Let me first elaborate on the Credit Market in the Debt space and then comment about specific event which took place last year in the Debt segment. Prior to April 2020; Schemes investing in non-AAA category was a robust Rs.1.00 lac crores to Rs.1.50 lac crores or so. Same, I believe has come down to less than Rs.30,000 crores. SEBI had created a separate category in Debt space viz. Credit Risk Schemes. Though the main purpose of these schemes was to invest in non-AAA rated Credits and deliver optimum risk adjusted returns for the Investors; non-AAA rated borrowers got access to another source of borrowing as well. Just like Capital Markets get developed through Small and Medium Cap Companies accessing Capital Markets and getting listed; Credit Risk Schemes were developing the Capital Markets by giving access to non- AAA rated borrowers and growing Indian Economy and GDP through the Debt space. Bringing depth in the Debt Markets and making Secondary markets more liquid and robust, has been the recommendation of many Committees created by both the Central Bank and Ministry of Finance. Mutual Fund Industry was doing a great job of both the aspects by managing Credit Risk Funds.

However, one major difference between two pillars of Capital Markets viz. Equity and Debt is that even if the Equity Markets correct by say 30-50%; underlying securities will fetch some price, value and liquidity as well. As against that, Debt markets which is not so well-developed, struggles on this aspect when Liquidity dries up or say an Institution may not buy a non-AAA security because their Board Mandate is to invest only in AAA rated securities. Something similar happened in April 2020 when Risk Aversion to invest (G Secs, AAA or non-AAA) in any debt securities. These are the times when a Fund Manager becomes helpless when there are no buyers on the other side – at any price.

Now, with this background and difference in Equity and Debt as an Asset Class having been explained; let me now concentrate on major Credit Event which took place in April 2020.

It is already 1 year past when Franklin Templeton Mutual Fund (FT) decided to wind up 6 of their Debt Schemes on April 23’2020. Lot of water has flown both under the Bridge and over the Bridge since then. Lot of information, misinformation, insinuations, accusations have been exchanged between various stakeholders during this past 1 year. Many court cases by both interested parties and parties with some hidden agenda (non-interested parties) have been launched and heard by different Courts across the Country and finally heard and decided by Hon Supreme Court of our Country.

Throughout this period, by keeping the interests of only the affected Investors, I had personally written articles, created Tweets on an ongoing basis, done an in-depth interview with the President of FT, Mr. Sanjay Sapre and tried to bring a very dispassionate view on the table for the hapless investors. These Investors were torn between information and misinformation to dissuade them from Voting YES for winding up. In the bargain they lost a lot of precious time to get their funds back.

Today, I wish to go down the memory lane of this past 1 year and put things in perspective – this entire saga for the benefit of not only the affected Investors; but for all in the Mutual Fund Industry. This can then work as a guide for the Mutual Fund Industry at large.

Let me start with one para on how this unfolded and why and then take this note forward on FACTS v/s MYTHS propagated by some non-interested parties:

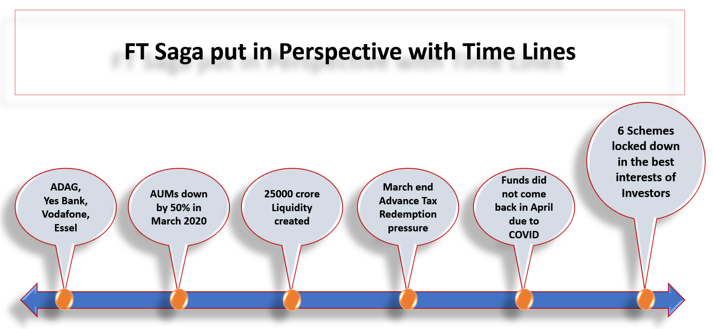

It all started way back in September 2018 with IL&FS fiasco. Thereafter the NBFC crisis and subsequent fall out due to defaults and downgrades by some well-known Corporate Houses as shown above. By March 2020, most Schemes of FT had come down by 50% due to redemptions which were met through internal accruals, sales, maturities to the tune of Rs.25,000 crores. Month of March is the tightest month in terms of liquidity due to advance tax outflows, Government’s year end spending and much more. All these put huge pressures on generating extra liquidity by the Fund House. Generally, this liquidity comes back into the system by April; which did not happen due to COVID and lock down announced throughout the Country.

