I had posted following Tweet a few days back, wherein I had suggested that FY 2024 same 3 Asset Classes will do well which did well in FY 2023 as well viz. Gold, Debt and Asset Allocation:

Many agreed but many also asked me to give reasons why I believe that these asset classes will do well in FY 2024?

Here are my thoughts:

Gold:

At the outset, let me make one thing clear: I do not believe that Gold is an investment. At best, in Indian context, it should be an allocation in every Indian household portfolios due to social compulsions like gifting at the time of marriage and other social functions. Having said this, let me give my reasons why Gold should do well in FY 2024:

Ideally Gold should have delivered better returns than it had in post COVID period from April 2020 to October 2021 when there was huge uncertainty in the world markets due to pandemic, lock downs, etc. However, due to liquidity infusions by Central Banks across the Globe (India being an exception), all asset classes started doing better and going into Bubble zones like Crypto, Equity and Real Estate. Performance of Gold suffered due to rise in speculative activities in Cryptos when Bitcoin touched an all-time high of $64,000 + at its peak.

Thereafter, in February 2022, Russia-Ukraine war started and geo political tensions mounted. US and other countries raised sanctions against Russia and froze many of their dollar assets lying in western countries. This prompted many countries to move away from their over dependence on dollar assets and started negotiating bilateral trades (bypassing settlement in dollars and paying in their local currencies). Also Fed announced Quantitative Tightening to the tune of $95 bln from May 2022 onwards; thereby sucking out excessive liquidity from the global markets.

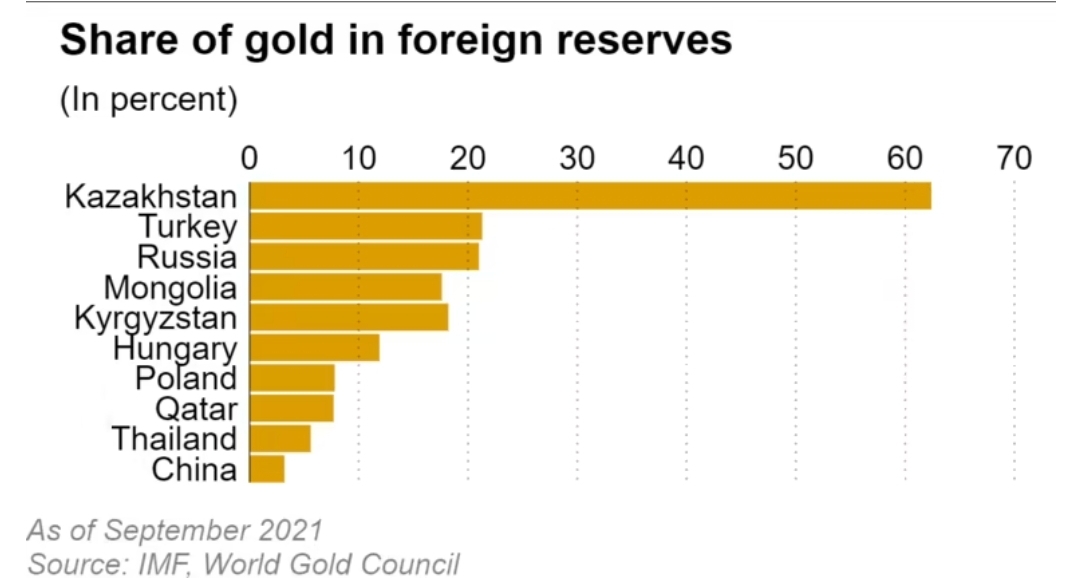

Central Banks around the world are increasing the Gold they hold in foreign exchange reserves, bringing the total to a 31 year high in 2021 & beyond. Value of dollar against gold has dropped sharply over the last decade as large-scale monetary relaxation has kept boosting the supply of the US currency.

Share of Gold in foreign reserves have gone up substantially for many countries:

Central Banks of emerging economies with weak credit strength began to protect their assets with gold. Sanctions, geo political issues, Fed’s easy monetary policy of past decade are some of the many factors where countries are moving away from reliance on Dollar reserves and increasing their Gold reserves. Also, depreciating Dollars is always good for gold prices to go up.

Final blow according to many experts to decline in Dollar dominance is when Saudi Arabia started their active talks with Beijing to price some of its oil sales to China in yuan instead of dollars. This move will dent the US Dollar dominance even in the petroleum market.

