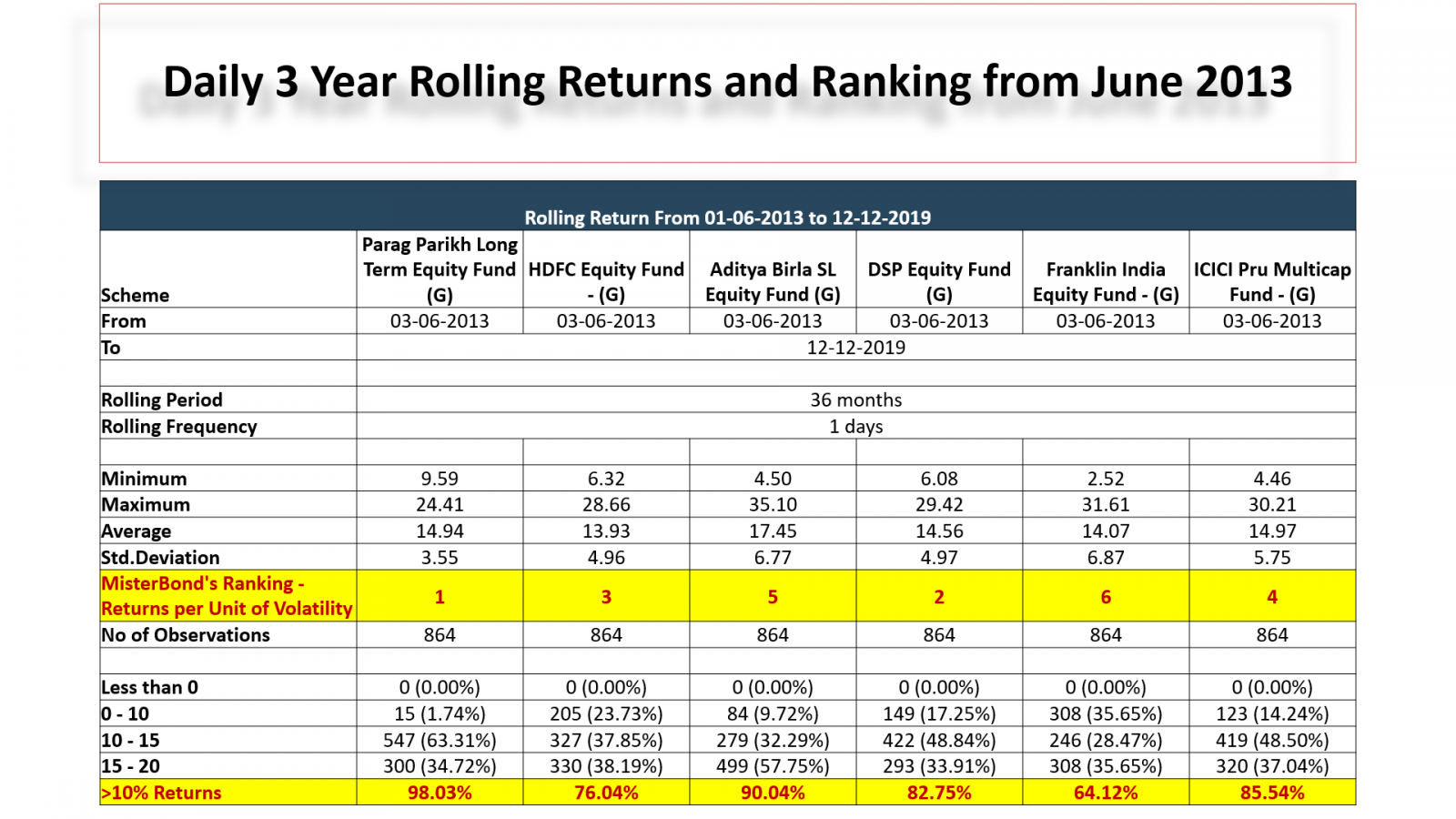

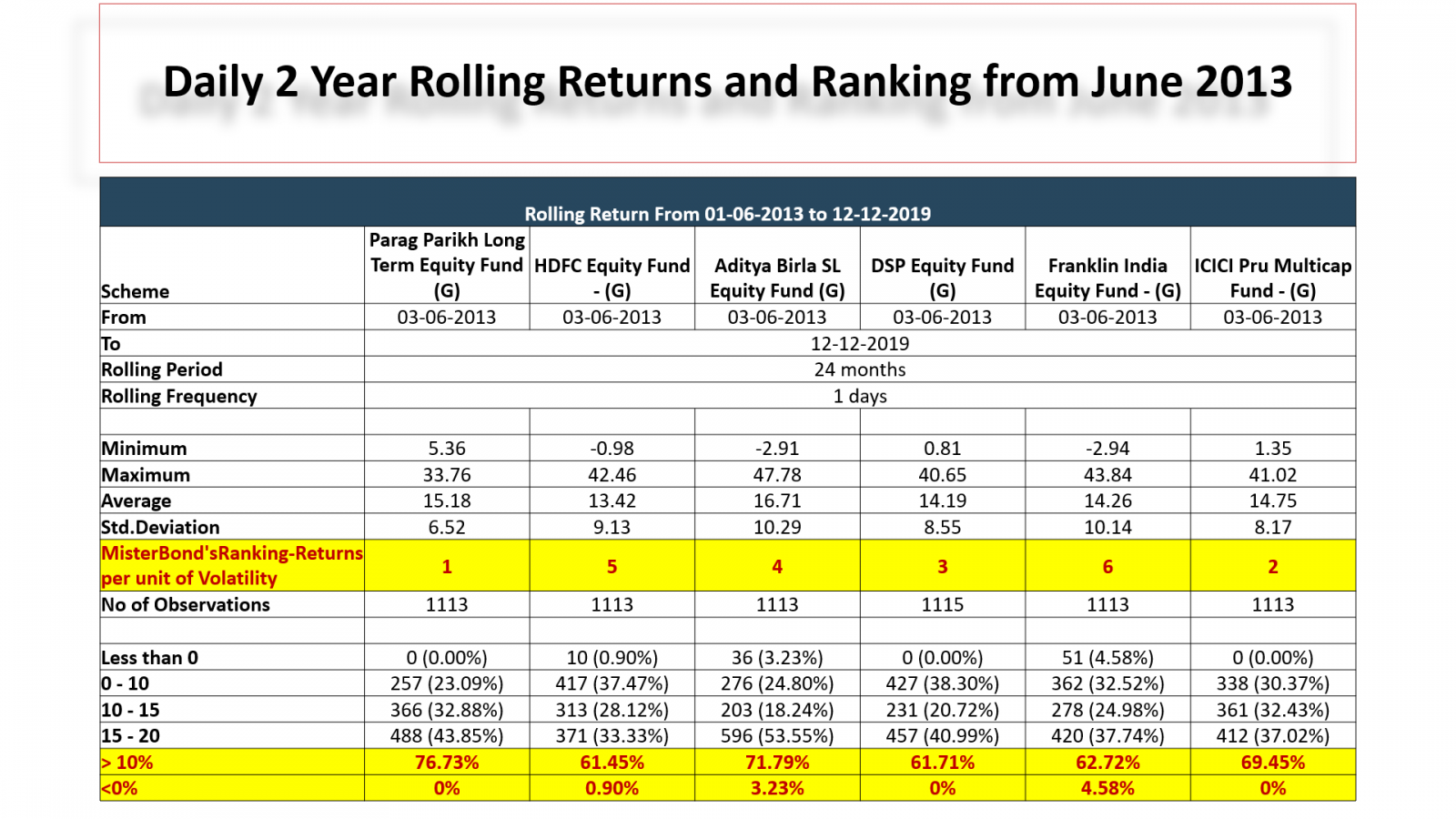

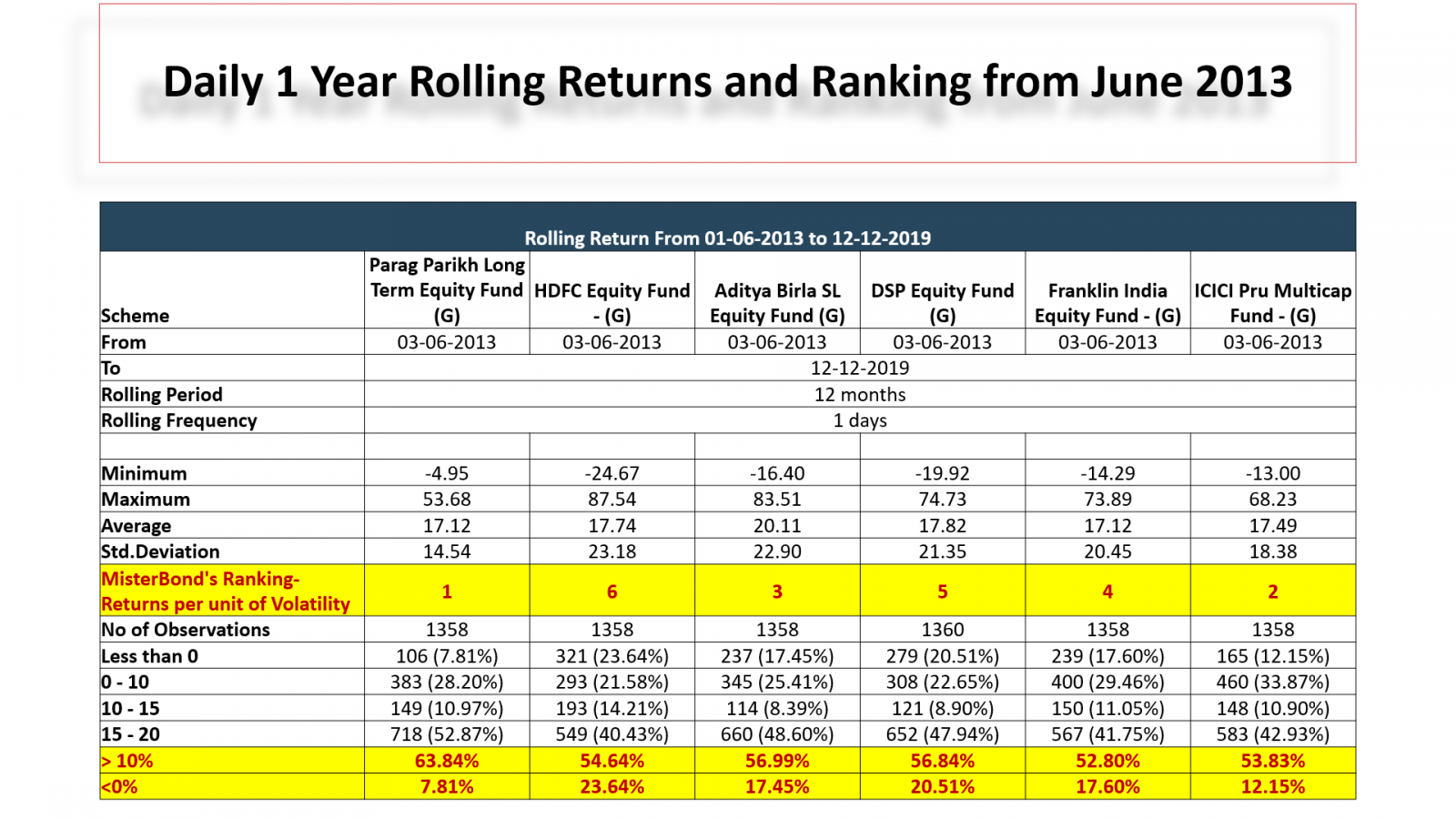

- Since Inception (May 2013): Daily 5/3/2/1 year Rolling Returns analysis

- Percentage of total observations that delivered more than 10% CAGR under each one of the above Rolling Returns analysis

- Percentage of observations that delivered less than 0% (negative returns) under each one of the above Rolling Returns analysis