FT had two choices: 1) Honor all redemptions at any cost – even by selling securities at huge discounts as there was huge risk aversion in the system. This was evident from the fact that Banks were parking their surplus liquidity to the tune of Rs.6-7 lac crores in Reverse REPO instead of lending or buying G Secs or Debt securities or, 2) Wind UP the Schemes – in the interests of the Investors; give some breathing time to the Fund Manager and the portfolios to mature, repay itself, etc. and then start repaying the Investors.

FT chose the 2nd option – entirely for the benefit of Investors. This has been my stand from day 1 and I still stand by it. Time has proven that what I have been advocating and thought process of FT for winding up – both have been proven correct and in the best interests of the Investors.

Captured below Are the Time Lines of How this Entire Saga Unfolded:

- 23 April’2020: The Trustees of Franklin Templeton make an announcement to wind up 6 fixed income schemes

- 28 May’2020: Trustees issue notices on e-voting & unitholder's meet from 9th to 12th June’2020 as per regulation 41 of SEBI (Mutual Fund) Regulation 1996

- 8 June’2020: Gujarat High court stays e-voting and unitholders meet to be held from 9th to 12th June’2020.

- From June 2020 to December 2020 – different cases filed by different set of investors in different states. Hon SC consolidates all cases and transfers to Hon Karnataka HC. Hon Karnataka HC upholds the decision of FT Trustees on winding up of schemes subject to once again Unit Holders approval. Hon SC allows FT to seek Unit Holders approvals

- 26-29 December 2020 – January 2021: E-voting and Unitholder’s meeting takes place. An overwhelming 96% plus unitholders (over 98% by number of units) voted in favour of the winding up of six schemes

- 12 February’2021: The Hon Court also appoints SBI MF as the authorized person under regulation 41 to take next steps on monetization

- 15 February’2021: SBI MF makes first partial payment of Rs 9,122 crores in five cash positive schemes in the week of February 15, 2021

- 18 March, 2021: SBI MF in consultation with Franklin Templeton and SEBI, finalizes the Standard Operating Procedure (SOP) to monetize assets of the schemes under winding up and distribute the proceeds to unitholders. During the hearing held on March 18’2021, the Hon SC takes note of the SOP

As can be seen, there was a delay of more than 9 months from when FT had sought consent of Unit Holders for winding up to finally disbursing 1st tranche of funds in February 2021. Why did this delay take place?

This happened because there were some elements (who had no stake in this whole Saga – with their own admission) who had started spreading malicious lies, misinformation, misguiding Investors, filing frivolous Court Cases, dissuading Investors from Voting YES for winding up of schemes and much more. This dragged on for almost 7-8 months in different courts and then finally landing at the doorsteps of Hon SC.

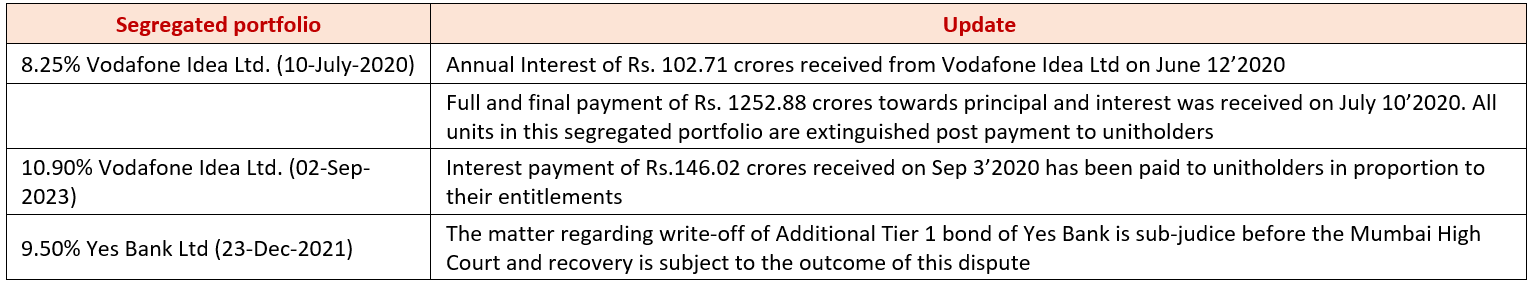

Above delay due to various Court cases became like a blessing in disguise as Risk Appetite of banks improved with improved COVID situation, many Securities matured, many borrowers prepaid to take advantage of lower interest rates (they restructured their borrowing at lower levels), interest payment flows also accelerated cash flow generation and in general gave some breathing time to the Fund Manager who was pushed against the wall in the month of April 2020. Issuers of some of the segregated portfolios like Vodafone also started fulfilling their obligations.