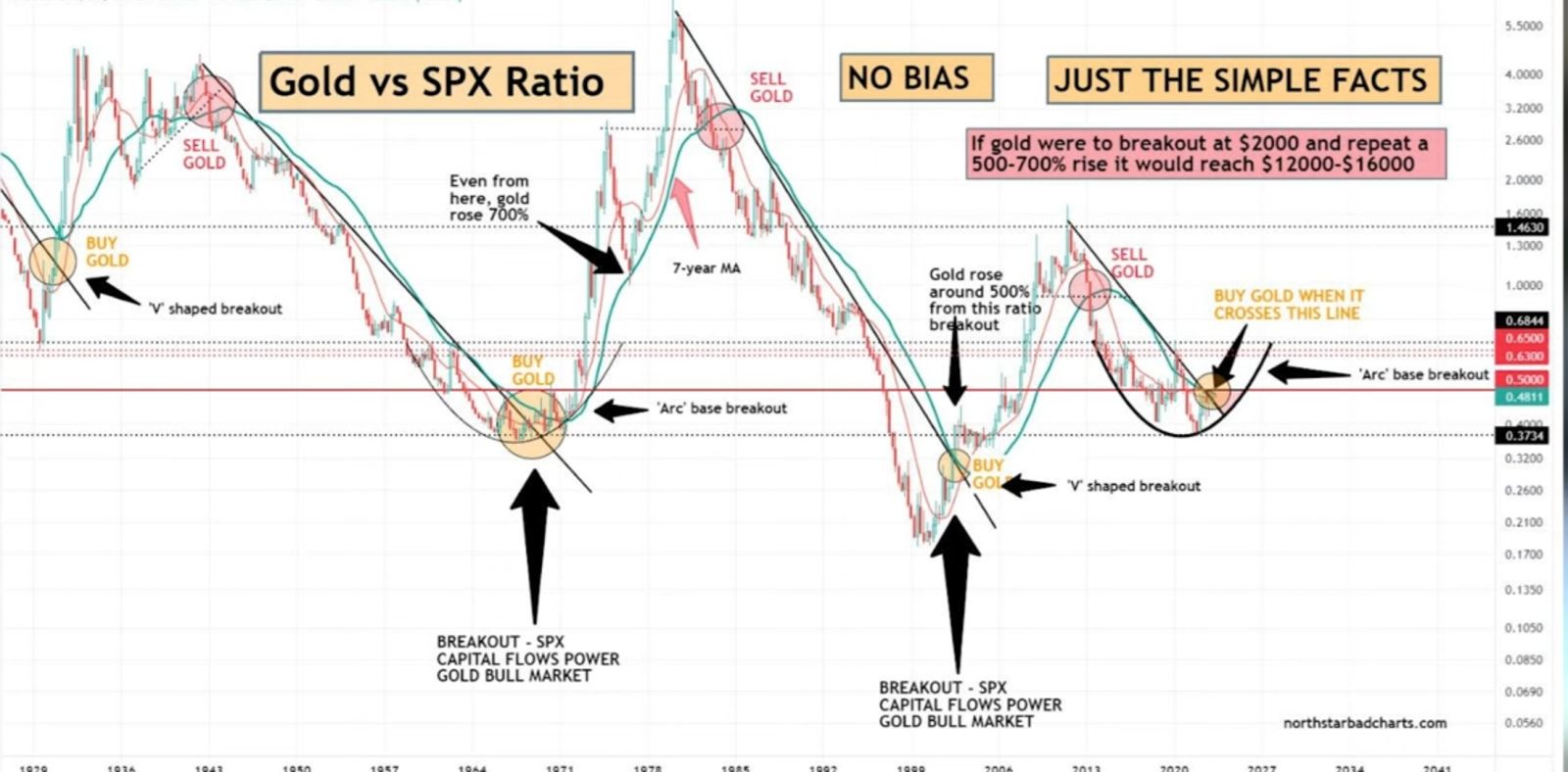

Going forward, with slowing Global World economies like the US, China, European Countries (including the UK) and likely recession, dollar is likely to depreciate further, equity as an asset class will deliver negative to sub-optimal returns – time when Gold should start outperforming.

Though I am not a technical analyst or an expert, I came across following technical chart which depict that Gold is at the cusp of a major break out and likely to deliver very handsome returns going forward:

Debt:

I have said this in the beginning of 2023 and repeating again: according to me, Debt will delver decent to very good returns in FY 2024 (may be even better than equity as an asset class). Reasons for this are many viz. after prolonged easy policies of various Central Banks and softer interest rate regimes since the outbreak of COVID in March 2020, inflation had gone through the roof and in many developed countries including the U.S. it was at 4 decade high. Naturally, the fuel which ignited this to spiral out of control was printing of dollars and easy liquidity situations.

At first, Fed was in denial stating that inflation was transitory and will come under control sooner than later. But when it became sticky and they were once again proven wrong, they went into damage control mode by raising rates and tightening liquidity (QT of $95 blns). This is likely to push (or already pushed) many world economies towards recession.

In recent RBI policy announcements, they had resorted to rate pause (with an eye on inflation). RBI has decided to monitor situation closely (post crude oil production cuts by OPEC + countries and rise in crude oil prices). In that sense, one more rate hike cannot be ruled out. All eyes are now on Fed and its stance on hold/raise by 50 bps/raise by 25 bps and its subsequent impact on a) inflation and b) recession/slowdowns.

With this background, it is almost certain that interest rates have peaked or likely to peak very soon, followed by pause in rate hikes and subsequently rate cuts to induce growth in slowing economies across the globe. This augurs well for debt markets which have not seen such mouth-watering yields in a long while. Also, due to slow down in economies, liquidity may not be at premium and hence rates may soften going forward even during rate pause periods of Central Banks (including RBI in India). Subsequent rate cuts by end of 2023 or beginning 2024 will give rise to huge gains in debt market investments (when rates soften, price of bonds go up, NAVs of debt schemes go up).

Also, generally, when equity markets don’t do well; debt markets are supposed to perform (in recessionary trends) i.e. there is negative correlation between Debt and Equity and also between Gold and Equity.

Asset Allocation:

Returns through asset allocation thrives on volatility in the markets. To make Volatility your friend, one invests through strategies like Systematic Investments (SIP), Systematic Transfer (STP) and Asset Allocation. Due to flip flop by the Fed on liquidity infusion/tightening – there are bursts in Equity outperformance followed by lull/corrections. If there was no volatility and markets were to only go one way up or down, would you have invested through above strategies? Volatility can become your enemy when a) one invests at any valuations (read even at expensive valuations) and b) adopts Buy and Hold strategy thereafter.

With debt likely to perform, equity performing in bursts and becoming more volatile in FY 2024 due to global slowdown/recessions, Asset Allocation – which follows buy low sell high strategy with constant profit booking will deliver returns to the investors in this financial year.

Please note that these are my reasons why I believe these 3 themes will work and deliver returns in FY 2024. Please do not follow this blindly, do your own research before investing in any of the above asset classes. Also, do not treat this note as my recommendation to invest/disinvest in any of the asset classes (including equity).