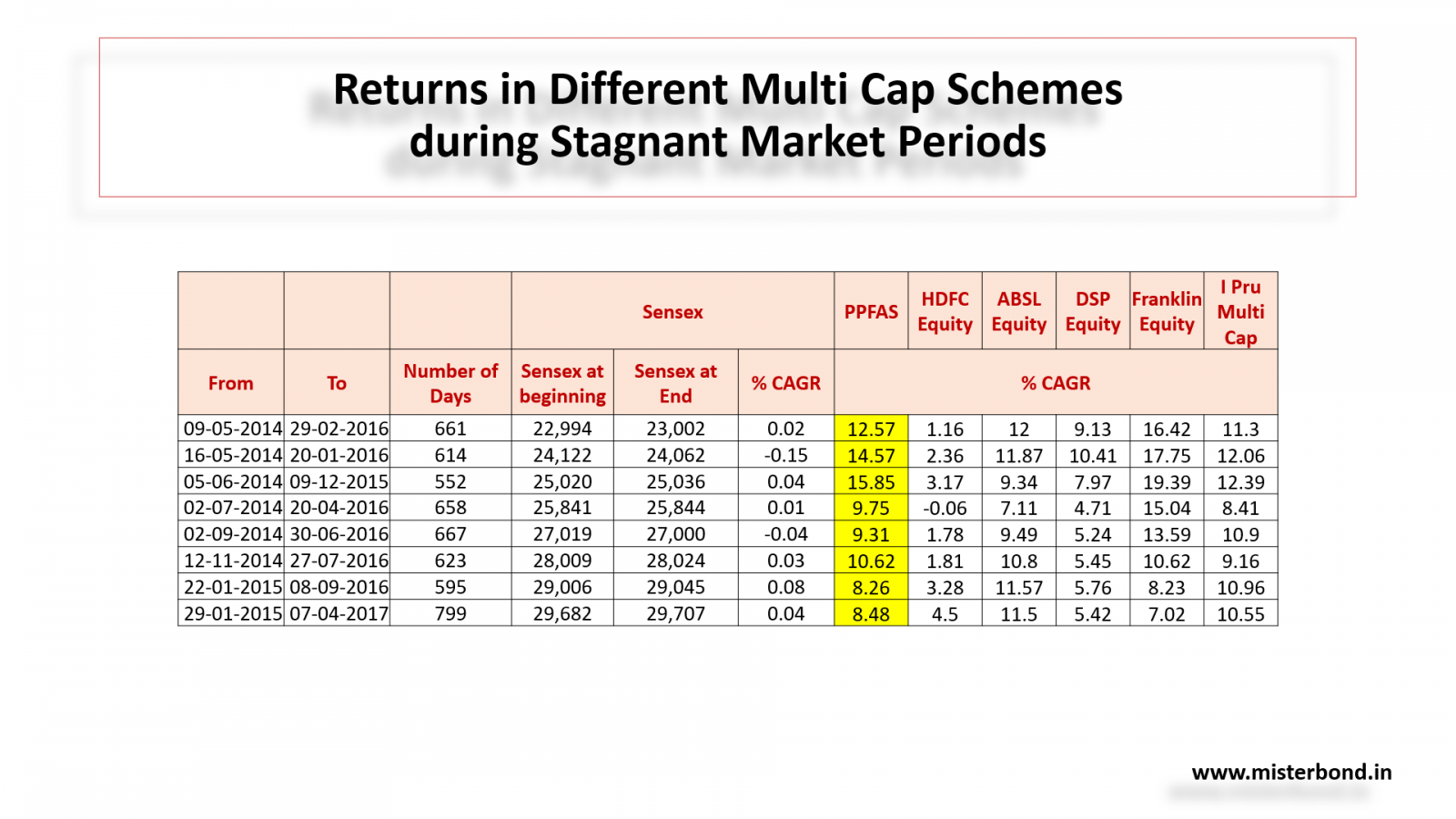

- Returns in the scheme during stagnant market periods

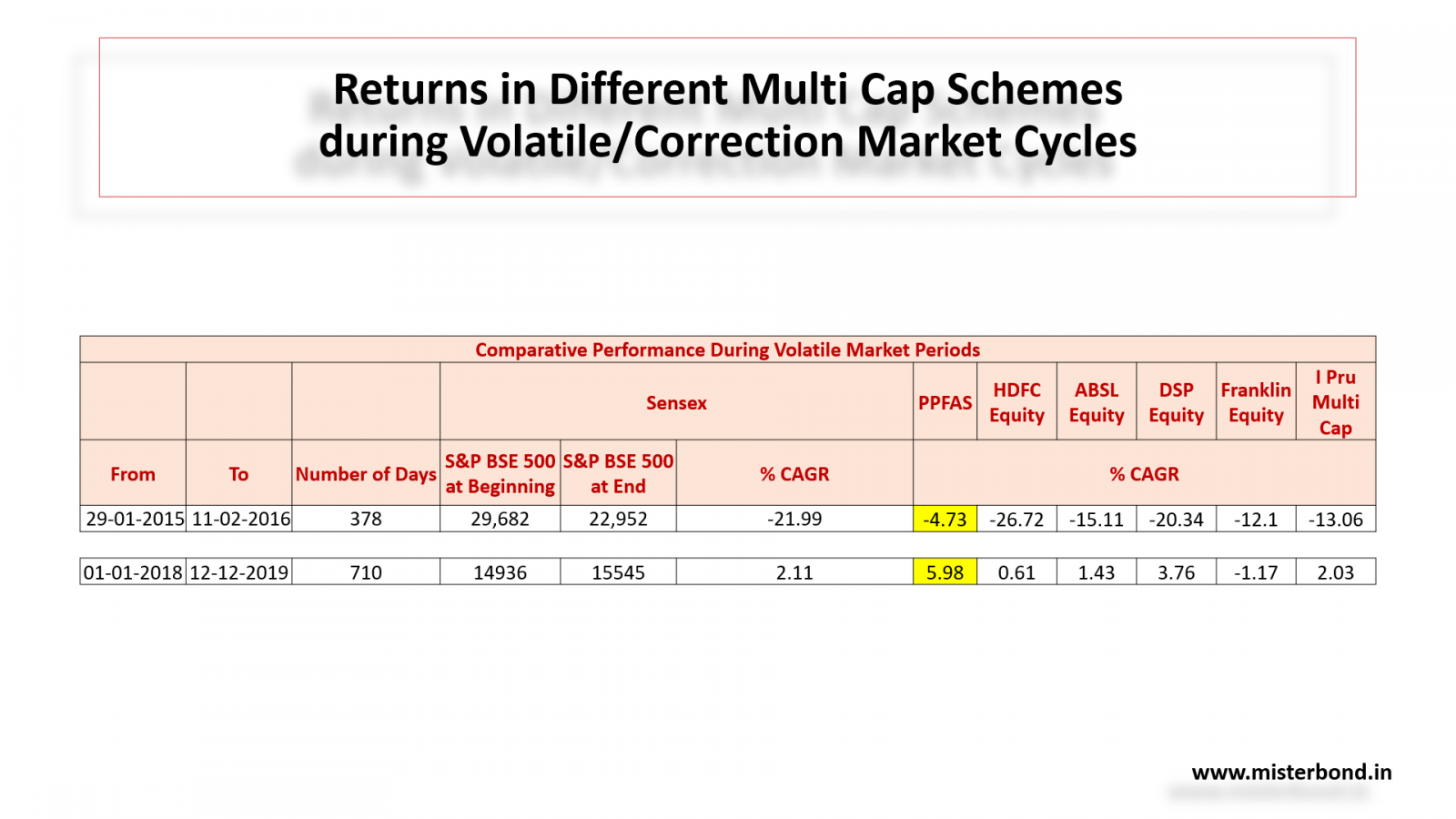

- Returns in the scheme during Large Cap meltdown of 2015-2016 period

- Returns in the scheme during current Mid and Small Cap melt down from January 2018 onwards till date

- My own Rankings based on consistency of returns vis a vis volatility i.e. Returns per unit of Volatility (very soon I will be publishing this data for the benefit of all Investors and advisors. This will be more reliable Rankings than current Ranking methods which changes the leaderboard every month, every quarter based on recent past performance)

I will show case each on the of the above data below.

I call this All in One scheme. Why do I call it this?

Reason I call this All in One Scheme is because it has following main attributes and constituents:

- It invests in Large and Mid-Cap stocks in the Domestic Markets and Mega Cap Stocks in International Markets; thereby giving not only dollar diversification but also geographical diversification. They can and have invested up to 30% in International Stocks

- It is capable taking cash calls up to 80-85% - as and when the Fund Managers find their underlying individual stock valuations to be on expensive side – thereby providing downside protection. This 80-85% will consist of 35% in cash and cash equivalent and up to 50% in fully hedged arbitrage positions. This will ensure Equity taxation at all times. Since inception, they have taken up to 30% cash calls on certain occasions

- Hence, instead of the Advisors/Investors taking this Asset Allocation calls; Fund Managers are managing the same quite beautifully without sacrificing on upside participation

- Daily 5/3/2/1 Year Rolling Returns since May 2013 to December 2019 with MisterBond’s own Rankings and data on Percentage of Returns with more than 10% CAGR and less than 0% CAGR:

- Returns During Stagnant Market Periods:

- Returns during Correction/Volatile Market Periods:

I am surprised that this has not caught the fancy of Mutual Fund IFAs and their Investors who are only concentrating on scheme offerings of some of the well-known large Fund Houses and ignoring schemes which merit their attention.

To conclude, I would strongly recommend every Advisor to have this scheme in their Investor Portfolios. Fund Managers are doing an excellent job of cash calls, international Equity exposure, selection of quality domestic Large and Mid-Cap stocks and delivering above average returns with very smooth and less volatile Investment experience.

I would recommend readers to do their own analysis based on suitability, time horizon, current market valuations, global markets etc. before taking an investment call.