One such Association merits special attention and who were at the forefront of spreading these malicious lies and scaring and misguiding Investors. CFMA from Chennai went on levelling allegations against FT, its Management and the Fund Manager. All their false claims were exposed as soon as Investors Voted YES for winding up and the process of refunds started.

What were their Claims and What is the Reality now?

- They claimed that potential loss to Investors will vary between 50% to 81%

- Duration of repayment would be between 5 years to 7 years

- Affected Investors were 3 lacs to 38 lacs

What is the Reality?

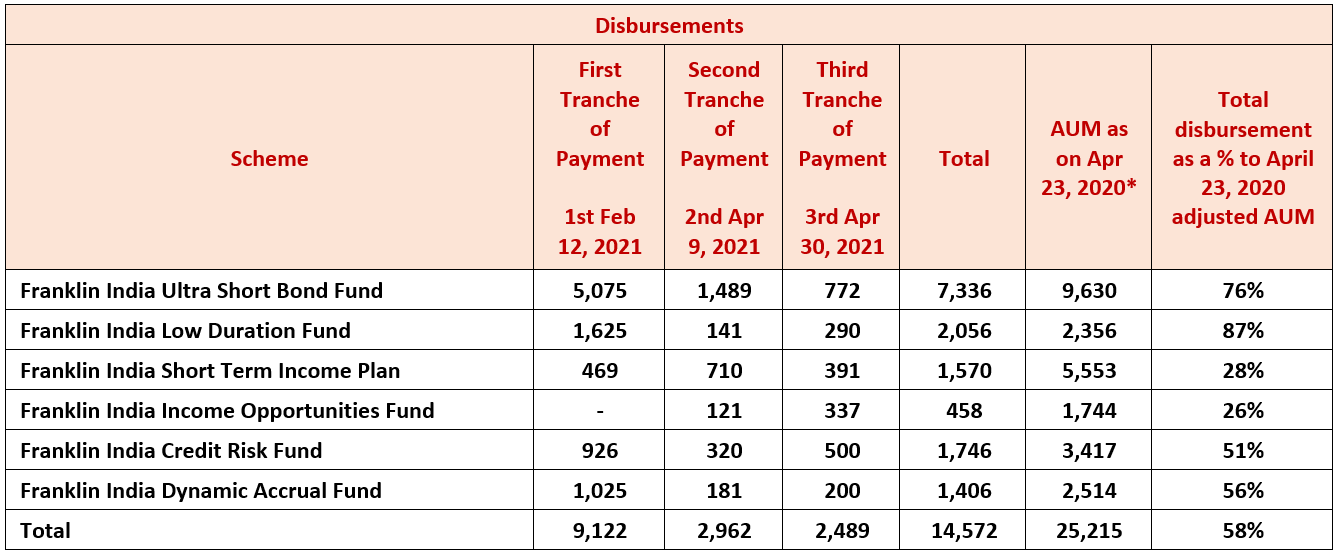

- FT has already returned Rs 14,572 crores in three tranches to unitholders besides paying their borrowings

- Six schemes, on a consolidated basis, would have paid 58% of their AUM as on April 23, 2020

- Across these 6 schemes the minimum that they have returned to investors is 26% (Franklin India Income Opportunities Fund) and the maximum they have returned to investors is 87% (Franklin India Low Duration Fund)

- The cash flows received in these 6 schemes till April 30, 2021 are 148% of those projected in the maturity profile published for April 23, 2020

