Income Fund Fundas

Should I start saving and investing based on on my goals?

Episode 31 I wish to accumulate following Corpuses for my different Goals. Should I start saving and investing based on these requirements?

Education Corpus in 21 Years: Rs.25 lacs

Retirement Corpus in 30 Years: Rs.200 lacs

Why should I invest in either Debt or Equity and take unnecessary risks?

Episode 30 Many times some debt schemes generate even sub liquid fund returns? What should one do at that time? Should we exit and get into another scheme?

What should one look to and select the right scheme?

Episode 29 What should one look to and select the right scheme? Point to Point or Rolling Returns and why?

What are Point to Point Returns and Rolling Returns

Episode 28 What is Point to Point Returns and Rolling Returns?

Why some debt schemes generate even sub liquid fund returns?

Episode 27 Many times some debt schemes generate even sub liquid fund returns? What should one do at that time? Should we exit and get into another scheme?

What are Duration Schemes and Dynamic Bond Funds?

Episode 26 What are Duration Schemes and Dynamic Bond Funds?

How do Fund Managers construct schemes? - Part 2

Episode 25 How do Fund Managers use these Concepts and construct schemes? - Constant Rolling Down

How do Fund Managers construct schemes? - Part 1

Episode 24 How do Fund Managers use these Concepts and construct schemes? - Hold to Maturity - Rolling Down

Understanding Debt Market Concepts - Part 2

Episode 23 Debt Market Concepts –Part 2 (Constant Rolling Down / Compression)

Understanding Debt Market Concepts - Part 1

Episode 22 Debt Market Concepts –Part 1 (Roll Down / Hold to Maturity)

What determines direction of interest rate movements?

Episode 21 What Determines Direction of Interest Rate Movements? How do we gauge whether interest rates are going up or down?

What are Monetary Policy Rates and what is MPC and its Role?

Episode 20 Some Economic Jargons and their Meanings – Part 3

What is Current Account Deficit and OMO?

Episode 19 Some Economic Jargons and their Meanings – Part 2

What to look for in a Debt Portfolio to gauge Liquidity Risk?

Episode 17 Guidelines for on Liquidity Management

How do we identify portfolios suffering from Low Liquidity?

Episode 16 Which Segment Suffers from Low Liquidity Risk?

What is Liquidity Risk and does it affect Investor portfolios?

Episode 15 Different Risks in Debt Market – Liquidity Risk

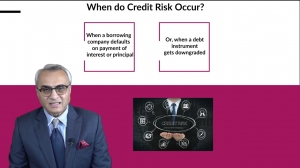

What is Credit Risk and does it affect Investor portfolios?

Episode 14 Different Risks in Debt Market – Credit Risk

What are different types of Risks in Debt Market space?

Episode 13 Different Risks in Debt Market – Interest Rate Risk

Importance of Debt as an Asset Class

Episode 9 When Equity is supposed to deliver Long Term Wealth, why should one invest in Debt?

Hair Cut and Side Pocketing in Mutual Fund parlance

Episode 8 What is Hair Cut and Side Pocketing in Mutual Fund parlance?

Understanding Accrual, MTM and Yield Curve

Episode 7 Understanding Accrual, MTM and Yield Curve?

Meaning of Average Maturity, Duration and Modified Duration

Episode 6 Difference between Average Maturity, Duration and Modified Duration or do they all convey the same meaning?

Negative correlation between price of a bond and its yield

Episode 5 - Why do debt schemes generate negative returns when interest rates go up and vice versa? And how do debt schemes generate returns? Are returns equal to attached coupons?

Difference between Coupon, Yield and Yield to Maturity (YTM)

Episode 4 - Is investing in a Debt Instrument with say 10% Coupon, is coupon same as Yield and what is my Yield to Maturity? Is there any difference?

How, What and Why of Debt Mutual Fund Schemes

Episode 3 - How does one Invest in Debt markets? What are the Benefits and Why there is volatility in Mutual Fund Debt Schemes?

Why and How Do Governments & Corporates Borrow ?

Episode 2 - Income Fund Fundas brought to you by Axis Mutual Fund

What is Debt? and Why does one Borrow?

Episode 1 - Income Fund Fundas brought to you by Axis Mutual Fund

Can one use Debt as an Asset Class to achieve all Financial Goals?

Episode 32 I have different Goals to achieve. Can I use Debt as an Asset Class to achieve all these Goals?