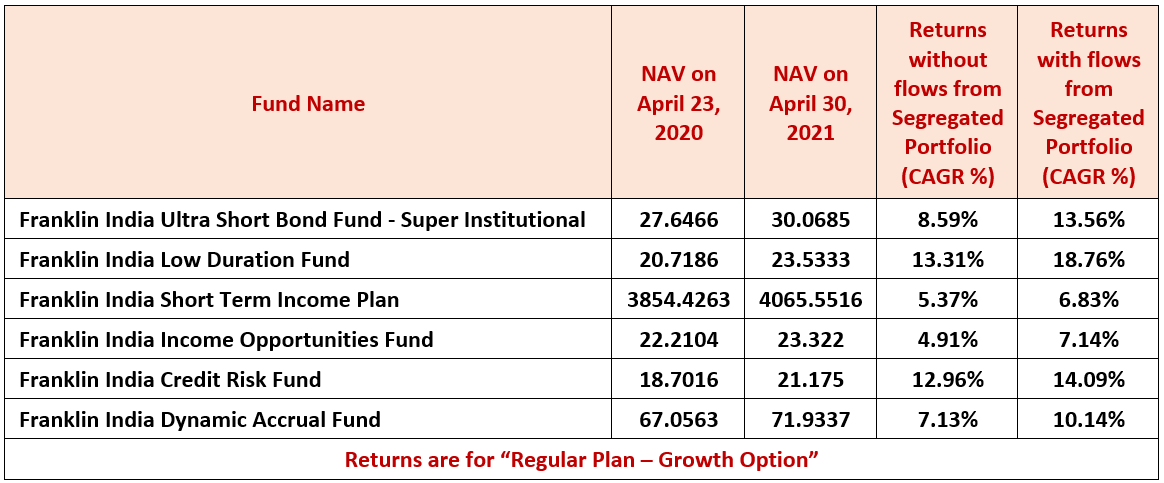

- The Net Asset Values (NAVs) of all the six schemes, as on April 30, 2021 is higher than the NAV on April 23, 2020

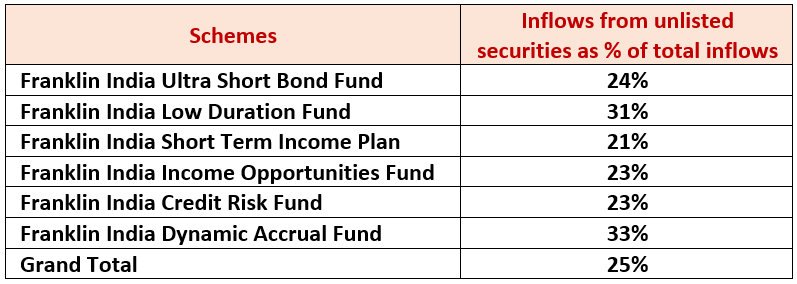

There was also a huge debate around portfolio quality and its outcome in terms of whether FT will need to take Hair Cuts in some of the lower quality Securities held in their portfolios including some unlisted securities. Following table should give a lot of comfort to the Investors on this aspect as well:

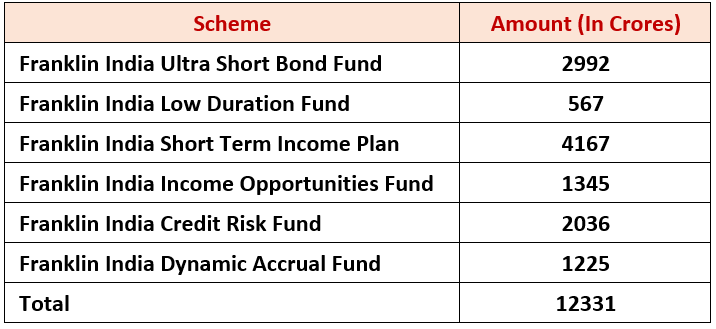

Out of the Rs.19,353 crore of inflows received till April 30, 2021:

- 25% is from unlisted securities.

- In case of Franklin Income Dynamic Accrual Fund (FIDA), this percentage is as high as 33%.

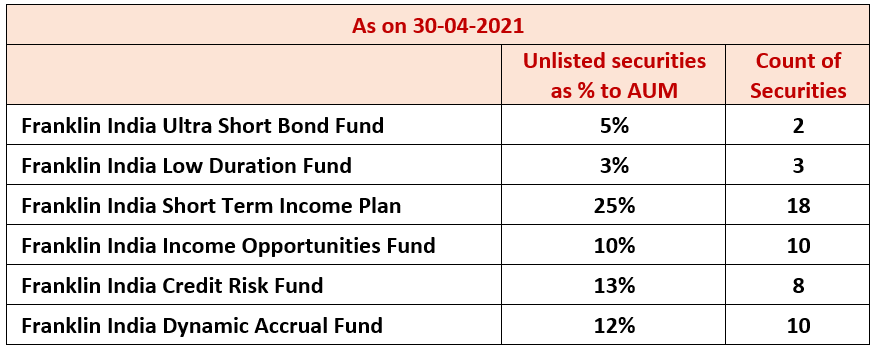

Due to these recoveries, number of unlisted securities and their holding as % of AUM has also reduced substantially. Hence, concern about unlisted securities should come down substantially:

What is the status of Segregated Portfolios before April 2020?

What is the Current Outstanding AUM Status – as on April 30’2021?

Now, let us visit some very interesting and pleasant outcome out of this entire Saga:

As all of us are aware, most schemes of FT had a good portion in Credits with much higher yields. Since April 2020 to April 2021 - interest rates have softened to decadal lows. This happened due to intervention by the Central Bank to tide over COVID crisis and crisis of Risk Aversion – by reducing interest rates and infusing liquidity through various measures. This has had huge positive impact on all the schemes of FT (including the wound-up schemes). Some of the schemes would be number 1 ranked in terms of their returns to their investors since they were wound up in April 2020. Following Table gives returns to investors without the segregated portfolio as well as including segregated portfolios which have realised their dues since last April:

Above should give a lot comfort to the Investors of Wound-Up schemes who had patiently waited for their funds. I had mentioned in one of my Webinars: treat this phase of waiting by convincing yourselves (investors of wound-up schemes) that you had invested in close ended 1-3-year FMPs. You will get your funds back with better returns once all the securities are monetized at their fair values rather than pushing the Fund Manager to sell at huge discounts, book losses and be happy with whatever liquidity they may generate due to this.

That aspect seems to be coming true.

In Conclusion I wish to state as follows:

- You had trusted FT and their Fund Manager over past so many years and made that Fund House the biggest Fund House in Credit space delivering above Industry average returns

- You should have trusted them and their intentions when they took a very hard decision of winding up – in the best interests of the Investors

- Also, you should have trusted a Fund Manager with so many years of experience behind him that he will not jeopardise Investors funds by investing in Securities which will not pay back. There must be reasons and structures behind some of the unlisted borrowers and lower quality borrowers in these schemes

- FT could have sold the securities at whatever prices, raised their hands and given back whatever funds they could generate at that point in time and no one would have blamed them as these are Open ended schemes with both Credit and Liquidity risks attached to them. But they did not. They took the hit to their hard earned 25 years long reputation for the sake of what was good for the investors

- We do not blame Equity Fund Managers when Markets collapse and Investors have to bear the Market Risk

- All were aware of the Credits in the schemes; in spite of that they invested. There can be some Credit events but COVID, subsequent lock downs, lack of risk appetite and liquidity – all were unforeseen circumstances beyond the control of the Fund House or the Fund Manager

- In fact, the Fund House and the Fund Manager have taken a huge reputational risk, let go off almost Rs.50,000 crores of AUM by proactively suggesting winding up

- As one can see in hind sight – Winding Up was in the best interests of the Investors

- Most Importantly, all the stake holders like the Regulator, The Central Bank, Ministry of Finance, Mutual Fund Industry will have to think long and hard on developing the Credit Risk Space, bring depth in the debt market by making it more robust and liquid to ensure development of Economy, Capital Markets and access to affordable funds to non-AAA segment

- All Market participants need to put their heads together for the sake of developing robust Capital Markets and Economy. Mutual Funds have done a great job in increasing awareness in Equity Markets – EPFO investing in Equity is one such example. We need to parallelly, work towards increasing depth of Fixed Income

- Suggestions on this subject are welcome

Please note that this Note is created to bring confidence of Investors back in the Mutual Fund Industry, put the FT Saga in right perspective – not justifying any of the actions or inactions of the Fund House or the Fund Manager in this issue. That would be only post-mortem, blame game etc. My note, my Tweets, Interview, Articles are only Forward Looking on what is the best course of action for Investors – nothing beyond that. Also, how should the Industry as a whole react and advice the MFD community and their Investors. It is very easy to spread negativity – but to bring out positive aspects about any crisis is the need of the hour.